- Case StudyHelp.com

- Sample Questions

Question 1

Azka plc is evaluating an investment in a new machine. The cost of the machine is MVR 180,000 and is to be paid immediately. The machine has an expected life of four years and will be sold for MVR 20,000 scrap at the end of the fourth year. The company expects to generate the following pre-tax cash flows by selling goods produced by the machine.

Year Cash flows (MVR)

1 77,000

2 76,000

3 75,000

4 74,000

Working capital of MVR 25,000 will be required at the start of the first year of operation. This will be recovered at the end of the fourth year.

Azka plc pays tax one year in arrears at an annual rate of 25% per year (tax in year 1 is paid in year 2 and so on) and is able to claim capital allowances on a 20% reducing balance basis. The after-tax cost of capital is 10%.

Required:

- Calculate the net present value (NPV) of investing in the new machine. (9 marks)

- Calculate the internal rate of return (IRR) of investing in the new machine. (5 marks)

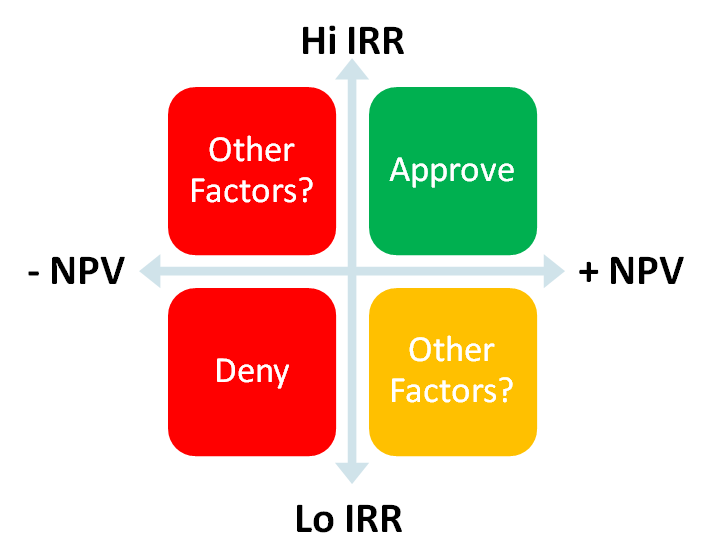

- Based only on the NPV and IRR that you have calculated above, advise whether Azka plc should accept the proposal. (2 marks)

- Azka plc also has the option of taking the machine on lease rather than buying it. Operating lease is a popular source of debt finance for a business. Discuss three reasons for its popularity. (9 marks)

Question 2

Winter plc and Spring plc are retailers in electrical equipment operating in the same market. The following financial information is available about the two companies for the previous year.

Winter plc Spring plc

MVR MVR

Sales revenue 2,217,150 2,685,600

Gross profit 689,700 863,250

Net profit 149,850 156,900

Share capital (MVR1 ordinary shares) 480,000 375,000

Total assets 1,950,000 2,126,550

Winter plc has announced its intention to pay a total dividend of MVR 202,500 and Spring plc has announced its intention to pay a total dividend of MVR 142,500 in respect of the year. The market value of each share at the end of the year is MVR 7.50 for Winter plc and MVR 9.20 for Spring plc.

The average ratios for the electrical equipment sector are as follows:

Dividend payout ratio 59.5%

Dividend yield ratio 2.44%

Price/Earnings ratio 26.46

Required:

- For each company, calculate the following ratios:

- Dividend payout ratio

- Dividend yield ratio

- Earnings per share

- Price Earnings ratio (8 marks)

- Based on the sector information and the ratios you have calculated, discuss the performance and market rating of the two companies. (8 marks)

- Winter plc intends to expand its operations into a new market. It can do so by setting up its own facilities in the new market and slowly establishing itself. Alternatively, it can take over an existing company already established in that market. Describe three advantages to Winter plc of a takeover-led strategy in preference to setting up its own facilities. (9 marks)