- Case StudyHelp.com

- Sample Questions

MGA 103 Managerial Accounting Assignment Analysis Report with Question and Answer

Looking for MGA 103 Managerial Accounting Assignment Analysis Report? Get Custom Managerial Accounting Assignment Help from the Case Study Help Experts. Our professional writers work hard to provide you with the best assignment assistance at the best price. We are well recognised among the students of the UK, USA, Australia and others for our MBA Assignment Help, Dissertation, Essay, Thesis Writing Service and more.

Instructions

Raajje Fresh is a newly registered business with the aim to promote locally produced products in the growing Food industry of the Maldives. Their products are mainly sold on social media platforms such as Facebook/Instagram etc. and via their official website, www.raajjefresh.com.

Addition information about the business and their products will be available from the brochure attached with this assignment.

Annex 1.

Raajje Fresh provides the following information relating to their current operations (3000 units) for a given period of time:

| MVR | |

| 3000 Bottles price | 25782.6 |

| 2 years Website hosting | 1201.28 |

| Stickers printing price | 5723.45 |

| Shipment of stickers | 2280 |

| Delivery Order charges | 3793.32 |

| Customs duty | 744 |

| Clearance | 360 |

| Shipping documentation | 413 |

| MPL charges | 554.38 |

| Rent of warehouse | 6500 |

| Wages | 3000 |

| Raw Materials | 4000 |

| Unit Selling price | 231 |

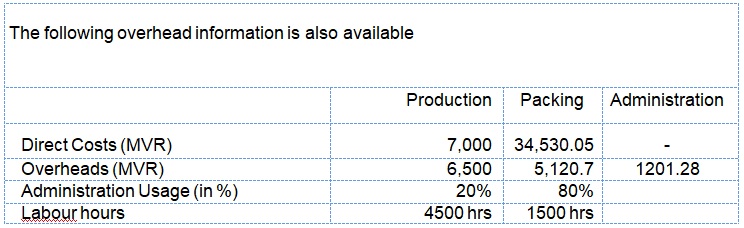

Annex 2.

You are Accountant of the company and you are being asked to submit a report to the Management regarding following matters:

- Briefly discuss the different cost classifications which are relevant for a business like Raajje Fresh.

- Using the information in Annex 1, identify the Fixed Costs and Variable Costs, showing them in a table.

- Using the table prepared in (2) above, prepare a break-even chart for the given period (with clear labels).

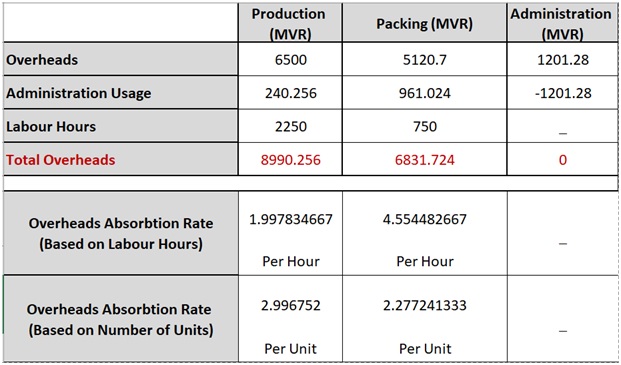

- Using the information in Annex 2, prepare an overhead summary, showing clearly the total overheads for each department. Prepare the following calculations using the total overhead for each department:

- Calculate the Overhead Absorption Rate (OAR) based on Labour hours.

- Calculate Overhead Absorption Rate (OAR) based on number of units (for 3000 units)

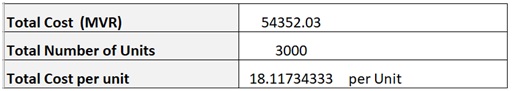

- Calculate the Total Cost per unit from the available information (use OAR based on cost per unit)

- Which of the above absorption bases is more suitable for Raajje Fresh?

- Using your calculations from above, analyze the data and provide recommendations to the Management on Costing and Pricing strategies for different products the business is selling. Provide your view on using overhead absorption technique on pricing decisions of different products the business is currently selling.

Please follow the guidelines below.

- Your assignments should be word limit of (10% above or below acceptable).

- For all others please follow general guideline.

Background of the Business

Raajje Fresh is a newly registered business in 2020, which aim to making available locally produced products to everyone. The Mission of the Business is to promote Local products locally and internationally through online platforms like Instagram and Facebook.

Each product of Raajje Fresh are in three sizes in different price range. Below are the currently available products from Raajje Fresh.

- Rihaakuru

- TheluliRihaakuru

- MasMirus

- Dhivehi Havaadhu

Cost Classifications

Cost is an amount of expenditure on a defined activity (Weetman, 2006). Cost Classification is the logical process of categorizing the different costs involved in a business process according to their type, nature, frequency and other features to fulfil accounting objectives and facilitate economics analysis (M, 2018). The different basis of cost classification is: (M, 2018)

- BY Nature

- BY Relation to Cost Centre

- By Function

- By Behavior

- By Management Decision Making

- By Production Process

- By Time

In this report I will be going to Detail about Cost Classification by Relation to cost Centre and Cost Classification by Behavior, since those are most applicable cost classification for Raajje Fresh.

Cost Classification by Relation to Cost Centre.

Direct Cost

Direct cost is the significant cost immediately associated with a production process. (M, 2018). Direct cost is the cost of that materials and wages which is directly related to manufacturing or selling of the product. For example, Raw material and wages cost.

Indirect Cost

Indirect cost is the cost which cannot be directly allocated to a particular process of production. Indirect cost is that cost which is indirectly related with the production. For example, custom duty and clearance charges.

Cost Classification by Behavior

Fixed Cost

Fixed cost is that cost which do not change in level of activity. This cost remains fixed. For example, website hosting charges.

Variable Cost

Variable costs are that costs which changes with change in level of activity. For example, cost od bottles will increase if consumption increases and cost of bottle will decrease if consumption decreases.

Below table shows the Fixed Costs and the Variable Costs.

| # | Variable Costs | Fixed costs | ||

| Costs | Amount (MVR) | Costs | Amount (MVR) | |

| 1 | 3000 bottles Price | 25782.6 | 2 Years Website hosting | 1201.28 |

| 2 | Stickers Printing Price | 5723.45 | Rent of Warehouse | 6500 |

| 3 | Shipment of Stickers | 2280 | ||

| 4 | Delivery Order Charges | 3793.32 | ||

| 5 | Customs Duty | 744 | ||

| 6 | Clearance | 360 | ||

| 7 | Shipping Documentation | 413 | ||

| 8 | MPL charges | 554.38 | ||

| 9 | Wages | 3000 | ||

| 10 | Raw Materials | 4000 | ||

| Total Variable Costs | 46650.75 | Total Fixed Costs | 7701.28 | |

Break-Even Point

Break-even point is the level of production at which the costs of production equal the revenues for a product (Mitchell, 2021). In break-even point company makes no lose, no profit. The break-even point for Rajje fresh is MVR 35.45 per units. In Rajje Fresh the total revenue in break-even point is MVR 8257.13 and the total cost in break-even point is also MVR 8257.13. So the profit is Zero.

Break-even Point

35.74513315 units

Total Revenue in Break-even point =8257.125757

Total Cost in Break-even point =8257.125757

Break-Even Chart

Fixed cost = 7701.28

Variable Cost = 46650.75

Variable Cost Per Unit = 15.55025

Selling Price per unit = 231

Total Number of Unit = 3000

Contribution Per Unit = Selling Price per Unit – Variable Cost Per Unit

= MVR 215.44975

Break-even Point = Fixed Costs / Contribution Per unit

= 7701.28 / 215.44975

= 35.74513315

Overhead Summary

Production – Labour hours

Overheads incurred in production department should be absorbed /allocated on the basis of labour hours actually worked. No of units produced won’t be appropriate as there is normal loss involved in each production process and no of units finally produced doesn’t consider this standard loss.

Packing – Numbers of units

Packing cost is directly related to number of units produced, so the appropriate absorption base for overheads of packing department is no of units.