- Case StudyHelp.com

- Sample Questions

SBS-MBA Financial Management Assignment Question and Answer

Assignment Detail:-

- Number of Words: 3000

Are you searching for SBS-MBA Financial Management Assignment Question and Answer? Casestudyhelp.com provides quality assignment writing services at a pocket-friendly price. We have MBA assignment experts who deliver top-notch Financial Management Assignment Help. If you have any queries regarding the assignment, you can go through our 24/7 online chat support facility.

Answer all the Questions

Question 1

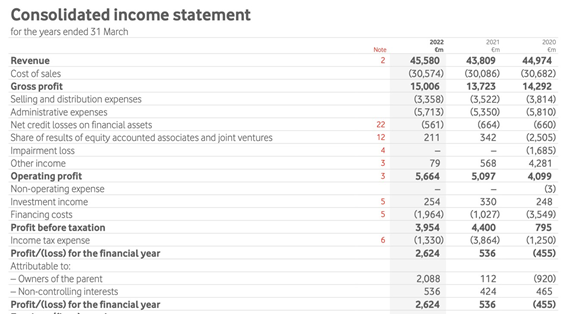

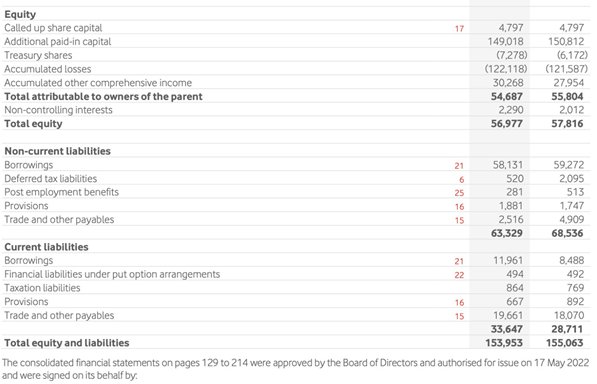

See Appendix 1 Vodafone Financial Accounts

a. Calculate the following ratios for 2020 to 2022:

- Net Profit Margin

- Gross Profit Margin

- Debtor (Receivable) Days

- Creditor (Payable) Days

- Debt Equity Ratio

- Return on Capital Employed

- Net Asset Turnover

b. Based on the ratios calculated above comment on the financial performance of Vodafone plc over three years.

c. At a recent board meeting of Vodafone, the sales director said that the company is doing so well now given the £2.6billion pounds profit in 2022 that the primary focus of the company must be maximization of profits.

Critically discuss if this should be a long-term goal for Vodafone and what other objectives might be important.

Question 2

Sloane plc is looking to take on a new investment. The company will evaluate two mutually exclusive projects, whose details are given below. The company’s cost of capital is 12%.

| Project A | Project B | |

| Initial costs | (AED m) | (AED m) |

| Year 0 | 150 | 152 |

| Cash inflows: | ||

| Year 1 | 40 | 80 |

| Year 2 | 50 | 60 |

| Year 3 | 60 | 50 |

| Year 4 | 60 | 40 |

| Year 5

Year 6 |

85

20 |

30

50 |

Required:

a. Calculate the:

- Expected payback period

- Accounting Rate of Return

- Net Present Value

- Internal Rate of Return

b. Explain and evaluate the benefits of calculating the above investment appraisal techniques for the firm?

What are the challenges of conducting investment appraisal analysis?

Question 3

Doha plc has some surplus funds that it wishes to invest in bonds. The company requires a return of 15% on bonds, and the finance director has asked you to analyse whether it should invest in either of the following bonds that are available:

Company A: Expected profit 12% bonds, redeemable at par at the end of two more years, with a current market value of QAR 95 per QAR 100 bond

Company B: Expected profit 8% bonds, redeemable at QAR110 at the end of two more years, with a current market value of QAR 95 per QAR 100 bond

a. Calculate the expected value (price) of the two bonds and evaluate if either offer an appropriate return for Doha Plc.

b. Critically evaluate what would be the impact on the price of bonds if Doha Plc reduces their required return.

c. Critically evaluate and discuss the factors that should be considered by the directors of a company when choosing whether to use debt or equity finance for a new project

d. Recently one director has attended a finance conference, on their return the director has decided the company should fund all projects with internal sources of financing as they are essentially ‘free’. Critically discuss if you agree with this statement.

Appendix 1

For REF… Use: #getanswers2002476