- Case StudyHelp.com

- Sample Questions

Solved: Liability for Refundable Deposits Assignment Paper

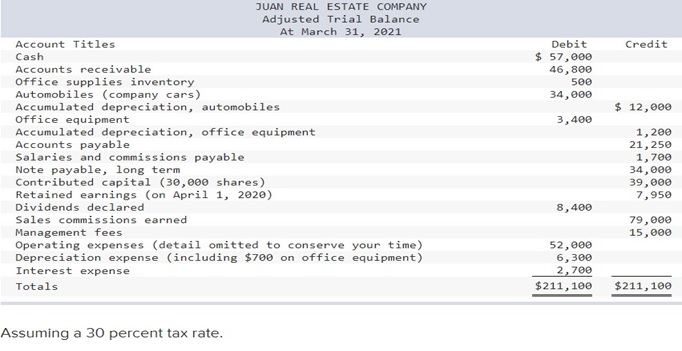

Question A. Juan Real Estate Company (organized as a corporation on April 1, 2013) has completed the accounting cycle for the year, ended March 31, 2021. Juan has also completed a correct trial balance as follows:

It is important that students get assignment help from professionals who understand the concepts taught in the course. This is especially true when students are completing their accounting assignments in a short period of time. Professionals experienced in the accounting field can help ensure that the assignments are done correctly and efficiently.

Required:

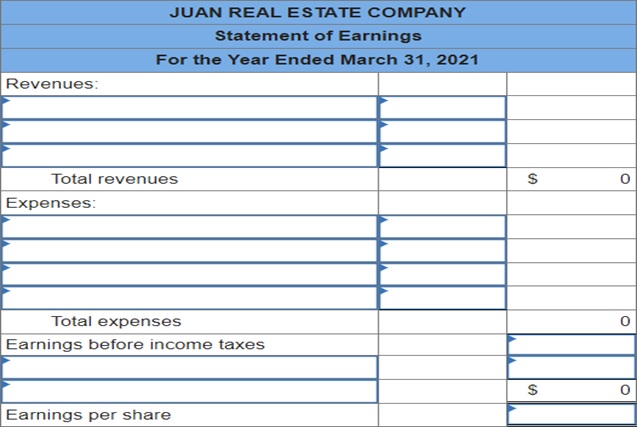

1. Prepare a statement of earnings for the reporting year ended March 31, (Round “Earnings per share” to 2 decimal places.)

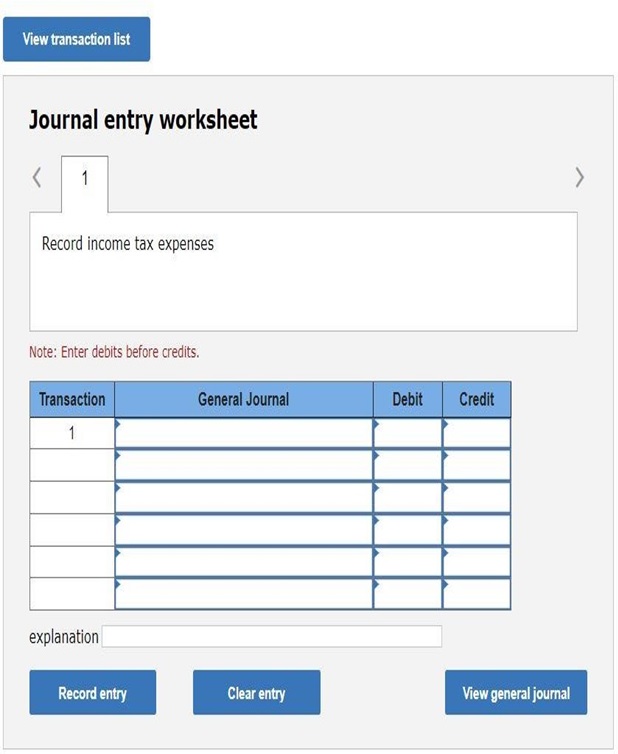

2. Prepare the journal entry to record income taxes for the year (not yet paid). (If no entry is required for a transaction/event, select “No journal entry required” in the first account)

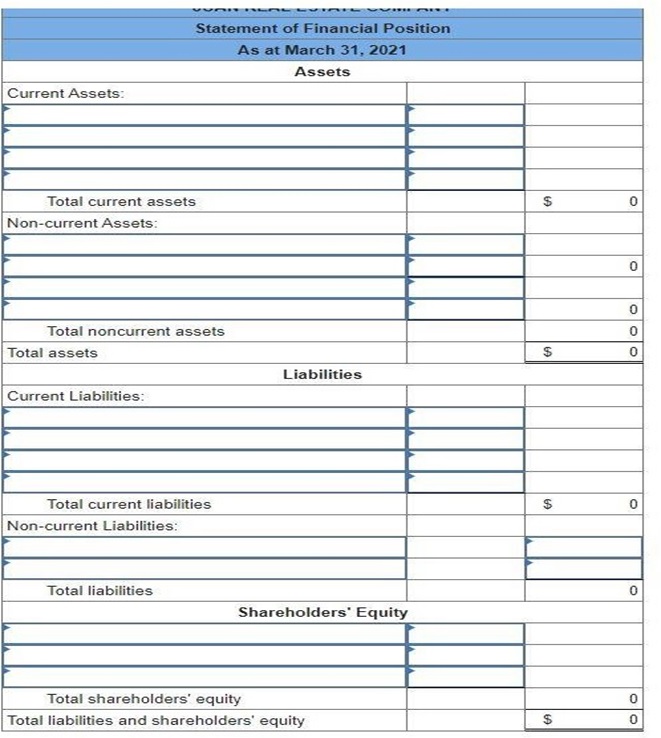

3. Prepare a statement of financial position at the end of the reporting year, March 31, 2021.

4. Compute the net profit margin ratio and the return on equity. (Round the final answers to the nearest whole number)

5. Prepare the closing entries on March 31, 2021. (If no entry is required for a transaction/event, select “No journal entry required” in the first account)

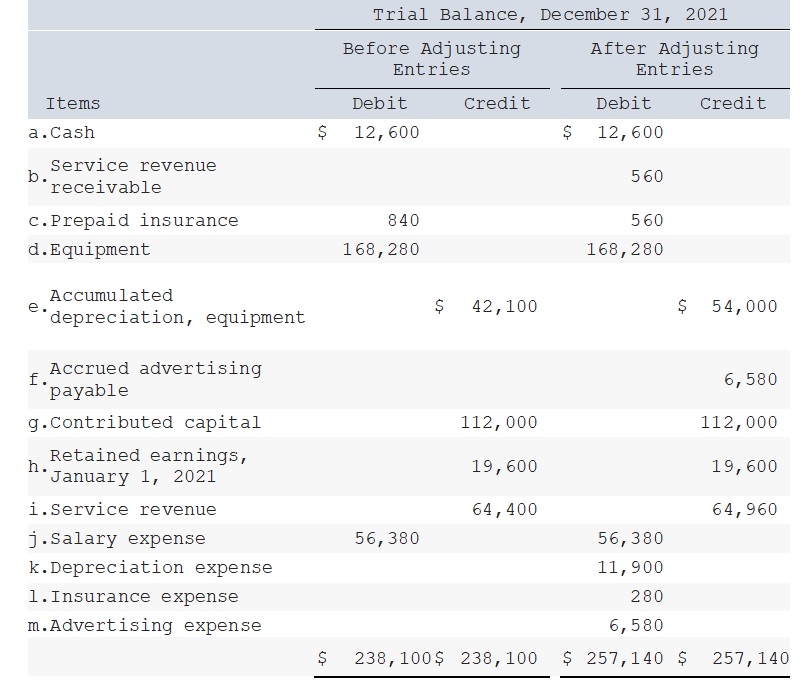

Question B: Savory Ltd. is completing the information-processing cycle at its fiscal year-end, December 31, 2021. Following are the correct account balances at December 31, 2021, both before and after the adjusting entries for 2021:

Required:

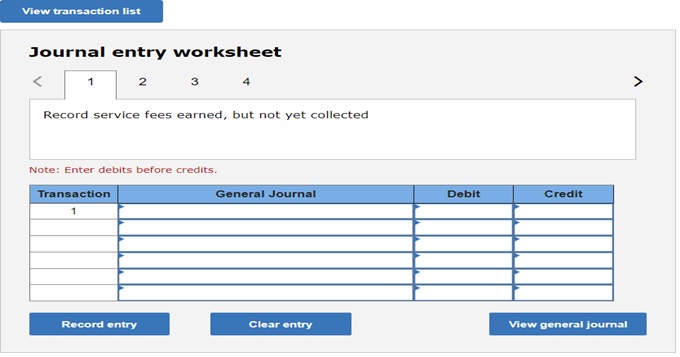

1. Compare the amounts in the columns before and after the adjusting entries to reconstruct the adjusting entries made in 2021. (If no entry is required for a transaction/event, select “No journal entry required” in the first account)

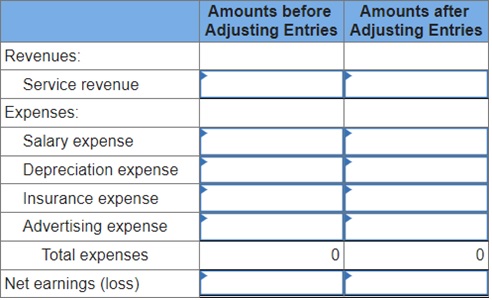

2-a. Compute the amount of net earnings, assuming that it is based on the amounts (a) before adjusting entries and (b) after adjusting entries.

2-b. Which net earnings amount is correct?

Multiple choice

- Amounts before adjusting entries

- Amounts after adjusting entries

3. Compute the earnings per share, assuming that 4,000 shares are outstanding. (Round the final answer to 2 decimal places.)

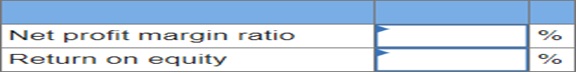

4. Compute the net profit margin ratio and the return on equity, assuming that contributed capital did not change during the year. (Round percentage answer to 1 decimal place (i.e., 0.124 should be entered as 4).)

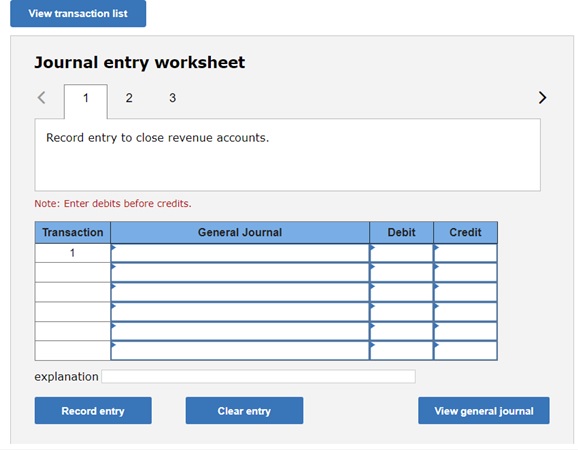

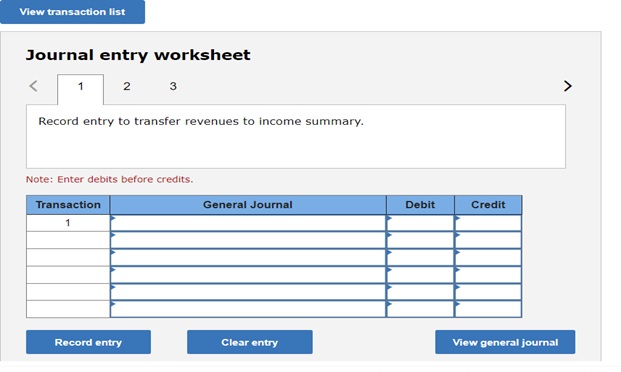

5. Prepare the closing entries at December 31, 2021. (If no entry is required for a transaction/event, select “No journal entry required” in the first account)

Question C.

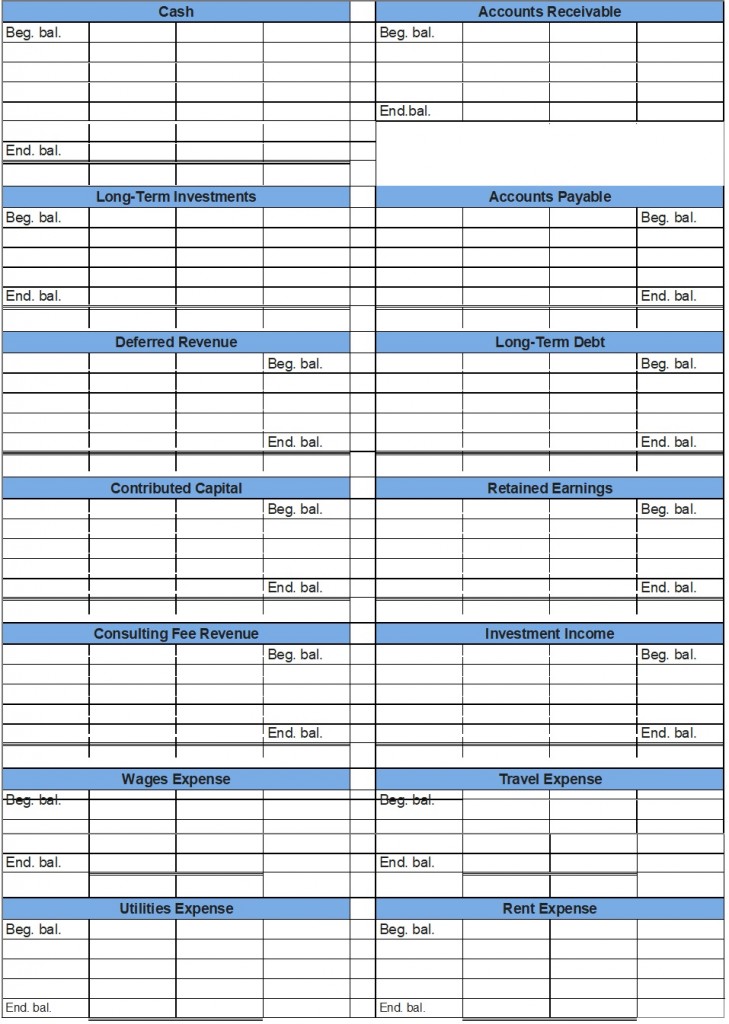

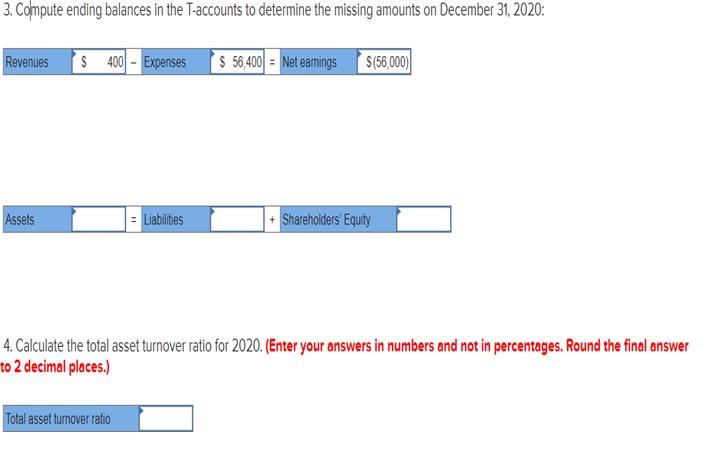

2. Enter the following 2020 transactions in the T-accounts (Enter zero for entries with no beginning balance):

a. Provided $58,000 in services to clients; received $48,000 in cash and the rest on account.

b. Received $5,600 cash from clients on

c. Received $400 in cash as income on investments.

d. Paid $36,000 for wages, $12,000 for travel, $7,600 in rent, and $1,600 on accounts

e. Received $1,600 in cash from clients in advance of services that IMI will provide next year.

f. Received a utility bill for $800 for services used in

g. Paid $480 in dividends to shareholders.

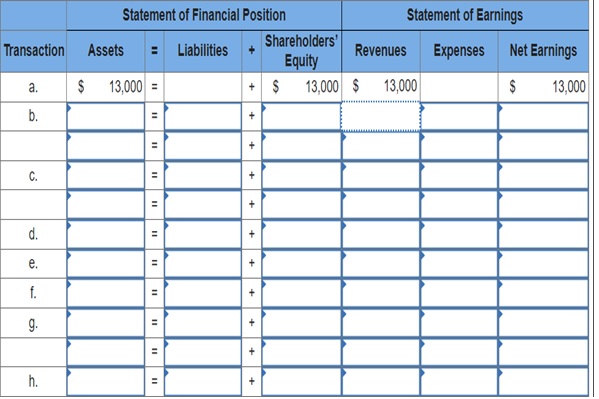

Question D. Peter’s Curling Inc. operates several curling centres (for games and equipment sales). The following transactions occurred in October of the current year:

- Peter’s collected $13,000 from customers for games played in October (example).

- Peter’s sold $7,000 in curling equipment inventory; received $3,000 in cash and the rest on account; cost of sales is $4,200.

- Peter’s received $2,500 from customers on account who purchased merchandise in

- The curling league gave Peter’s a deposit of $2,600 for the upcoming fall

- Peter’s paid $1,900 for the September electricity bill and received the October bill for $2,200 to be paid in November. Show net effect on

- Peter’s paid $4,700 to employees for work in

- Peter’s purchased $1,800 in insurance for coverage from October 1 to December

- Peter’s paid $1,400 to plumbers for repairing a broken pipe in the

Required:

For each of the transactions above, complete the tabulation, indicating the amount of each transaction. (Remember that A = L + SE, R − E = NE, and NE affects SE through retained earnings.) The first transaction is provided as an example. (Enter any decreases to account balances with a minus sign.)

For REF… Use: #getanswers2002530