- Case StudyHelp.com

- Sample Questions

FMA101 Financial Management Study Guide

Looking for FMA101 Financial Management Case Study Guide with Answers? Get Answers Case Study on FMA101 Financial Management Study Guide. We Provide Help With Financial Accounting Assignment, Finance Assignment Help & Management Case Study Assignment Writing from Masters and PhD Expert at affordable price? Acquire HD Quality research work with 100% Plagiarism free content.

The information below was taken from a financial ratio analysis prepared by Canned Foods Ltd to assess its financial performance for 2019. Sales revenue R50 000 000 Gross profit margin 65% Operating profit margin 40% Net profit margin 6% Return on total assets 16% Return on ordinary shareholders’ equity 18% Total asset turnover 4% Average collection period 58 days Number of days in a year 365 Use the ratios and other information provided to calculate the rand value for the following accounts: 1.3.1. Gross profit 1.3.2. Cost of goods sold 1.3.3. Operating profit 1.3.4. Operating expenses 1.3.5. Profit available to ordinary shareholders 1.3.6. Total assets 1.3.7. Total shareholders’ equity Show all calculations.

WELCOME

Welcome to Financial Management (FMA101) for the Bachelor of Business Administration degree. Southern Business School wishes you success in studying this subject and trust that you will find it a most enjoyable and very useful learning experience!

TUTORIAL LETTER 1

ASSIGNMENT 01

Question 1 [33]

- The management of Globe Travel (Pty) Ltd extracted the following information from the accounting records for the financial year ending 30 June 2020:

| Depreciation | R25 000 |

| Administration expenses | R220 000 |

| Sales | R3 450 000 |

| Sales expenses | R180 000 |

| Cost of goods sold | R2 550 000 |

| Lease expense | R40 000 |

| Interest expense | R30 000 |

| Dividends on preference shares | R35 000 |

| Dividend per ordinary share | R0.50 |

| Number of ordinary shares in issue | 900 000 |

| Tax rate | 28% |

Required:

Use the information provided to calculate the earnings per share (EPS) and the net profit margin.

Show all calculations. (12)

- You are a business journalist reporting on the financial performance of companies. In a recent interview with the CEO of an engineering company, the CEO stated that the company is performing very well at present and because it is using the most modern engineering technology while at the same time keeping its inventory levels low. The CEO stated that the use of state-of-the-art technology coupled with low inventory levels will soon result in the company achieving high profit levels.

The CEO presented the following ratio analysis to support his statements:

| 2017 | 2018 | 2019 | 2020 | |

| Current ratio | 1.30 | 1.70 | 1.90 | 2.10 |

| Quick ratio | 1.20 | 0.80 | 0.50 | 0.40 |

Required:

Do you agree with the CEO’s statement about profits? Use the information provided in the table to explain your answer. (14)

- The information below was taken from a financial ratio analysis prepared by Canned Foods Ltd to assess its financial performance for 2019.

| Sales revenue | R50 000 000 |

| Gross profit margin | 65% |

| Operating profit margin | 40% |

| Net profit margin | 6% |

| Return on total assets | 16% |

| Return on ordinary shareholders’ equity | 18% |

| Total asset turnover | 4% |

| Average collection period | 58 days |

| Number of days in a year | 365 |

Required:

Use the ratios and other information provided to calculate the rand value for the following accounts:

- Gross profit

- Cost of goods sold

- Operating profit

- Operating expenses

- Profit available to ordinary shareholders

- Total assets

- Total shareholders’ equity

Show all calculations. (7)

Question 2 [32]

Dagmar Suppliers Ltd wants to do a scenario analysis to assess possible profitability for 2021. The company will consider three different sales scenarios. The pessimistic prediction of sales is R840 000, the most likely sales are R1 125 000 and the most optimistic prediction of sales is R1 350 000.

Dagmar’s statement of comprehensive income for 2020 is as follows:

Dagmar Suppliers Ltd

Statement of comprehensive income for the year ended 31 December 2020

| Rand | |

| Revenue | 950 000 |

| Less: Cost of sales | 446 500 |

| Gross profit | 503 500 |

| Less: Operating expenses | 326 250 |

| Operating profit | 281 250 |

| Finance cost | 45 000 |

| Profit before tax | 177 250 |

| Less: Income tax | 53 175 |

| Profit for the year | 124 075 |

Required:

- Apply the percentage-of-sales method to the statement of comprehensive income for 2020 to develop the pessimistic and optimistic pro-forma statements of comprehensive income for 2021. Use the table format below to prepare your answers. (18)

| Items | 2020 | % of sales | Pessimistic | Optimistic |

- Explain why the percentage-of-sales method could result in an overstatement of profits for the pessimistic scenario and an understatement of profits for the optimistic scenario. (14)

Question 3 [21]

The chief financial officer (CFO) of Quinn Logistics wants to determine the value of its shares using the free cash flow method. The CFO calculated the free cash flows for the period 2015– 2019 as follows:

Quinn Holdings: Free cash flows 2015–2019

| Year | FCF2015–2019 |

| 2015 | 650 000 |

| 2016 | 720 000 |

| 2017 | 775 000 |

| 2018 | 825 000 |

| 2019 | 880 000 |

Additional information:

| · FCF growth after 2019 to infinity | 5% |

| · Weighted average cost of capital (WACC) | 11% |

| · Market value of debt | R4 200 000 |

| · Market value of preference shares | R1 200 000 |

| · Number of ordinary shares issued | 200 000 |

Required:

Apply the free cash flow method to the information provided by the CFO to calculate the value of an ordinary share of Quinn Holdings.

Show all calculations and round off all values to the nearest whole number.

Question 4 [38]

Sky Explorations Ltd is a company that provides aerial scanning services using drones. The company intends to expand its services by purchasing an additional drone. The survey team of the company researched the suppliers of drones and has narrowed down its preference to two drones from which it needs to select one. The two drones are the Stellar drone and the Bigeye drone.

With the assistance of the financial manager, the survey team prepared the following table with the expected internal rates of returns for both drones together with the probabilities of these returns. Sky Explorations requires a 15% return on its investment.

| Stellar | Bigeye | ||

| Internal rate of return (IRR) | Probability | Internal rate of return (IRR) | Probability |

| 12% | 30% | 7% | 40% |

| 16% | 40% | 15% | 20% |

| 20% | 30% | 25% | 40% |

Required:

- For each of these drones, calculate its expected internal rate of return, standard deviation and coefficient of variation. (24)

- Which drone do you recommend the survey team consider purchasing? Provide reasons for your recommendation. (14)

Question 5 [31]

Agrico Ltd is a manufacturer of agricultural products. The company intends to invest in the development and production of a new type of multipurpose fertilizer. The initial research and development costs are R7 800 000. The company’s cost of capital is 11% and it estimates the after-tax operating cash flows as set out in the table below.

| Year | Cash flows |

| 1 | 2 500 000 |

| 2 | 3 500 000 |

| 3 | 3 200 000 |

| 4 | 2 400 000 |

Required:

- Use the information provided to calculate the net present value of this investment project. Use 20% as an alternative cost of capital. (20)

- Calculate the internal rate of return for the project. (7)

- Would you recommend to Agrico to invest in this new product? Give reasons for your recommendation. (4)

TOTAL: [155]

LIST OF REFERENCES

Els, G., Van Gaalen, R., Strydom, N.T. & Beekman, R. 2015. Fundamentals of finance – a practical guide to the world of finance. 6th ed. Cape Town: LexisNexis.

Gitman, L.J., Beaumont Smith, M., Hall, J., Lowies, B., Marx, J., Strydom B. & Van der Merwe, A. 2015. Principles of managerial finance: global and southern African perspectives. 2nd ed. Boston: Pearson Prentice Hall.

Marx. J., De Swardt, C.J., Beaumont-Smith, M. & Erasmus, P. 2009. Financial management in South Africa. 5th ed (revised). Cape Town: Pearson.

Ross, S.A., Westerfeld, R.W. & Jordan, B.D. 2019. Fundamentals of corporate finance. 12th ed. New York: McGraw-Hill.

Ross, S.A., Westerfeld, R.W. & Jordan, B.D. 2020. Essentials of corporate finance. 10th ed. New York: McGraw-Hill/Irwin.

Zimmerman, F. 1997. Cash flow planning. The Entrepreneur Network.

ANNEXURES

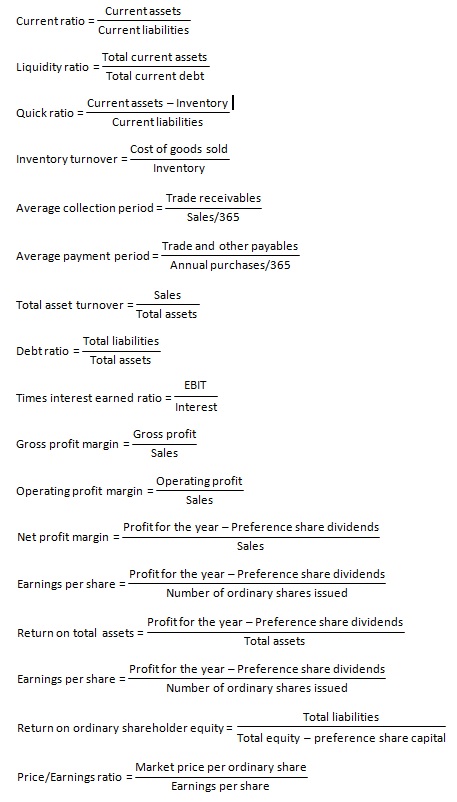

SELECTED FINANCIAL RATIOS