- Case StudyHelp.com

- Sample Questions

Practical (Module 6-9) Assessment Answers on FNS50315 – Diploma of Finance and Mortgage Broking Management

Words: 10000

Are You Seeking for Practical Assessment FNS50315 Diploma of Finance and Mortgage Broking Management?Casestudyhelp.com is the one-stop solution for every Australian student who has searched the internet with the phrase ‘write my assignment answers‘. Case Study Help Experts FNS50315 Diploma of Finance and Mortgage Broking Management Assessment Task offers.

Module 6: Sales

Q1. Determine the Borrower’s Requirements

Read the following scenario closely and then follow the step-by-step instructions.

Loan Scenario

Tom and Elaine Robertson intend to purchase a newly completed residential unit in Wolli Creek. The property is being purchased as a residential investment. The unit is in a block of forty units with a mixture of both owner-occupiers and investment rentals. The location is close to public transport and ideal for this type of investment. There is demand for this type of dwelling with low vacancy rates in that area. They have placed a 0.05% holding deposit and have 10 days to exchange contracts.

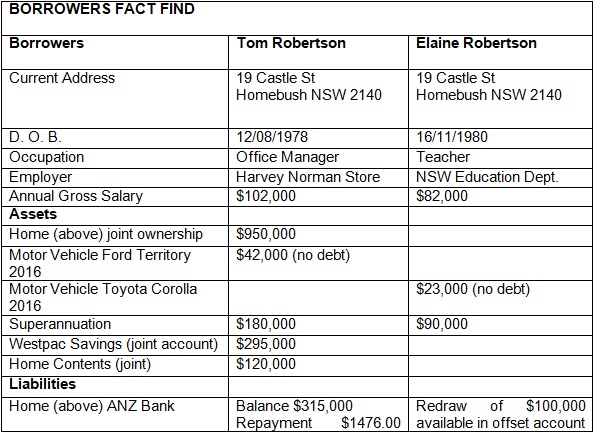

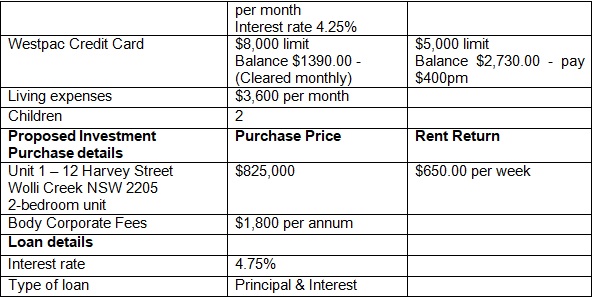

After reviewing the Robertson Fact Find follow the instructions and complete the three tasks as required.

The customer was very clear that they would only proceed if their repayments did not exceed $4,000 per month as the expected rental income is approximately $2,800 per month.

1.1 As this loan is regulated by the NCCP which document do you provide the client concerning your internal and external disputes resolution scheme?

Prior to offering any financial advice and discussing personal client information we prepare and provide the Credit Guide and Client Proposal Assessment. These documents provide the client with details they require concerning the NCCP Internal and External disputes resolution scheme.

Disputes that are unable to be resolved internally can then be referred to EDR for decisions that are binding on the insurer. The Financial Ombudsman Service (FOS) is the ASIC-accredited EDR service for financial service providers, including general insurers.

Financial service providers are required by ASIC to be a member of an EDR system accredited by ASIC. For general insurers this EDR system is FOS, which is an amalgamation of various financial service oversight bodies, including the former Insurance Ombudsman Service.

With the information available prepare a document in a form you can forward to your client which will include:

1.2 Present two loan product options for the borrowers to consider based on your research. Your comments are to explain why you have chosen these loan options and include standard information such as (i.e. type of loan, loan features, expected fees and charges. (You may use and attach aggregator software report for this activity or source from the internet)

1.3 List at least two potential risks that you have identified with this financing proposal.

Q2. Explain who the borrowers can consult with for issues outside your qualified expertise as a broker.

Q3. From the Genworth table below, list and explain the advantages and disadvantages of an 80% compared with a 90% LVR based upon your analysis of the borrower’s situation. The information must be presented in clear and unambiguous language that avoids industry jargon (unless explained).

Also Read: FIN 201 Principles of Business Finance Assignment Answers

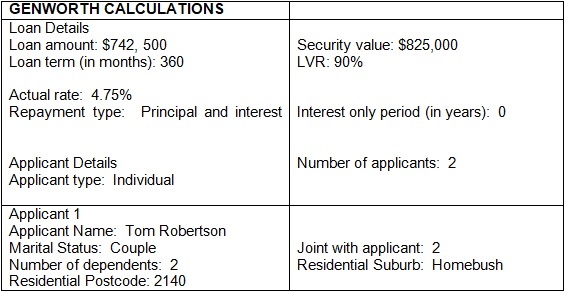

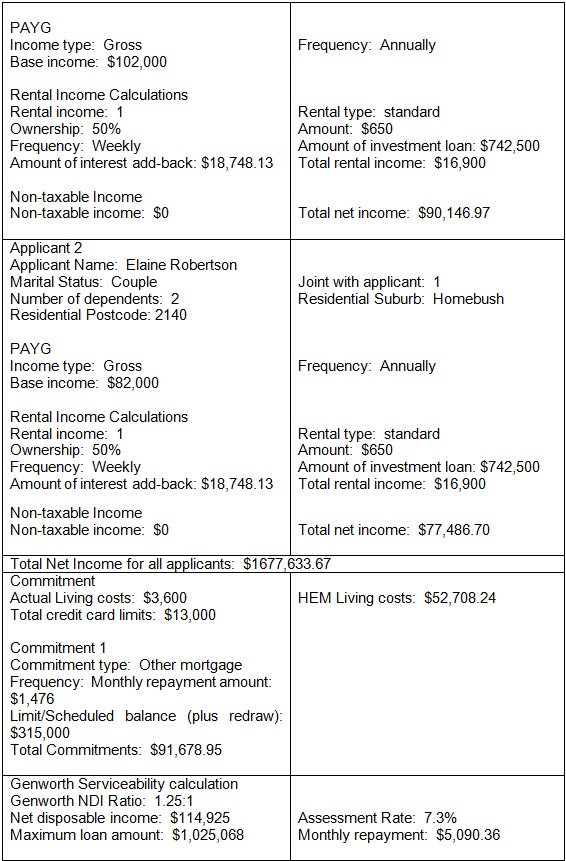

Q4. From the table used in Q3, conduct a serviceability calculation for the loan product you are recommending (if you are not working in the industry go to the Genworth website and use their loan service calculator) and attach to this task. (Base the LVR at 90%, interest rate 4.75% and principal & interest loan)

4.1 Explain whether the maximum loan borrowing determined by the Genworth service calculator is appropriate for the borrowers based on your analysis of their affordability and requirements.

4.2 To better understand your client’s requirements and address the concerns raised in the loan scenario prepare a list of five questions you could ask the client about this proposed loan.

Module 7: Complex Lending

Q5. Completing a Finance Contract

Read the following scenario closely and follow the step by step instructions.

Loan Scenario

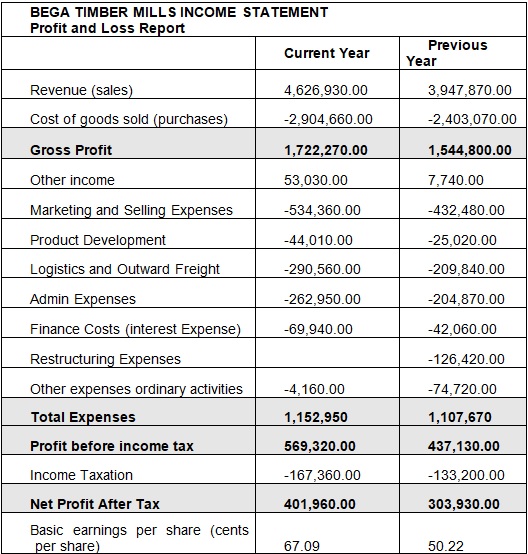

The owners were referred to you by their accountant who explained that the financing restructure is intended to improve cash flow and upgrade the Bega timber mill plant to accommodate expansion plans.

Business Background

Bega Timber Mills Pty Ltd operates saw milling plants in both Victoria and New South Wales. Their head office is located at 210 Collins Street Melbourne Vic 3000.

Ownership

Michael and Neil James are the directors of the company. The ownership is through a holding company known as M & N Holdings Pty Ltd where Michael, Neil, and their wives Mary and Jean hold equal shareholdings.

Both the Victorian and NSW plants have experienced operations managers with extensive knowledge of the timber industry. They have a reputation for providing a high standard of service to their clients.

Financial Controls

The Big Bank of Victoria has been the Bega Timber Mills bank since inception in 2003. The bank though has requested they reduce their overdraft from $400,000 back to $250,000.

When the directors approached the bank to assist in their restructure they were advised that they are no longer supporting in their business due to the bank withdrawing from this sector.

The directors do not agree with the bank’s appraisal of the sector even though a competitor closed their business recently. The directors see this as a further opportunity to expand their business.

Company Operations

The company is well established with long-term satisfied customers. Their timber is cut to demand and is dried on site and delivered when cured.

The plant machinery is not new but is well maintained in not in need of replacement. The company has a policy of careful and timely maintenance of all equipment including vehicles, saws, and other log managing machinery.

Purpose of Loan

As the bank has a ‘general security agreement’ (fixed and floating charge) over the assets of the business, they will need to refinance all of their existing loans with the Big Bank of Victoria.

The additional plant and equipment for Bega is required to accommodate a new customer Fantastic Australian Furniture Pty Ltd (FAF).

This new customer will increase the turnover of the business by another 2% to 2.5%.

The mill will need some re- tooling, plus the installation of an additional cutting bench and support structures. It will require enclosed protective transport. With this equipment, it will provide an innovate edge over its competitors.

FAF also requires special credit terms, extending standard credit terms from 30 days to 90 days.

Funding requirements

- Refinance overdraft

- Refinance existing term loan

- Funds to plant and equipment purchases.

Broker observations

While researching the client, the broker noticed that their website needed updating to accommodate social media resources.

He also noted a comment that although the business is operated by experienced personnel and their plant and equipment are well maintained there appeared to be no formal training of staff.

The directors also commented that once the FAF contract is underway, they identified that an untapped market exists for raw design furniture and intend to expand into this market opportunity.

Threats to the business were considered and although acknowledged that over the years there are periods of lower than usual demand that the company is well resourced and can explore other opportunities with this natural resource.

5.1 After reviewing the scenario and financials prepare the Finance Broking Contract in full.

- Complete the two fees payable to the broker. (You can decide what fees you would like to charge the client)

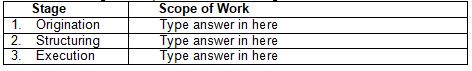

- Scope of work (information on scoping work can be found in Module 7)

- Complete all three stages

- This will include at least two aspects for each stage

- Complete the loan details (there are two loans to be refinanced and one loan for the purchase of equipment. Research may be required to prepare proposal).

FINANCE BROKING DEED

Recitals

a). The Broker operates a business that provides financial brokerage services.

b). The Client has approached the Broker to secure finance for the Client (“Services”)

c). The Broker has agreed to make applications to such financial institutions (each a “Lender”) as the Broker deems appropriate to obtain finance for the Client.

1. Authority to Act

- The Client agrees to engage the Broker to act in relation to, apply for, negotiate and arrange a loan facility on behalf of the Client (“Loan”) in accordance with the Client’s requirements referred to in the Schedule hereto.

- The client acknowledged and agrees that no guarantee, assurance or representation has been made by the Broker that it will be able to secure any Loan required by the Client and/or its nominee from any Lender and/or within any specified time frame.

2. Fees Payable to the Broker

The client agrees to pay the Broker fees for its Services which Broker’s fees are divided into two parts as follows:

I). Application Fee

The Client agrees to pay to the Broker upon the execution of this Deed a non-refundable application fee of $ Type answer in here inclusive of GST. (Student to decide fee)

II). Brokering Fees

The Client agrees to pay the Broker a broking fee of Type answer in here percent (student to decide percentage) plus GST of the total monies that are loaned or to be loaned to the Client upon settlement of the Loan by the Lender or in the circumstances referred to in this clause.

In the event, the Client should withdraw from the Loan offered by the Lender upon the production of a Final Letter of Offer, the Client agrees this fee is still due and payable by the Client to the Broker.

3). Scope of Work

The Broker agrees to perform the following work on behalf of their client.

4). Authority to Disclose Confidential Information

The Client authorises the Broker or its employees or agents to provide to potential Lenders any information about its creditworthiness, credit history and financial position to facilitate the Loan and responding to any enquiries made by potential Lenders. The Client agrees that it shall execute any privacy disclosure statement and consent which is required by the Broker and/or Lender upon request by the Broker.

5). Liability

The Client agrees that the Broker shall not be liable for any loss, damage or expense suffered or incurred by the Client arising out of the Services provided by the Broker and/or the inability by the Broker to secure a Loan from any Lender.

6). Independent Legal and Financial Advice

The Client acknowledges that the Broker has not and will not provide any legal advice as to the suitability of any Loan proposal that is offered by any Lender. The Client acknowledges that it has been advised by the Broker to obtain its own independent legal and financial advice as to the suitability of any Loan, its or its nominees capacity to meet the repayments of any such Loan, and the terms of any Loan contract that is submitted by any Lender.

If You Need: Finance Assignment Sample

Module 8: Risk

Q6. Using Risk Tools

Using the same scenario from Q5 above, follow the step by step instructions. In this scenario “you” refers to you the student in the role of a broker.

This task requires you to calculate a range of ratio analysis for the lender.

Using the information provided in the set of financials (also from Q5 above), complete the following ratio analysis exercises. Reference material for these formulas is provided in the course manual.

Now prepare a strengths and weakness table based on information contained in the loan scenario, the ratio analysis completed in Q5 and the company financials.

Q7. Dealing with physical risks

While you were in conversations with the timber mill at the head office in Melbourne you heard of an accident that recently occurred at the Bega mill.

One of the timber mill workers was seriously injured and need to be transported to the local hospital. The timber mill worker had removed the safety guard from a saw due to machine malfunctioning periodically over the last month. The worker failed to report the maintenance issue to his supervisor.

The employee was off work for two weeks, but the workers who witnessed the accident were in shook and didn’t resume their duties that day.

As a consequence of the accident, production was stopped until damaged machine that caused the accident was repaired. The mill manager called in a replacement worker and trained them to operate the machine.

The manager also filled out a lengthy accident report and several insurance and regulatory forms.

It was found following an investigation that the by a workplace safety inspector that there was inadequate WHS training and no WHS policy and procedures manual existed and Work cover were now considering litigation.

7.1 After reviewing this task, explain what steps could have been taken to prevent this incident from occurring?

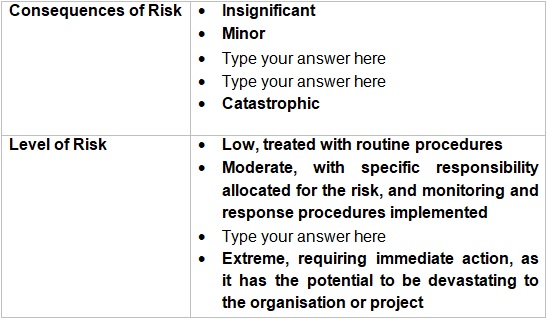

7.2 Complete the Risk Categorisation Table that would apply to this incident. Select what you think is the correct approach.

Module 9: Management

Q8. Developing policy and procedures

Read the following sections from the scenario in Module 7 Q5, and follow the step by step instructions. The sections for focus are:

- Business Background

- Ownership

- Company Operations

- Broker Observations

7.1 When developing a policy for business, it may involve discussing the policy and procedures with various stakeholders. List three stakeholders one may consult when preparing a policy for the environment and sustainability?

7.2 What methods can be introduced to communicate the importance of sustainability to staff?

7.3 This task requires you to establish a policy and procedures for Bega Timber Mills to assist them to manage risks associated with their mill operation and sustainability policies. You need to focus on the office, the vehicles and the compliance issues.

Q9. This question requires you to complete a business plan. The subject business will be a mortgage broking business. You may need to conduct some research on the internet or draw on your own past experiences. You can also utilise information contained in the course materials.

This business plan can follow a similar format as found at www.business.gov.au. You may wish to source ideas from this site.

As this is an assessment exercise, the information does not need to be personal in nature. You are required for this assessment to demonstrate your skills in preparing a business plan.

FOR REF…Use: #getanswers2001466