- Case StudyHelp.com

- Sample Questions

FORD CASE ANALYSIS

- IDENTIFY THE PROBLEM

- CONDUCT ANALYSIS

IS ONE FORD REALLY WORKING?

In January 2015 Ford Motor Company reported its best January sales performance since 2004. Retail sales were up for passenger cars and utility vehicles, with the Mustang, Lincoln MKC, Lincoln Navigator, Explorer, and Escape leading the way. The Transit van segment also had its best January sales results since 2001, but the real star, as always, was the Ford F-Series pickup, America’s best- selling truck for the 38th straight year. The all-new F-150, which hit an all-time annual record of 54,370 vehicles sold in January, was named 2015 North American Truck of the Year.1

Ford was hoping for a big year in 2015, driven primarily by the F-150 popularity. New CEO Mark Fields was relying on North American sales in 2015 to offset increasing losses in Europe, as well as uncertainty in Asia as Ford continued its cautious introduction of Lincoln into the Chinese luxury-vehicle market.

Ford needed all the good news it could get, having posted a 2014 year-end profit that saw a 56 percent drop from 2013. As CEO Fields remarked, [Last year] was a solid yet challenging year for Ford— with our investments and a record number of new products launched around the world positioning us for strong growth this year and The entire Ford team remains focused on our three priorities of accelerating our ONE Ford plan, delivering product excellence, and driving innovation in every part of the business.2

Given the current lackluster performance and associated ambivalence of the investment community in the wake of Ford’s disappointing year-end numbers, Mark Fields had some significant decisions to make in the coming year. Fields had been promoted to CEO in July 2014 upon the retirement of Alan Mulally, who was widely hailed as one of the “five most significant corporate leaders of the last decade” and was the architect of Ford’s eight-year turnaround from the brink of bankruptcy in 2006.3 It was Mulally who had created the vision that drove Ford’s revitalization—“ONE Ford.” The ONE Ford message was intended to communicate consistency across all departments and all segments of the company, requiring people to work together as one team, with one plan, and

* This case study was prepared by Professor Helaine J. Korn of Baruch College, City University of New York; Professor Naga Lakshmi Damaraju of the Indian School of Business; Professor Alan B. Eisner of Pace University; and Associate Professor Pauline Assenza of Western Connecticut State University. The purpose of the case is to stimulate class discussion rather than to illustrate effective or ineffective handling of a business situation. Copyright © 2015 Alan B. Eisner.

One goal: “an exciting, viable Ford delivering profitable growth for all.”4 Mulally had wanted to leverage Ford’s unique automotive knowledge and assets to build cars and trucks that people wanted and valued, and he had managed to arrange the financing necessary to pay for it all. The 2009 economic downturn that caused a financial catastrophe for U.S. automakers had trapped General Motors and Chrysler in emergency government loans, but Ford was able to avoid bankruptcy due to Mulally’s actions.

Mulally had worked to create a culture of accountability and collaboration across the company, and he had groomed his successor, Mark Fields, since 2012, instilling confidence among the company’s stakeholders that Ford would be able to continue to be profitable once Mulally stepped down. Even with this preparation, CEO Fields was facing an industry affected by general economic conditions over which he had little control and a changing technological and sociocultural environment in which Consumer preferences were difficult to predict. Fields would have to anticipate and address numerous challenges as he positioned the company for continued success.

Attempts at repositioning Ford had been underway for many years. In the 1990s, former CEO Jacques Nasser had emphasized acquisitions to reshape Ford, but day-to-day business activities were ignored in the process. When Nasser left in October 2001, Bill Ford, great-grandson of company founder Henry Ford, took over and emphasized innovation as a core strategy to reshape Ford. In an attempt to stem the downward slide at Ford, and perhaps to jump-start a turnaround, Bill Ford recruited Alan Mulally, who was elected as president and chief executive officer of Ford on September 5, 2006. Mulally, former head of commercial airplanes at Boeing, was expected to steer the struggling automaker out of the problems of falling market share and serious financial losses. Mulally created his vision of “One Ford” to reshape the company, and in 2009 he finally achieved profitability, committing to remaining “on track for both [Ford’s] overall and North American Automotive pre-tax results to be breakeven or profitable”5 in the coming years. Mulally was able to sustain this success past the initial stages of his tenure and maintained profitability until his retirement in June 2014. Mark Fields would have to take over from there (see Exhibit 1).

History of the Ford Motor Company

In 2015, Ford Motor Company, based in Dearborn, Michigan, had about 187,000 employees and 62 plants worldwide. It manufactured or distributed the automotive brands quadricycle in 1896, Ford developed other vehicles, primarily racing cars, that attracted a series of interested investors. In 1903, 12 investors backed him in the creation of a company to build and sell horseless carriages, and Ford Motor Company was born.

Starting with the Model A, the company produced a series of successful vehicles, but in 1908 Henry Ford wanted to create a better, cheaper “motorcar for the great multitude.”6 Working with a group of handpicked employees, he designed the Model T. The design was so successful, and demand so great, that Ford decided to investigate methods for increasing production and lowering costs. Borrowing concepts from other industries, by 1913 Ford had developed a moving assembly line for automobile manufacture. Although the work was so demanding that it created a high degree of employee turnover, the production process was significantly more efficient, reducing chassis assembly time from 121⁄2 hours to 2 hours 40 minutes. In 1904, Ford expanded into Canada and by 1925 had assembly plants in Europe, Argentina, South Africa, and Australia. By the end of 1919, Ford was producing 50 per- cent of all the cars in the United States, and the assembly line disruption in the industry had led to the demise of most of Ford’s rivals.7

The Automotive Industry and Ford Leadership The automotive industry in the United States had always been a highly competitive, cyclical business. In 2015 there were “a wide and growing variety of product offerings from a growing number of manufacturers, ”8 including the electric-car lineup from Tesla Motors, self-styled as “not just an automaker, but also a technology and design company with a focus on energy innovation.”9 The total number of cars and trucks sold to retail buyers, or “industry demand,” varied substantially from year to year depending on general economic conditions, the cost of purchasing and operating cars and trucks, and the availability of credit and fuel. Because cars and trucks were durable items, consumers could wait to replace them, and, starting in 2013, the average age of light vehicles on U.S. roads was over 11 years. Due to this, high replacement demand for cars and car parts was forecast to result in increased sales for 2015 and beyond. These sales would be aided by an improvement in the general economic situation, reduced gasoline prices, and lower interest rates for car loans, all contributing to the best results for U.S. auto sales since the 2008 recession.10 However, sales in the U.S. markets no longer belonged just to U.S. manufacturers (Exhibit 2).

Originally dominated by the “big 3” Detroit-based car companies—Ford, General Motors, and Chrysler— competition in the United States had intensified since the 1980s when Japanese carmakers began gaining a foothold in the market. To counter the problem of being viewed as foreign, Japanese companies Nissan, Toyota, and Honda had set up production facilities in the United States and thus gained acceptance from American consumers. Production quality and lean production were judged to be the major weapons that Japanese carmakers used to gain an advantage over American carmakers. Starting in 2003, because of innovative production processes that yielded better quality for American consumers, Toyota vehicles unquestionably became “a better value proposition” than Detroit’s products.11

Back in 1999, Ford Motor Company had been in good shape, having attained a U.S. market share of 24.8 per- cent, and had seen profits reach a remarkable $7.2 billion ($5.86 per share), with pretax income of $11 billion. At that time people even speculated that Ford would soon overtake General Motors as the world’s number one automobile manufacturer.12 But soon Toyota, through its innovative technology, management philosophy of continuous improvement, and cost arbitrage due to its presence in multiple geographic locations, was threatening to overtake GM and Ford. In addition, unfortunately, the profits at Ford in 1999 had come at the expense of investing in Ford’s future. Jacques Nasser, the CEO at that time, had focused on corporate acquisition and diversification rather than new vehicle development. By the time Chairman Bill Ford stepped in and fired Nasser in 2001, Ford saw declines in both market share and profitability. By 2005, market share had dropped to 18.6 percent, and Ford had skidded out of control, losing $1.6 billion, pretax, in North American profits. It was obvious that Ford needed a change in order to adapt and survive. Observers believed that the Ford family would take action to prevent further losses: “Ford may need a strongman . . . a Ford characteristic—the ‘prime minister’ who actually runs the company under the ‘constitutional monarch,’ a member of the Ford family.” It was speculated that Mark Fields, named the head of Ford’s North American operations in 2005, might be tapped to take that job.13 this became a legitimate observation about Ford’s approach to succession planning.

The Ford empire had been around for over a century, and the company had not gone outside its ranks for a top executive since hiring Ernest Breech away from General Motors Corporation in 1946 (see Exhibit 3).14 Since taking the CEO position in 2001, Bill Ford had tried several times to find a qualified successor, “going after such industry luminaries as Renault-Nissan CEO Carlos Ghosn and DaimlerChrysler Chairman Dieter Zetsche.”15

Among large corporations, it had become fairly common to hire a CEO from outside the family or board. According to Joseph Bower from Harvard Business School, about one-third of the time at S&P 500 firms, and about 40 percent of the time at companies that were struggling with problems in operations or financial distress, an outsider was appointed as CEO. The reason might have been to get a fresh point of view or to get the support of the board. “Results suggest that forced turnover followed by outsider succession, on average, improves firm performance.”16 Bill Ford claimed that to undertake major changes in Ford’s dysfunctional culture, an outsider might be more qualified than even the most proficient auto industry insider.17

An outsider CEO might also help restore faith in Ford management among investors, who were discontented with the Ford family’s high dividends and extravagant lifestyle. The Ford family controlled about 40 percent of the company’s voting shares through their ownership of all its class-B stock and holdings of common stock. The class-B family shares had almost the same market value as that of the common stock, but the voting rights of the family shares were exceptionally high by industry standards. The dividend stream was an annuity, which over the years had enabled various family members to own a football team, fund museums, and philanthropic causes, and even promote the Hare Krishna movement. Given that the company was experiencing serious financial problems, these activities raised stockholder dissent, as the annual retained earnings in the past had been dissipated as dividends instead of reinvested in firm operations or acquisitions to increase the net value of the firm.

In 2006, Alan Mulally had been selected as the new CEO and was expected to accomplish “nothing less than undoing a strongly entrenched management system put into place by Henry Ford II almost 40 years ago”—a system of regional fiefdoms around the world that had sapped the company’s ability to compete in a global industry, a system that Chairman Bill Ford couldn’t or wouldn’t unwind.18 Mulally’s Vision

Alan Mulally understood that organizational culture was the key to organizational change and that an appropriate organizational structure could aid change. However, that restructuring had to be supported and inspired by a clear vision. Prior to joining Ford, Mulally had served as executive vice president of the Boeing Company and as president and chief executive officer of Boeing Commercial airplanes. In those roles, he was responsible for all the Boeing Company’s commercial airplane programs and related services.19 Under Mulally’s visionary leadership, Boeing had regained the top position in its market from its major European competitor, Airbus. The market saw the appointment of Mulally at Ford as a move to utilize his experience and success in managing manufacturing and assembly lines to help shape the future of Ford.

Alan Mulally had come from a metal-bending business that, like auto making, was influenced by global competition, had a unionized workforce, and was subject to complex regulations and rapidly changing technologies.20 Although he was not an auto guy, he had a proven record in an industry that faced issues similar to those faced by the automobile industry, and a lot of his expertise and management techniques were highly transferable. In his own words, “Everybody says, well, I’m not a car guy so that you couldn’t make a contribution here. But I’m a product (guy), and I’m a designer.”21

Bill Ford praised Mulally as “an outstanding leader and a man of great character.” In his email to Ford employees announcing the appointment of Mulally, Bill Ford wrote, “Alan has deep experience in customer satisfaction, manufacturing, supplier relations, and labor relations, all of which have applications to the challenges of Ford. He also has the personality and team-building skills that will help guide our Company in the right direction.”2

Mulally set his own priorities for fixing Ford: “At the top of the list, I would put dealing with reality.” The newly elected CEO signaled that “the bigger-is-better worldview that has defined Ford for decades was being replaced with a new approach: Less is More.”23 Ford needed to pay more attention to cutting costs and transforming the way it did business than to traditional measurements such as market share.24 The vision was to have a smaller and more profitable Ford.

Mulally’s cutback plan built on the 14 plant closures and 30,000-plus job cuts announced by Ford in January 2007. Ford’s new plan added two more North American plants to the closure list and exceeded the targeted $5 billion in cost cuts by the end of 2008,25 but it pushed back a target for North American profitability by one year to 2009 and then again to 2011.26 The company targeted seven vehicle manufacturing sites for closure. At the same time, it also planned to increase the plant utilization and production levels in each production unit, while focusing more on smaller, more fuel-efficient vehicles. The overall strategy was to use restructuring as a tool to obtain operating profitability at a lower volume and create a mix of products that better appealed to the market.

By 2011, Ford had closed or sold a quarter of its plants and cut its global workforce by more than one- third. It also slashed labor and health care costs, plowing the money back into the design of some well-received new products, like the Ford Fusion sedan and Ford Edge crossover. This put Ford in a better position to compete, especially taking into consideration that General Motors and Chrysler had filed for bankruptcy in 2009 and Toyota had recently announced a major recall of its vehicles for “unintended acceleration” problems.27 Ford’s sales grew at double the rate of the rest of the industry in 2010, but entering 2011 its rivals’ problems seemed to be in the rearview mirror, and General Motors, especially, was on the rebound.

Mulally had set three priorities: first, to determine the brands Ford would offer; second, to be “best in class for all its vehicles”; and, third, to make sure that those vehicles would be accepted and adopted by consumers around the globe— “if a model was developed for the U.S. market, it needed to be adaptable to car buyers in other countries.”28 Mulally said that the “real opportunity going forward is to integrate and leverage our Ford assets around the world” and decide on the best mix of brands in the company’s portfolio.29 the “best mix of brands” appeared to have been established going C250 CASE 33: IS ONE FORD REALLY WORKING?

Into 2011, after brands such as Jaguar, Land Rover, Aston Martin, and Volvo were all sold off and the Mercury brand was discontinued. Ford also had had an equity interest in Mazda Motor Corporation, which is reduced substantially in 2010, retaining only a 3.5 percent share of ownership. This left the company with only the Ford and Lincoln brands, but the Lincoln offerings had struggled against Cadillac and other rivals for the luxury-car market. Mulally acknowledged that this needed fixing, and forecast date of 2013 for real changes in the Lincoln lineup.30

Since his appointment, Mulally had also made some additional structural and procedural changes in the company. For instance, instead of discussing business plans monthly or semiannually as they used to do, executives now met with Mulally weekly. The in-depth sessions were a contrast to executives’ previous efforts to explain away bad news, said Donat R. Leclair, Ford’s chief financial officer. “The difference I see now is that we’re actually committed to hitting the numbers. Before, it was a culture of trying to explain why we were off the plan. The more eloquently you could explain why you were off the plan, the [easier] it was to change the plan.”31

Mulally also did some senior executive reorganization at Ford, and many of the newly appointed executives reported to him directly, including a global head of product development. In addition, the head of worldwide purchasing, the chief of quality and advanced manufacturing, the head of information technology, the chief technical officer, and the leaders of Ford’s European division, its Asia, Pacific, and Africa units, and its Americas unit all reported directly to him.32

Mulally’s fearlessness had been well suited to pushing through projects at Boeing, but its suitability to Ford’s good-old-boy culture was a question. Like every new leader, he had to move with confidence in his early days, but as an industry outsider, he also had to take care to avoid violating long-standing industry norms.33 Regarding his approach to culture change, one observer noted, “Mulally’s approach to management and communication hasn’t been seen before in the halls of Ford, which have historically been the atmosphere of a kingdom with competing dukes.”34 Mulally encountered conflict between his management style and the old “Ford way,” but this didn’t deter him from making changes.

One significant thing Mulally did was to break down the global structure in which Ford Europe, Ford Asia, Ford North America, Ford Australia, and Ford South America had long created redundancies of efforts, products, engineering platforms, engines, and the like, as a way of perpetuating each division’s independence.35 The geographic segments were reconfigured into Ford North America, Latin America (including Mexico), Europe, and Asia/Pacific/ Africa. Mulally further consolidated top leadership to cover the major operations—the Americas, Europe, Asia/Pacific/ Africa—and appointed leaders for global manufacturing and labor and for global marketing, sales, and service.

However, these restructuring efforts also had their drawbacks. Unable to accept the Mulally management approach, some senior executives left Ford. The international chief of the company, Mark A. Schulz was one of them. “He had decided to retire after working for more than three decades at the company. Schulz was just one of a string of senior executives to leave after Mulally took over. Ford’s second-ranking North American executive, its North American manufacturing chief and its chief of staff also all announced their departures after Mulally’s hiring.”36 Ford lost some of its most experienced leaders because of the outsider CEO. Yet Mulally remained confident that his restructuring decision was still the right one for the long term.

Going into 2013, Mulally appeared to have reached his goal. As he said,

We achieved several important milestones, including restoring Ford’s investment-grade status and reclaiming the Ford Blue Oval, resuming regular dividend payments to our shareholders and achieving 14 straight quarters of operating profit. We launched 25 vehicles and 31 power trains globally in 2012, a testament to our ongoing commitment to product development. We also announced plans to revitalize our Lincoln brand . . . which will introduce an exciting new lineup of great luxury vehicles.37

In 2014, thanks to Mulally’s vision and perseverance, Ford maintained its position. Ford had introduced 24 vehicles around the world, including the new Mondeo in Europe, but although the firm was still profitable, net income was down $4 billion from 2013. Even though Ford maintained its number-two position in Europe, behind Volkswagen, major losses had occurred in that sector, primarily due to Russian economic instabilities, and South America had also seen losses due to currency devaluation and changing government rules. In addition, Ford’s push into the Asia-Pacific region, specifically China, was behind schedule. North American sales, while still strong, had resulted in operating margin reductions due to recalls and costs associated with the relaunch of the F-150. The one real bright spot was in financial services. Ford Motor Credit, the financing company that lends people money to buy new cars, saw its best results since 2011.38

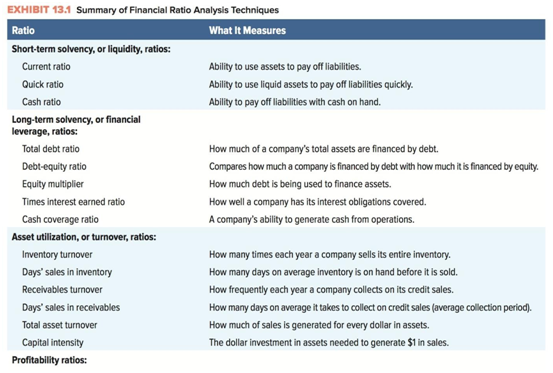

As Mark Fields took over as CEO, he pointed to the ONE Ford plan as essential to Ford’s future: “Our ONE Ford plan is built on compelling vision, comprehensive strategy, and relentless implementation, all leading to profitable growth around the world.”39 The actions of Mulally and now Fields, in enacting the ONE Ford plan, had attracted many long-term investors who believed in the strategy. Going into 2015 the financials, especially the balance sheet, appeared strong, and because of this, the company was able to reinstate and subsequently boost the dividend to shareholders, rewarding those investors who had stayed the course. (See Exhibits 4 and 5.)

1. IDENTIFY THE PROBLEM

2. CONDUCT ANALYSIS