- Case StudyHelp.com

- Sample Questions

Financial Analysis

- Calculate the relevant financial ratios of Tactile using information provided, that you believe are relevant to the business performance and an assessment of the business for acquisition purposes, explaining the rationale and insights gained.

- Calculate all the ratios that were shared during the programmed for Tactile for 2014 and 2013.

- Always calculate the ratio’s using the Group results as this is where the trading of the organization is reflected. When calculating the various ratios, please include the actual formula as well as the amounts you used to calculate to the answer.

- Indicate ratio’s in the appropriate format. For instance, profit ratios are expressed as a % while collection and inventory ratios are reflected as days. Round off all number to one decimal after zero. (2 – 3 pages; 20 marks)

- Interpret the ratios calculated for Tactile 2014 financial statements. It is not enough to merely say a ratio increased or decreased from 2013 to 2014. Clearly explain why the ratio increased or decreased.

- Analyze the financial performance of Tactile comparing 2013 to 2014 Income statement and Balance sheet. Highlighting any concerns and indicating how you believe the company has performed. Include in your discussion information gathered from external sources and highlighted the financial risks being managed. Discuss how Tactile address risks such as interest rate and exchange rate risks. (3 – 5 pages; 20 marks)

Conclusion

Provide a conclusion critically evaluation the advantages and disadvantages of the financial position of Tactile Limited and make a final recommendation to Business Partners whether they should buy 100% share of the organization or not. (½ – 1 page; 5 marks)

Part B – Budgets

Discuss and explain what critical information you would require regarding budgeting and forecasting for a business to assist in your decision making. Compare this to the current budgeting process your division/organization you work at. Would rolling forecasts make a difference to this information and why? (2 – 3 pages; 20 marks)

The following requires attention in your discussion:

Explain the Budget Process

- Discuss the best practices for the budget process as per the White paper that was shared. Explain the current budget process at your organization/company.

- Compare the budget best practice to your organization’s budget process and make recommendations that can enhance the process.

- Lastly, explain what rolling forecasts are, and comment of it can be used to the benefit of your organization in the process.

- The budget discussion should not be based on Tactile Limited.

Conclusion

Conclude on the overall budget process and the necessity or not, to have a budget in any business. Critically evaluate the advantages and disadvantages of utilizing a budget in any business. (½ – 1 page; 5 marks)

Conclusion: Personal reflection and leanings

Share your learning and insights gained from the Fundamental of Business Finance programmed and this assignment. (½ page; 5 marks)

General

- Please be very clear to outline all assumptions and explain decisions clearly and briefly and include all calculations.

- Total Marks: 100

- Pages: 10 pages. Page allocations per section are for guidance only

- Due date: Refer to Moodle

- Submission format: Word; Arial; font size 12; 1,5 line spacing UK English

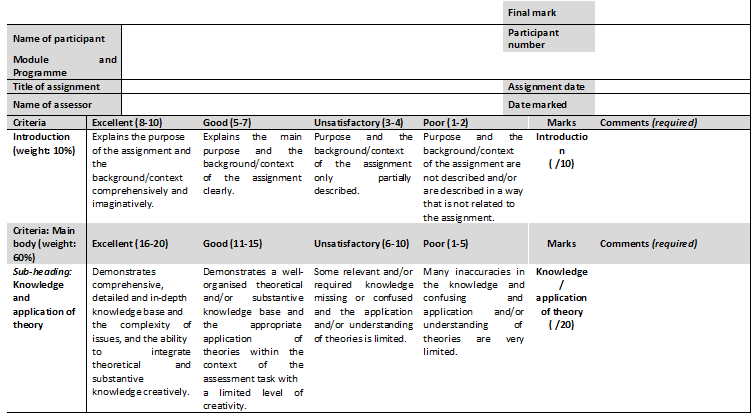

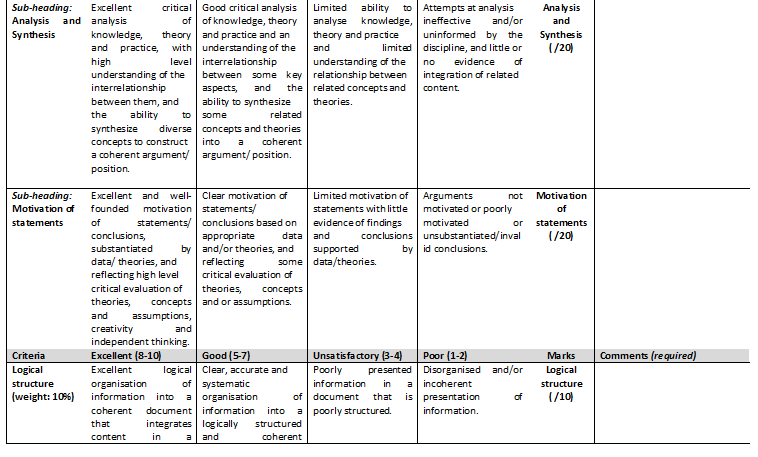

Marks will be Assigned as Follows:

Introduction (10 marks – statement of problem and analysis of issues). A body of an answer (60 marks )

- Knowledge and application of theory (20 marks)

- Analysis and Synthesis (20 marks)

- The motivation of statements (20 marks)

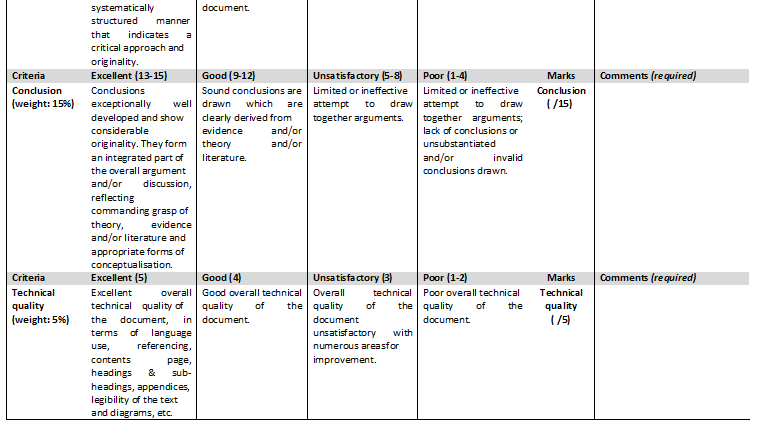

Conclusion (15 marks – set out a closing argument of what was discussed, what you believe the outcomes are that will support/not support your proposal).

Logical structure and technical quality (15 marks – logical organization of information and overall technical quality of the document).

Refer to the Assessment rubric below for assessment criteria of marking assignments.