- Case StudyHelp.com

- Sample Questions

NIFH06V

Case study

Andre is looking for a plot of land upon which to build a house and not far from where he lives presently, in a small fishing village on a Greek island. A half-hectare plot has been for sale for nearly three years. The owner, a former resident of the island, had used two local real estate agencies in succession without concluding a sale.

Last week another, different, real estate agency erected a ‘for-sale’ board on the site, and Andre checked the sale particulars on the Internet. The asking price is $250 000, which was $20 000 above the price asked for the plot on the owner’s previous attempts to sell it. Interestingly, the owner had not dropped his price despite his failure to sell.

Andre enquired about the plot at the mayor’s office in Zante, the island’s only town, 18 kilometers away, seeking details of any planning restrictions affecting the site and what was expected from any building or buildings erected there. He was assured there were no planning restrictions on what could be built on it.

He contacted the selling agent, Ms. Voutos, who claimed there had already been many inquiries from people living on the island and from Athens, where Giorgio Krimpas, the owner, lived. She also said that Giorgo was determined to get his price of $250 000, that he was in no hurry to sell, and that he insisted that all negotiations were to be conducted by herself.

Andre thought the owner might be in a strong bargaining position by demonstrating his firmness on price and by recently increasing the price to $250 000. Leaving everything to his agent, Ms. Voutos, her commission presumably rested on her getting Giorgio his price given the alleged interest in the site.

Andre’s problem boiled down to where to open his negotiations. Should he offer the asking price? If not, should he go over it? How far should he go under it? If either, which price should he offer?

He had insufficient finance in place to pay close to the asking price for the land, given that, in addition to the land price, he had to finance the clearing of the land of bush and overgrowth, much of it a disused and neglected old olive grove, plus the accumulated rubbish dumped on it over the years. Then he had to undertake to landscape on the sloping ground and build a boundary fence, pay the architect’s fees, install all the electricity, water and sewage utilities, and construct a 500-meter private access road. Lastly, he had to finance the construction of his house, plus a swimming pool.

Andre did not like dealing with agents; he preferred direct negotiations between principals. He did not like Giorgio’s aggressive price tactics of increasing his price to $250 000 when he couldn’t sell the land for three years at $230 000. In these circumstances, he was determined that he would not accept Giorgio’s opening price. If a commercial developer took an interest in the site, which was large enough to build three or four houses for holiday lets during the summer season, this could create problems for Andre’s ambitions.

Required:

- In this transaction what are Giorgo and Andre’s interests?

(8 marks)

- How would you describe the distributed bargaining problem between Andre and Giorgo/Ms. Voutos?

(8 marks)

- Why would Giorgo use an agent such as Ms. Voutos?

(8 marks)

- How might Andre deal with Giorgo’s apparently strong bargaining position with a conditional bargain for Andre to settle at less than, but no more than, $250 000?

(8 marks)

5. If Andre’s entry price for the land is $220 000 and his exit price is $245 000, and Ms Voutos entry price is $250 000 and her exit price is $240 000, explain the concept of Negotiator’s Surplus and identify the necessary conditions for a deal to be agreed between the buyer and the agent (subject to Giorgo’s veto as principal seller).

(8 marks)

Essay Questions

Essay 1

‘Look,’ said Ramos, ‘we dealt with these people some weeks ago, and they played it very tough indeed. They kept interrupting, didn’t accept what we said, demanded we cut our prices, wanted lots of extras, and wouldn’t take no for an answer. Let’s admit it; we did badly. The deal is hardly profitable, and now they are back to re-negotiate the Argentinean communications’ deal. So how are we going to play it?’ ‘Perhaps, they will play it softer as the deal they have is already a good one for them,’ offered Martinez. ‘How should we play it if they come across all friendly?’ Ramos replied ‘Let us go in hard and pull back items we were too soft on last time. Let’s give them a taste of their own medicine.’

Why should a negotiator always practice the purple principle of assertive conditionality when dealing with any aggressive Red, submissive Blue, or assertive Purple negotiating style?

(20 marks)

Essay 2

Yvonne had listened carefully to what Ruth said about the terms under which she would buy the television series from Yvonne’s media production company. Ruth had said: ‘I love the series, Yvonne. It is the best I have seen for a new 10- programme series this year and I want to make it work for Channel 10.

But you will have to review your pricing structure and the repeat fees because my budget for new programmes is already down 20 per cent and the Board is nervous about risking so much on a new, unproven show. It may be a great success in India, but this is Mauritius, and we do not have the population to pay the rates you want. Now come back to me with revised figures attuned to my situation with my advertising revenues, and I’ll fast-track your programmed series through the Board, because I just love it, but I cannot stretch to your rates.’

Discuss why negotiators resort to manipulative ploys and what may be the likely consequences?

(20 marks)

Essay 3

‘I made them stick to the contract,’ said Melanie. ‘They signed it, and they must live with it.’ Rose disagreed, saying, ‘Yes, but, this is a fairly good client, and they decided to switch their systems and did not need the Alpha Plus service. We should have given them a break and kept the business connection.’ ‘But the contract had two years to run and was highly profitable Rose, and we would have given up good profits that made us look good at Head Office. So I told them ‘no,’ and there’s nothing they could do about it but pay up.’ ‘Don’t you see, Melanie, they have now written in refusing to renew their contract, and have informed us they will not buy any systems from us again in future. That’s $250 000 per year now gone to our rivals.’

How does the prisoner’s dilemma game assist our analysis of negotiation?

(20 marks)

OUC 2009 Examiner’s Solution

Case Solution

- In this transaction what are Giorgo and Andre’s interests?

(8 marks)

Interests are the motivations for preferring certain solutions to the negotiation problem compared to others. Interests are ‘why’ the bargainer wants the solution to the negotiation issue.

In Andre’s case, his interests include:

- to obtain a price for his land that provides a clear profit from the transaction;

- to conclude the deal and to receive the agreed payment at low risk that complications will be avoided, such as post-sale disputes;

- no imposed legal burdens;

- no claims associated with ‘buyer’s post-sale regrets; no delays in full payment; no ‘come-backs’;

- to have several serious buyers competing for the land.

In Andre’s case, his interests include:

- to pay the price for the land that provides a cost-effective opportunity to erect the house he aspires to;

- to obtain clear legal title;

- to have the seller meet his agreed obligations without any legal complications subsequently arising;

- to have the seller fulfill his obligations arising from the agreement;

- to ensure that the seller’s sale’s particulars are accurate and truthful;

- not to have serious competition for the land.

- How would you describe the distributed bargaining problem between Andre and Giorgio/Ms? Voutos?(8 marks)

The distributed bargain is a means of generalizing the dilemmas facing the parties in a negotiation over a single issue, such as price. Giorgio has set an entry price of $250 000 for the land and Andre has to choose an entry price in response. The range between Giorgo’s entry Price and Andre’s entry Price constitutes the negotiation range.

Andre should know that a negotiator does not (normally) accept the first price that the other negotiator opens with. Why? Because negotiators usually think regarding ranges, not fixed prices, and if a negotiator’s entry price is $250 000. It is likely that his exit price is less than his entry price. The difference between the entry price and the exit price is the seller’s negotiating range; the gap between the buyer’s entry price and the exit price is the buyer’s negotiating range.

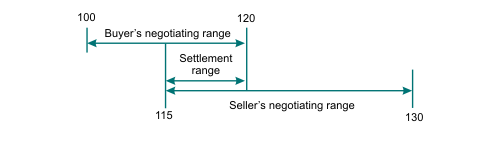

In Figure 2.4 (from the Text) the seller’s and buyer’s range overlap in that the least the seller is willing to accept (the exit price) is less than the most the buyer is willing to pay (the buyer’s exit price). The extent of the overlap in exit prices constitutes the ‘Settlement range,’ meaning that at any price within the settlement range, a settlement is possible.

Figure 2.4 The negotiators’ exit prices overlap

Assume that the most Andre will pay for the land is $245 000 and the least that Giorgio will accept is $230 000, then the settlement range is $15 000. Of course, the range depends entirely on the choice of exit price each party makes. Giorgio knows three bits of information – his entry and exit prices and Andre’s entry price; he does not know Andre’s exit price. Andre knows his entry and exit price and Giorgio’s entry price but does not know his exit price.

Choosing exit prices is not shared information. Why Giorgo’s entry price is $250 000 is not stated. Andre has to think about George’s choice. What does it tell him about Giorgio’s intentions? What should his response be? $220 000, $230 000, $240 000? Andre has to think about how real is the competition? How candid is Ms. Voutos about the number of inquiries? How many of the inquiries about the land are serious about wishing to buy and able to do so?

As long as the negotiation is about a single issue, price, it is likely to be zero-sum – what Andre gains from Giorgio lowering his price, Giorgio loses; and what Giorgio gains by Andre raising his price, Andre loses. If the competition for the land is non- existent, Andre can expect Giorgio to settle closer to Andre’s entry price; if the competition is real, Giorgo can expect Andre to settle closer Giorgo’s entry price. In some circumstances, depending on the competition and the credibility of the other negotiators bargaining claims, either party could settle lower (seller) or above (buyer) their exit prices.

- Why would Giorgo use an agent such as Ms. Voutos? (8 marks)

Giorgio lives in Athens, capital of Greece, and the land is on a Greek island. It is convenient for Giorgio to delegate the showing and selling of the land to Ms. Voutos who lives on the island and she can handle all inquiries about the land and its selling price.

Using an agent has other advantages. Many inquiries will not be serious and dealing with them on his visit to the island would waste Giorgo’s time, and not being present could lose otherwise interested and serious potential buyers, if his business kept Giorgio away at crucial times.

Ms. Voutos can handle inquiries about price and can limit the initial information on the sale to Giorgio’s entry price. Without George’s instructions to negotiate downwards on price, she acts as a barrier to a price collapse.

She can establish any prospective purchaser’s entry price and pass this information to Giorgio, who can decide to relay new instructions to her or can visit the island to continue or conclude the negotiations.

She also collects valuable information about prospective buyers and their circumstances, leaving Giorgio in a stronger negotiating position.

- How might Andre deal with Giorgio’s apparently strong bargaining position with a conditional bargain for Andre to settle at less than, but no more than, €250 000? (8 marks)

Giorgio’s bargaining position is apparently strong because he does not appear to be in a hurry to sell his land after three years. Andre needs to test this assumption. Why is he selling now?

On what basis has he set his price at $250 000? This should be explored; perhaps checked by a local land valuation specialist. What are other development lands selling for on the island? Is there any local development about to happen that would influence the price of land near the village? Does he need the money? What do local people (family?) know about Giorgio’s personal and business affairs that would affect the price or the need to sell?

Conditional bargains are formed by using the format of ‘IF–THEN’: ‘If you give me this that I want, Then I shall give you that which you want.’ By stating your conditions and linking them to your offer you immediately form a two-sided bargain that they have to agree to as a whole and not just to agree to accept the offer without its linked condition.

Andre needs to assemble a conditional bargain, and for this, he needs to think about possible conditions related to his purchase offer. The clearest area may be by trying to off-load some of the costs of the work on to Georgia if Andre is to be persuaded to raise his purchase price offer. Looking at the work schedule he needs to complete and pay for on top of the purchase of the land from Giorgio, potential candidates to select from are:

Two possible items for Giorgio to accept are:

- clearing of the land of bush, overgrowth, old olive grove;

- clearing the accumulated rubbish.

Increasingly unlikely, certainly as full cost items, but perhaps by selecting individual items from them are:

- landscaping the sloping ground;

- constructing a boundary fence;

- installing electricity, water, and sewage utilities;

- constructing a 500-meter private access road.

Other areas might be for Giorgio to pay legal fees for a transfer of title; government taxes on land sales, and such like.

A conditional bargain could be: If you clear the land of all overgrowth and old olive trees, and pay the registration of title fee, then I will increase my offer for the land from $235 000 to $242 000’.

- If Andre’s entry price for the land is $220 000, and his exit price is $245 000, and Ms. Voutos entry price is $250 000, and her exit price is $240 000, explain the concept of Negotiator’s Surplus and identify the necessary conditions for a deal to be agreed between the buyer and the agent (subject to Giorgio’s veto as principal seller).

(8 marks)

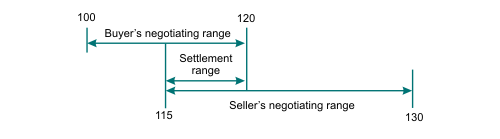

Enter and explain the data on the distributed bargain diagram:

Figure 2.4 The negotiators’ exit prices overlap

Define terms: the negotiating range is the range of prices between the seller’s and buyer’s Entry prices; the sellers and buyers negotiating ranges are the range of prices between their entry and their exit positions.

The negotiating surplus is the range of prices between the overlap in their Exit prices.

The necessary conditions for a deal to be agreed between the buyer and the agent is that the agent’s (acting for the seller) exit price is less than the buyer’s exit price (s<b).

The final deal is subject to Giorgio’s veto as principal (seller) over what his agent has negotiated with the buyer. This is a drawback for the buyer of negotiating with agents and not the principal and is why principals use agents.

OUC 2009 Examiner’s Solution

Essay 1

Why should a negotiator always practice the purple principle of assertive conditionality when dealing with any aggressive Red, submissive Blue, or assertive Purple negotiating style?

(20 marks)

Assertive purple proposal language centers on conditionality, or in the IF-THEN format: ‘If you do this for me, Then I will consider doing that for you’. While loose proposal language is better than making no proposals at all, assertive proposal language is better all round. Unassertive language sends the wrong signals, namely that you are unsure of your case, that you are not fully committed to your stance, and that you will retreat if pushed. What you invite you to provoke.

The weak unassertive language uses words such as ‘I would like,’ ‘I wish,’ and I hope,’ and it often gets the conditionality principle round the wrong way. For example, instead of making a proposal statement (IF you…Then I…) it asks a proposal question: IF I…will you? But asking a proposal question invites a refusal or a conditional acceptance, which squeezes out another concession (‘Only if you…’).

In negotiation with an aggressive red-style negotiator, weak language is positively fatal. The red stylist exploits weaker negotiators. Weak language encourages anybody with a proclivity for red behavior to be more red than usual.

The two extremes of style are Red (‘more for me means less for you’) and Blue (‘less for me means more for you’). Effective negotiators work in the purple style of conditional bargaining. This means they are assertive (but not aggressive) and accommodating (but not submissive). The use of assertive purple conditionality (‘IF-THEN’) is appropriate in dealing with either extreme (including devious) red and extremely blue. The recommended strategy for dealing with red players in the red-blue game, uses tit-for-tat, which is a purple strategy, because the blue player responds with a red only if the other player plays red and with a blue play always when the red player switches to blue.

The bombastic, aggressive red stylist – usually wanting something for nothing – is unable to intimidate the assertive purple stylist who insists on applying the principle of: ‘give me some of what I want, and I will give you some of what you want.’ The aggressive red cannot get anything from the assertive purple. Aggressive red gets something for nothing from the submissive blue. The more subtle devious red stylist also wants something for nothing but cannot ruffle the insistence of an assertive purple negotiator. As the conditionality principle is the basis of all assertive purple proposals, the subtle red stylist is stuck with either revealing their red nature or accepting that the decision is going to be made only by trading (IF-THEN)

A normally extreme blue stylist – the submissive, the cringing and the weak – expects little from the negotiation and usually is not disappointed. But assertive purple stylists do not behave differently with submissive types – to do so would be to exploit them in the way a red stylist attempts. By consistently applying the conditionality principle of ‘IF–THEN,’ the submissive is treated no differently. For once they are treated as partners, and they are offered something back for what they give in exchange. By showing the submissive how to trade conditionally, they also learn how to stand up to the red stylists who normally dominate them.

This leaves the assertive purple negotiator up against another assertive purple negotiator. As both negotiators are using the same conditionality principle (IF-THEN), they experience no problems of understanding what each is about. Both insist on getting something specific back for what they give, and both formulate their tentative proposals in the same way. Negotiations can proceed to a conclusion without either of them being exploited (though the terms they settle upon can vary).

Essay 2

Discuss why negotiators resort to manipulative ploys and what may be the likely consequences?

(20 marks)

This Essay is about the tactical choices made by negotiators in ‘live’ negotiations. Examples from real negotiations attract discretionary marks.

Define the purpose of manipulation: to influence the perceptions of the outcome and lower these expectations so that ‘more for me means less for you.’

Describe the most famous, the ‘Bogey,’ the ‘Krunch,’ the ‘Nibble,’ and others (e.g. ‘Russian Front,’ ‘Good guy/Bad guy,’ ‘Mother Hubbard,’ ‘Salami,’ etc.).

‘Why’ negotiators manipulate is more important that a mere description of famous ploys.

Contrast red, blue and purple behavior. All red behavior is manipulative because it aims to get something for nothing, and includes bullying, intimidation, domineering and aggression. Also more subtle, even good mannered and, on occasion, covert.

Purple behavior trades something for something (e.g., ‘more for me means more for you’) but submissive blue gives something for nothing and gives in to red behavior.

Tactical ploys work with submissive blue negotiators. Ploy negotiators who get something for nothing from somebody prepared to give them something for nothing receive a pay-off for their manipulations. Assertive purple negotiators make ploys useless because they insist on the exchange principle: ‘if you give me some of what I want, then I will give your some of what you want.’ One-way red deals aim to exploit them.

Experience teaches people subjected to tactical ploys that they are disadvantaged in the exchange from which they seek to protect. Two motives for playing red: to exploit the other player (take advantage of their blue gullibility) or to protect oneself from the other player (‘do unto others before they do it unto you’). These motives explain why negotiators resort to tactical ploys.

The exploiter motive creates ‘street-wise’ dealers and ‘tough guys.’ They seek to win at the other negotiator’s expense by ‘defeating’ her and from ‘winning.’ They are found in short-term businesses, used car sales, estate and house agents and brokers, and the one-off contracts. They increase the costs of a business sector, e.g., construction industry and its claims and counter claims for variations and defects.

‘Dominance,’ ‘Shaping’ and ‘Closing’ manipulations attracts discretionary remarks in an evaluative context.

Essay 3

How does the prisoner’s dilemma game assist our analysis of negotiation?

(20 marks)

The original prisoner’s dilemma type games explored the tension between coping with the risks of co-ordination and suffering from the lower or negative pay-offs from defection. The games can be played without content (the red and blue game) or with content through a short scenario (the original prisoner’s dilemma game, or the currency game, etc.). Over forty years, an abundance of literature has appeared analyzing the games and their derivatives (Game Theory), and they are applied in a variety of disciplines, as well as in negotiation studies. While the question specifies the prisoner’s dilemma game, it would be acceptable to discuss the other games as long as they have a structure based on the prisoner’s dilemma type of games (e.g., currency, red versus blue, war and peace, etc.).

First, a brief description of a prisoner’s dilemma game is required, with some understanding shown of the underlying structure of the game rather than merely describing it in great detail (and describing all known prisoner dilemma games in detail does not gain marks). In essence, prisoner’s dilemma is about the risks of trust and the choice of behaviors prompted by defensive intentions to protect from exploitation and aggressive intentions to exploit. It shows that because of these risks, players acting independently are often led to choices (or plays) which produce sub-optimal outcomes (lose-lose; lose–win; win-lose) compared to what they could have achieved if they had been able to co-ordinate their choices (win-win).

Describe the original scenario for Prisoner’s Dilemma (the numbers representing the pay-offs vary between accounts and are less important than understanding the nature of the dilemma).

In the original scenario of the two prisoners, each prisoner is told that the terms and outcomes of a possible deal are possible when they choose between confessing to the crime and not confessing. The dilemma is: what should a prisoner do?

On the face of it, the choice of confessing (defection) and not confessing is easy; both of them should not confess because this has the minimum risk, and, if they could safely co-ordinate their choices to deliver a win-win outcome this choice would be best for both of them. But the game precludes safe co-ordination and as neither prisoner can be sure what his partner will do, they cannot formulate an optimum or safe win-win strategy. Hence they are in a dilemma ‘If my partner thinks I will not confess, he may not confess too, to our mutual (win-win) benefit, or will he confess (i.e. defect) to my certain disadvantage? If, however, he is likely to defect by confessing, should I stick to my choice of not confessing or should I change my mind and confess? ‘What is my partner thinking about, what I think he is thinking about, what I am thinking he is thinking……?

The players are driven to a sub-optimal play not because they want to but because they must. Defection is forced upon them because they think the other will defect (protection of self). Trust to achieve a win– a win is overwhelmed by the risks of trust (them losing and their partner winning).

In a negotiation, there are similar dilemmas and similar problems of trust. We negotiate because we do not know the outcome that is satisfactory to both parties – we know what may be satisfactory to us and we also know that whatever that satisfactory outcome is, we would be even happier with a deal that is even more satisfactory to us. Caution is advisable, but suspicion breeds self-protection and a failure to co- ordinate by delivering the fruits of co-ordination.

The concept of win-win outcomes is in widespread use in negotiation literature. The win-win, or Nash outcome is available but rarely occurs because players are driven either by self- protection (‘I’ll play red because I believe my partner will play red’) or by exploitation (‘I’ll play red because I am sure my partner will play blue’). Or in the scenario above the question: ‘I’ll play red because my partner has no choice but to play Blue under the terms of our contract.’ This amounts to ‘I defect not because I must but because I want to.’ The outcome is predictable.

The act of playing red is self-fulfilling. If both play red they confirm the self-protection motive; if one plays blue and loses to red play, they switch to red play to protect themselves. The player who played red to exploit the victim now faces the prospect that his partner is alerted to his exploitative intentions which will force the blue player to switch to red in retaliation. The road to a lose-lose outcome is wide and slippery. At the first opportunity the other player stops doing business with the red player and meanwhile bad mouths that player at every opportunity with other business people.

In one-off exchanges, red play predominates because trust is perceived to be too risky. Playing red in a multi-round game, such as red-blue, the prevalence of blue play by one of the players in the first round increases to just under half of the players, but red is still the choice of just over half of the players. Many partners manage to agree on mutual blue play before the game is over, but the rest get stuck into a red-red cycle. and end up with lower positive scores than they needed to (i.e., well short of a Nash solution).

On the whole, over enough negotiations, players apparently learn from the disadvantages of protective defection and intentional exploitation, to find ways of cooperating to produce a win–win outcomes, and the evolution of blue–blue play ensures that negotiated outcomes in the longer run produce better results than the alternatives. Win-win negotiation successes dominate exploitative and coercive distribution of whatever is at stake – which is why, over the long run, negotiation is more closely associated with wealth creation and harmonious relations than its alternatives. Negotiators can be trained to play blue–blue.