- Case StudyHelp.com

- Sample Questions

BSBFIN501 Manage Budgets and Financial Plans Assessment Task

Assessment Detail:-

- Number of Words: 3500

Are you stuck up with your BSBFIN501 Manage Budgets and Financial Plans Assessment Answers? Find the best assignment providing website at affordable price. Casestudyhelp.com delivers Manage Budgets and Financial Plans Assignment Help at the lowest price. Get the most reliable Case Study Assignment Help from expert writers. We deliver top-notch assistance with timely delivery. Students can also avail of our free assignment sample with just a click.

Part 1

Case Study

The Prime constructors are working on a new construction project. At the different stages of the construction project, the cost incurred on the project at the scheduled time are calculated to monitor the expenditure and cost on agreed cyclic basis. The work schedule for completion of the construction project is 40%. The details of the budget plan are provided to you as below and you are required to perform calculations and answer the questions in the space provided to you.

The total planned budget details are as follow:

- The budget for your project is $100000

- Work schedule for completion is 40%

- Corresponding scheduled projected amount incurred should also be 40%

- Total number of hours estimated till 40% completion is 400 hours

- Direct labour cost per hour is $25 per hour

- Total amount spent upon quantities is $25000

- Overhead cost is $5000

The following factors have contributed to the excess spending of the project:

- Inflation in input supply prices

- Maintenance cost of the equipment’s

- Delays in supplies

Now, the actual quantities produced, and amounts used are as follow:

- Total number of hours estimated till 40% completion is 400 hours

- Direct labour cost per hour is $25 per hour

- Total amount spent upon quantities is $28000

- Maintenance cost is $3000

- Overhead cost is $5000

In this task, you are required to:

- Implement processes to monitor actual expenditure

- Monitoring the cost incurred on project at this scheduled time and measuring the cost variations.

- Modification in the contingency plans

- Report the revised budget to the higher authority such as your immediate manager. If you are not working in the industry, your trainer will act as your immediate manager.

Based on the scenario, perform the following calculations and give answers to the following questions:

Question 1: How would you monitor and manage the actual expenditure. Answer in 50-100 words.

Question 2: Identify the variations by calculating the cost variations and expenditure overruns.

Question 3: Based on the scenario, fill the template given below recommending the revised contingency plan:

- Risks identified

- Examples

- Risk control

Question 4: How much revised budget will cost now?

Part 2

Case study

Online Media Solutions is a marketing and web development business based in Melbourne, Australia. From idea to design, development and marketing, we achieve results for our clients and grow their business.

We have ventured into the web service industry to offer our superior and unique services to small businesses and organisations. Our experience and expertise in web sales and e-commerce give us the backing to provide solutions that are currently lacking in the market.

There is an all-time high demand for web development and marketing for small businesses with signs of rising further. Interestingly, few web developers have taken advantage of this opportunity, leaving the industry with no dominant provider.

The high costs of the projects and the focus on more prominent companies and organisations could be the contributing factor as to why this market remains untapped. We have a system that will reduce the project costs dramatically, giving us the opportunity to offer quality services at reduced prices.

Mission

Our professional team of specialists with industry expertise deliver solutions not only for leading brands but also for non-profit organisations and innovative start-up businesses. We aim to reach success by providing unique yet creative solutions to our customers that will elevate their online presence.

Our vision

Quality web solutions with a sound technical foundation that enable our clients to impress their customers and improve their online image worldwide. We want to make our customers stand out in the online environment and become the leading provider of online services for small and medium-sized businesses.

Keys to success

- We will offer quality web services to small businesses and organisations at affordable prices.

- Customised and tailored services.

- Establishment of alliances and partnerships with internet service providers and organisations involved in computer consultancy

Services offered

We offer the following services to our clients:

- Interface and Web Design Services

- E-commerce

- Web development

- Responsive web design

- WordPress Development Solutions

- HTML and CMS Development Services

- Coding

- Graphic Design

- Application development

- Online marketing

- Search Engine Optimisation

- Pay Per Click (PPC) Marketing

- Content marketing

- Social media marketing

- Online Email Marketing

- Copyrighting

- Content and Production Copyright

- Web hosting and support

Values

- Quality service to our clients

- Integrity and accountability

- Reliability

- Quality

- Innovation

- Respect

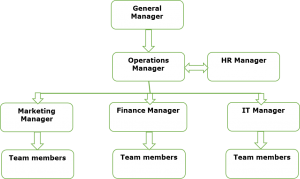

Organisational Hierarchy

Current scenario

The organisation has provided you with the budget and financial plans for the work team and want you to manage the budget and financial plan for the organisation for the next financial year.

Financial objectives

- To achieve a minimum error rate in the financial transactions processes.

- Reconcile the accounts and ensure the books meet the legislative and regulatory requirements.

Forecast

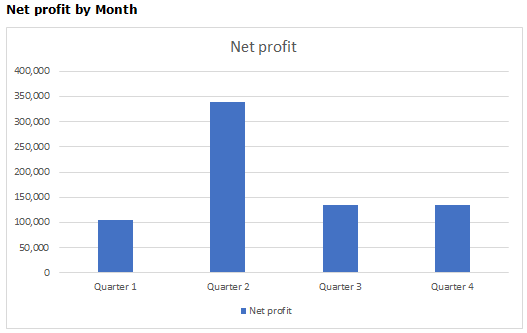

The company is expecting a net profit of $712,250 by the end of the current year.

Following is an excerpt from the financial forecasts for the financial plan and budget for the financial year:

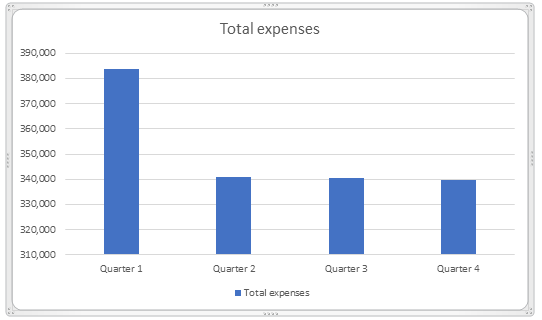

Expenses by Month

Projected master budget

| Master budget with profit projections | |||||

| Online Media Solutions | |||||

| Master Budget/Financial plan FY 2018/2019 | |||||

| FY | Q1 | Q2 | Q3 | Q4 | |

| REVENUE | |||||

| Commissions (2.5% sales) | 77,500 | 17,500 | 25,000 | 17,500 | 17,500 |

| Direct wages fixed | 200,000 | 50,000 | 50,000 | 50,000 | 50,000 |

| Sales | 3,100,000 | 700,000 | 1,000,000 | 700,000 | 700,000 |

| Cost of Goods Sold | 400,000 | 100,000 | 100,000 | 100,000 | 100,000 |

| Gross profit | 2,422,500 | 532,500 | 825,000 | 532,500 | 532,500 |

| EXPENSES | |||||

| General & Administrative Expenses | |||||

| Accounting fees | 20,000 | 5,000 | 5,000 | 5,000 | 5,000 |

| Legal fees | 5,000 | 1,250 | 1,250 | 1,250 | 1,250 |

| Bank charges | 600 | 150 | 150 | 150 | 150 |

| Office supplies | 5,000 | 1,250 | 1,250 | 1,250 | 1,250 |

| Postage & printing | 400 | 100 | 100 | 100 | 100 |

| Dues & subscriptions | 500 | 125 | 125 | 125 | 125 |

| Telephone | 10,000 | 2,500 | 2,500 | 2,500 | 2,500 |

| Repair & maintenance | 50,000 | 45,000 | 2,000 | 2,000 | 1,000 |

| Payroll tax | 25,000 | 6,250 | 6,250 | 6,250 | 6,250 |

| Marketing Expenses | |||||

| Advertising | 200,000 | 50,000 | 50,000 | 50,000 | 50,000 |

| Employment Expenses | |||||

| Superannuation | 47,500 | 11,875 | 11,875 | 11,875 | 11,875 |

| Wages & salaries | 500,000 | 125,000 | 125,000 | 125,000 | 125,000 |

| Staff amenities | 20,000 | 5,000 | 5,000 | 5,000 | 5,000 |

| Occupancy Costs | |||||

| Electricity | 40,000 | 10,000 | 10,000 | 10,000 | 10,000 |

| Insurance | 100,000 | 25,000 | 25,000 | 25,000 | 25,000 |

| Rates | 100,000 | 25,000 | 25,000 | 25,000 | 25,000 |

| Rent | 200,000 | 50,000 | 50,000 | 50,000 | 50,000 |

| Petty cash | 1,000 | 300 | 300 | 200 | 200 |

| Water | 30,000 | 7,500 | 7,500 | 7,500 | 7,500 |

| Waste removal | 50,000 | 12,500 | 12,500 | 12,500 | 12,500 |

| TOTAL EXPENSES | 1,405,000 | 383,800 | 340,800 | 340,700 | 339,700 |

| NET PROFIT (BEFORE INTEREST & TAX) | 1,017,500 | 148,700 | 484,200 | 191,800 | 192,800 |

| Income Tax Expense (30% Net) | 305,250 | 44,610 | 145,260 | 57,540 | 57,840 |

| NET PROFIT AFTER TAX | 712,250 | 104,090 | 338,940 | 134,260 | 134,960 |

Sales cost centre expense budget

| Sales Centre A | Sales Centre B | Sales Centre C | |

| Commissions | $30,000 | $15,000 | $15,000 |

| Wages | $150,000 | $75,000 | $75,000 |

| Telephone | $4,500 | $2,250 | $2,250 |

| Office supplies | $1,500 | $750 | $750 |

Note that the company deems a standard variance in budgets of up to 5% acceptable.

Your roles and responsibilities

You are working as a Finance Manager. You undertake financial management in your organisation. It includes planning and implementing financial management approaches and supporting and evaluating the effectiveness of financial management processes.

As part of your job role, you have the following job responsibilities:

- Communicate with relevant people to clarify budget and financial plans, negotiate changes and disseminate information

- Prepare, implement and modify financial contingency plans

- Monitor expenditure and control costs

- Support and monitor team members

- Report on budget and expenditure

- Review and make recommendations for improvements to financial processes

- Meet record-keeping requirements for the Australian Taxation Office (ATO) and for auditing purposes.

Project

This assessment task requires you to demonstrate skills to undertake financial management in your organisation and manage the budget and financial plan for one reporting period.

It includes planning and implementing financial management approaches and supporting and evaluating effectiveness of financial management processes.

In the course of the above, you must complete the following activities:

- Activity 1: Plan financial management approaches

- Activity 2: Implement the negotiated changes in the financial plan and budget

- Activity 3: Prepare a contingency plan

- Activity 4: Communicate revised master budget/financial plan and contingency plan to the team members

- Activity 5: Implement variations to the financial budgets

- Activity 6: Report on budget and expenditure

- Activity 7: Recommend improvement to financial processes

The roles and their responsibilities: Relationships with stakeholders such as team members and Operations Manager

The assessment task requires you to communicate with a number of organisational stakeholders. The main roles applicable to the assessment task includes:

Role number 1: Operations Manager: The General Manager is the individual who supervises or is in charge of the organisation. They belong of higher rank or status. Their job role and responsibilities are:

- Assign a team to you to complete the project

- Assist you in understanding the task requirements

- Provide you information about job roles and responsibilities

- Supervise you completing the assessment task and requirements

Role number 2: Team members: The team members are student’s co-worker or workfellow. They are associates that the candidate works with. Their job role and responsibilities are:

- Assist you in completing the project on time

- Help you to research and identifying relevant information

- Participate in a healthy and open discussion

- Communicate and collaborate with you for each assessment activity

Note:

- The trainer/assessor will take on the role of Operations Manager.

- The trainer/assessor will assign the roles of team members for each activity.

- Each student will be assessed individually for all assessment activities.

Timeframe to complete the project:

Two weeks (You have two weeks to complete the project)

Task requirements

- You will be assessed on your technical knowledge and skills to complete this project

- You will be assessed on working in a team environment and meeting your job role and responsibilities

- You must follow the instructions provided by the Operations Manager.

- All individuals must complete their role and assigned responsibilities and meet the specified deadlines

- The task must be completed in the specified timeframe

Activity 1: Plan financial management approaches

Activity context:

The financial plan and budget was implemented for the first quarter. The following were the outcomes of the

During the implementation of the financial plan and budget for the first quarter of financial plan, the following issues were identified.

- Poor sales due to economic downturn. The sales have declined by 20% for first quarter. Cost of goods sold remained same.

- The government has changed the minimum wages by 3%. This has led to increase in wage expense. (All the wages after June 2018 are to be calculated 3% extra).

Activity 2: Implement the negotiated changes in the financial plan and budget

Activity context:

The discussed negotiations have been approved by the Operational Manager. The Operational Manager wants you to implement the negotiated changes in the financial plan and budget.

Explain any two (2) processes to monitor actual expenditure and to control costs

Activity 3: Prepare a contingency plan

Activity context:

The Operations Manager wants you to prepare a contingency plan based on the revised Master budget/ Financial plan. The contingency plan is to be prepared, taking into consideration the following event into consideration:

- The advertising budget has been increased to achieve the desired sales. How will your management the contingencies related to the variations to sales figure?

Activity 4: Communicate revised master budget/financial plan and contingency plan to the team members

Activity context:

Your team has the following team members:

- Bookkeeper

- Budget Manager

The Operations Manager wants you to:

- Clarify the revised master budget/financial plan and contingency plan to the team members

- Provide the team members with the support by briefing them on their responsibilities for each role and how they can achieve the expected outcomes from the budget.

- Determine resources and systems to manage financial management processes within the work team.

Activity 5: Implement variations to the financial budgets

For the first two-quarters of the financial budget, there were no further variations in the implementation in the budget.

However, there are two customers that have bought products from the company, and their payments are still due. As per the company policy and procedures if the debts are not paid for a period of 60 days, then they are to be written as bad debts.

- On 21 October 2018, Damsons ltd purchased bicycles and have not made any payments. The total amount on the invoice due is $4,800.

- On 29 October 2018, Ping ltd purchased spare parts of the bicycles for $3,200 and have not cleared the invoice.

Based on the above-given information, prepare the following financial statements.

- Ageing summaries,

- Profit and loss statements

After preparing the financial statement, you are also required to modify the contingency plan for the next financial year.

Activity 6: Report on budget and expenditure

Activity context:

Due to decreasing the budget for maintenance and repair cost, some of the machines were not repaired during the first two quarters. This led to the breakdown in the machinery and occurrence of an extra cost of maintenance of $3000 in the third quarter.

Further, the office supplies accounted for an extra $500 in the fourth quarter.

Activity 7: Recommend improvement to financial processes

Activity context:

Online Media Solutions currently employ a manual system of accounting. This leads to a certain number of issues. These issues are as follow:

- The team miss deadlines or the entries are documented at late intervals

- Error rates are very high

This affects the morale of the team, causing them to feel as though they are wasting their time, undertaking useless or monotonous tasks, and being criticised for poor performance.

The management wants to make improvements to the financial processes. They want you to analyse the existing manual financial management system and recommend improvements.