- Case StudyHelp.com

- Sample Questions

Question 3 (30 marks)

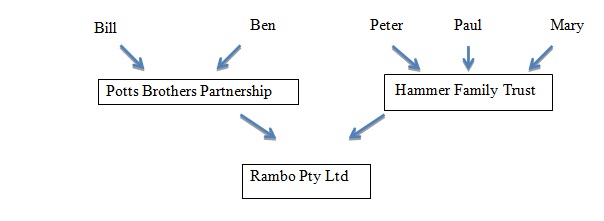

Rambo Pty Ltd (Rambo) is an Australian resident private company with two equal shareholders, being the Potts Brothers Partnership, and the Hammer Family trust, an inter vivos discretionary family trust. The two equal partners in the Potts Brothers Partnership are Bill and Ben. The named potential beneficiaries in the Hammer Family trust are Peter aged 25, Paul aged 22 and an undischarged bankrupt, and Mary aged 16 and attending school. All are resident individuals.

During the current income year Rambo had recorded the following transactions.

1 July Franking account surplus balance $ 3,000

8 August Foreign sourced investment income (net of

$3,000 withholding tax overseas) $27,000

30 September Payment of income tax installment $ 4,000

8 October Receipt of a franked dividend

(carrying imputation credits of $3,000) $ 7,000

10 November Payment of an interim dividend (franked to 50%

and carrying imputation credits of $3,000) $14,000

30 December Payment of income tax instalment $ 4,000

25 January Receipt of an unfranked dividend $ 6,000

30 April Payment of fringe benefits tax $ 6,000

30 May Payment of a final dividend (franked to 100% and

carrying imputation credits of $12,000) $28,000

30 June Australian sourced operating income for the year $50,000

30 June Business operating expenses for the year $30,000

Part A.

Required:

- Explain how taxable income of Rambo will be determined for the year of income, and the net tax payable on that income. Assume a company tax rate of 30%.

- Show the franking account entries for Rambo, and explain any implications from the transactions and the franking account closing balance.

Required:

- Explain how partnership net income of the Potts Brothers Partnership will be determined, and explain how this partnership net income will be taxed.

- The trustee of the Hammer Family Trust exercises discretion to distribute one-third of the total trust income (including franked dividends) to each of Peter, Paul and Mary.No beneficiary is specifically entitled to a franked dividend. Explain how trust net income will be determined, and explain how this trust net income will be taxed.

You should make full reference to any relevant legislation, cases, or tax rulings.

END OF PAPER

Please CHAT WITH LIVE Assignment Adviser to know more about Referencing styles and Citations.

Chat with our 24x 7 Online Agents CLICK CHAT NOW

Ask Your Assignment Question?

Check out our Assignment Help Services

Find Your Assignment Experts