- Case StudyHelp.com

- Sample Questions

ABC Claims Case Study Accessible – Accounting Assignment Solutions

Case Study Details:

- Topic: Accounting, Activity-Based Costing Case

- Document Type: Assignment Help (any type)

- Subject: Accounting

Do You Need ABC Claims Case Study Assignment Questions and Answers? Casestudyhelp.com.com is the leading cheap assignment answers provider in Australia, the UK, the USA and worldwide. Students who want to pay for their assignments should visit this site. This agency also offers college research paper writing services on a vast variety of topics and even report writing help to students who need it. Paying to write assignments is much easier and safer with them as they have convenient and secure payment options.

Claims Background

You are a key Team Member in the ABC pilot initiative. The Claims area has been selected by Top Management as the initial implementation site. This selection is an excellent area staffed by dedicated hard working personnel. The ABC Team and Top Management have defined the project objectives. They are

- Calculate accurately the cost of the work activities

- Assign activity costs to major product lines

- Develop total cost and unit costs for the major product lines

- Determine accurate profitability of the major product lines

- Assess and identify activity improvement opportunities

- Develop performance measures for key activitiesin Claims

- Prepare an activity feedback report for Top Management

- Develop recommendations and an improvement action plan

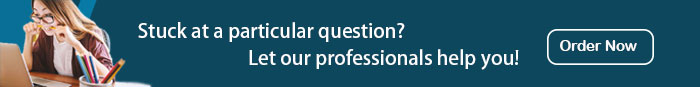

Phase I — Costing Activities

Salaries are $8 million for 2020. This includes all salaries and benefits recorded in the general ledger. Expenses are rolled up into one account called Equipment and Supplies. In 2020, expenses for equipment and supplies are $2 million. The following information determines the activity costs for shelling claims, setting up claims, investigating compensability, and managing cases.

Activity Costs

Salary costs are assigned to activities based on the actual hours doing the work. An electronic data collection system with bar coding provides us with the following hours.

| Activity | Actual Hours |

| Shelling claims | 26,000 |

| Setting up claims | 39,000 |

| Investigating compensability | 65,000 |

| Managing cases | 130,000 |

| Total Hours | 260,000 |

The cost of equipment and supplies is distributed among the activities based on dollars.

| Activity | Dollar Amount |

| Shelling claims | $200,000 |

| Setting up claims | $250,000 |

| Investigating compensability | $50,000 |

| Managing cases | $1,500,000 |

| Total Dollars | $2,000,000 |

Shelling Claims

This activity involves first report of injury distribution, entering data, flagging issues for review, and distribution to Management. Based on time spent the following hours are available.

20,800 hours of shelling claims are for Key Accounts and 5,200 hours are for Business Lines.

Setting Up Claims

This work involves verifying the policy, coverage, and type of claim. There would be a determination of medical only or lost time. The setup of the claim is completed in this step. There is a direct correlation between the number of data fields entered and the work and cost incurred.

The Key Accounts had 45,000 fields entered and the Business Lines required 100,000 for a total of 145,000 fields entered. 1% of the 145,000 fields entered required additional entry time due to poor information.

Investigating Compensability

Compensability investigations include the contact and requesting medical documents. Consideration of jurisdictional rules and statutes is factored into the decision process. A decision to accept or deny the claim is then made.

The number of contacts has been recorded by the staff. Key Accounts were contacted 7,250 times and Business Lines involved 3,000 contacts. The number of complaints are tracked for quality purposes. They totaled 500 in 2020.

Managing cases

You’ve done a study of the managing cases activity and collected detailed information. Managing cases includes requesting treatment plans, rehab nurse considerations, identifying options, medical management, claimant control and payments. It is determined to use the number of individual episodes for ABC purposes. They are as follows:

| Account type | Number of episodes |

| Key Accounts | 50,000 |

| Business Lines | 5,000 |

Sales Revenue

The controller reports that sales and claims for 2020 were as follows for each Major Product Line

Sales

| Account type | Sales |

| Key Accounts | $10,000,000 |

| Business Lines | $5,000,000 |

Claims

| Account type | Claims |

| Key Accounts | 2,000 |

| Business Lines | 2,300 |

Analysis

Using the information in the Claims case study, complete the ABC system below.

- What is the total cost for Key Accounts?___________________________________

- What are the profit margin dollars (Sales-Cost) for Key Accounts?_______________

- What is the profit margin percentage ((Sales-Cost)/Sales) *100 for Key Accounts?___________________________________________________________

- What are the sales and cost per claim for Key Accounts?______________________

- What is the total cost for Business Lines?___________________________________

- What are the profit margin dollars and percentage for Business Lines?____________

- What are the sales and cost per claim for Business Lines?_____________________

- What conclusions can we draw from this information? ________________________

- What recommendations could we suggest based on this ABC analysis? ____________

Case Study – Activity Based Management

Identify the:

- Cost drivers

- Performance measures

Part A — Improving processes

You have been asked by Top Management to “Make The Best Better”. Based on this information certain activities can be improved. Your Team begins its analysis by identifying key cost drivers. Each activity can have numerous costs drivers.

You also have decided to give managing cases extra attention based on its activity cost. By interviewing each claims employee, you have determined that the managing cases activity can be broken down into five smaller tasks for further analysis.

Analysis

Identify cost drivers for the given activities. Use the tables that follow, filling in the blank cells.

| Claims Activities | Cost Drivers |

| Shelling claims | |

| Setting Up Claims | |

| Investigating Compensability | |

| Managing Cases | See next table |

| Managing Cases Tasks | Cost Drivers |

| Requesting Treatment Plan | |

| Identifying Options | |

| Managing Medical Issues | |

| Controlling Claimant | |

| Processing Payments |

Part B — Measuring performance

Develop a set of performance measures for Setting Up Claims and Investigating Compensability including numeric values. Use the tables that follow, filling in the blank cells.

| Performance Measures for Setting Up Claims | Numeric values |

| Productivity | |

| Cycle Time | |

| Quality |

| Performance Measures for Investigating Compensability | Numeric values |

| Productivity | |

| Cycle Time | |

| Quality |

Part C — Measuring performance in your own organization

List some activities in your own Company that offer opportunities for improvement. Identify a least one cost driver for each activity. Use the table that follows, filling in the blank cells.

| Activity | Cost Drivers |

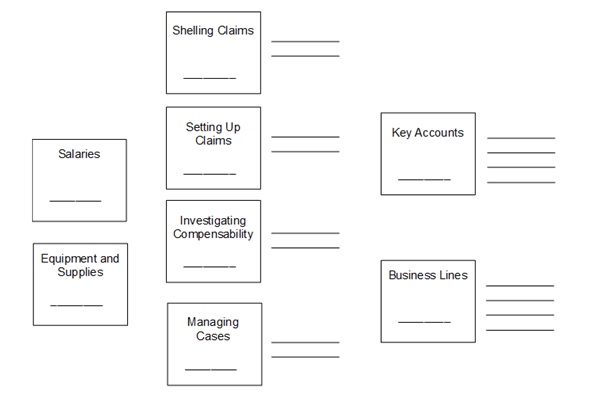

Part D — Fishbone Diagram

Complete the fishbone diagram below. Using the Managing Cases activity, identify possible causes for each of the four categories that drive cost.

For example, a procedure root cause might be poor handling of large cases. Asking “why” could reveal that poor training is the reason. These procedural problems result in an increase in the cost for the activity.

Category examples

Policy (Higher–level decision rules)

Procedure (Operating methods in the work flow)

Plant (Equipment, computers systems, and space)

People (The human element)

Case Study Feedback Reports and Recommendations

Typical feedback reports from an ABC system can include the information in the table that follows, please filling in the blank cells. :

| Activity | Total Cost | Output | Unit Cost | VA or NVA |

| Shelling Claims | ||||

| Setting Up Claims | ||||

| Investigating Compensability |

Managing Cases

Is This Activity Value Added?

Ask yourself these questions

- Could this activity be eliminated if some prior activity were done differently (or correctly)?

- If so – It is Non-Value Added

- Does the technology exist to eliminate this activity?

- If so – It is Non-Value Added

- Could this activity be eliminated without impacting the form, fit, or function of our customer product?

- If so – It is Non-Value Added

- Is this activity required by an external customer and will that customer pay for this activity?

- If so – It is Value Added

- Is this activity required by a regulatory agency?

- If so – It is Necessary

Use the table that follows, filling in the blank cells.

| Description | # Of Claims | Total Cost | Cost/Claim | % Of Total |

| Key Accounts | ||||

| Shelling Cases | ||||

| Setting Up Claims | ||||

| Investigating Compensability | ||||

| Managing Cases | ||||

| Totals | ||||

| Business Lines | ||||

| Shelling Cases | ||||

| Setting Up Claims | ||||

| Investigating Compensability | ||||

| Managing Cases | ||||

| Totals |

Please Record Your Recommendations to Top Management Below:

__________________________

For REF… Use: #getanswers2001844