- Case StudyHelp.com

- Sample Questions

Strategic Marketing Case Study – SmartCart

Do you need Strategic Marketing Assignment Help? At Case Study Help, we guarantee 100% plagiarism-free Custom Assignment Writing Service from our highly knowledgeable and experienced writers. Visit our site if you want an instant solution for Strategic Marketing on SmartCart Assessment. We never miss a single chance to wonder our customer.

Market Needs Report

Positioning Statement

SmartCart will benefit both the grocery store retailer and the individual shopper. Smart Cart is the only available product that offers aisle-by-aisle grocery store navigation, product and promotional recommendations, and personalized profiles for each of your shopper’s needs and interests. Smart Cart saves the shopper time and makes the ordinary grocery shopping experience more convenient and interactive. The grocer benefits by gaining more foot traffic in the store which will lead to more product sales. With Smart Cart, the shopper has the advantage of knowing exactly where in the store the item on their grocery list is located. Smart Cart single handedly transforms the way consumers do their weekly grocery shopping and establishes an on-going personal connection between the grocer and the consumer so that promotions can be tailored to their shopping behavior.

The Market Need

The SmartCart offers a solution to the negative feelings associated with the dull chore, “grocery shopping.” The product puts an end to frustratingly navigating through grocery stores during a busy day and it targets the shopper that has limited time in their day to wander aimlessly down grocery store aisles. Gone are the days of searching each aisle of a grocery store to complete your shopping list or forgetting an important item. With SmartCart, shoppers have the ability to input their shopping lists, receive turn-by-turn navigation within the store, and even get recommended additions based on previous visits. The Smart Cart expands the mundane functionality of a traditional shopping cart; this product enhances the shopper’s experience from start to finish. Once the shopper has completed their grocery shopping, SmartCart features a card reader that streamlines the self-check-out process; no bagging or grocery store staff needed.

Grocery store customers will be able to perform many tasks included in the main functionality of the touch screen interface. The patron can search for grocery products, view promotional discounts, and suggested items. The SmartCart program was created to anticipate the needs of the shopper and add value to the typical dash to the local grocer. The SmartCart aids the consumer’s shopping experience by incorporating current personalization technology that allows for the consumer to create a Store Profile that compiles information from previous visits to identify preferences in the shopper’s brand selection, product choice, and frequency of purchase to remind and recommend items during the visit. We have consulted with a member of management and shift members of local Publix Store #1468 about the launch of the product to gauge their receptivity. Smart Cart is highly anticipated and the local manager described the product as “game-changing!” The manager had concerns about the durability of the product and if the tablet interface was sensitive considering large items are used in the cart and small children aretransported in the same area and rough contact is often made. To address this concern, Smart Cart is included with a Lifetime Service Guarantee and any repairs or technology updates that arise will be honored quickly so use can continue. Also, the product was designed with this manager’s concern in mind. The award-winning casing material that covers the tablet interface is water-proof and can withstand up to one hundred pounds of weight. Smart Cart can withstand the rain, extra-large bags of pet food, and even the most rambunctious toddler!

Situation and Environmental Analysis

Industry Overview

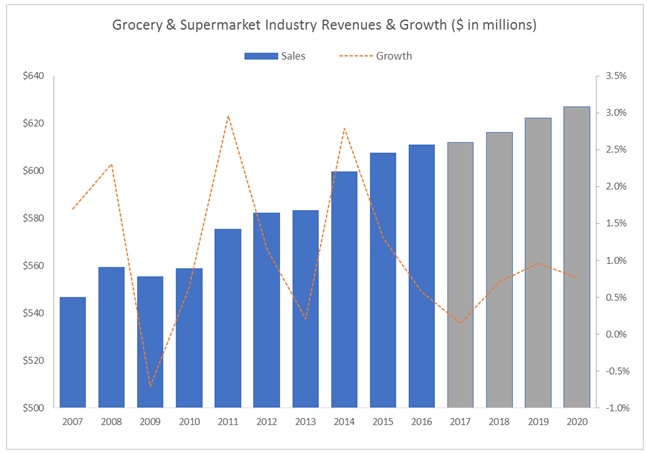

According to the Food Marketing Institute, Americans spent about $668 billion in supermarkets last year and the market share is constantly expanding to include e-commerce retailers appealing to consumers as a convenient alternative to get the products they need. Additionally, farm markets, online grocery ordering, and an increase in dinning out has decreased the amount of visits made to a grocery store. An increasing number of retailers are digitizing the consumer shopping experience by incorporating technology that creates a more interactive and efficient shopping experience. Technology incorporation has increased the competition among the existing major companies and introduced new players. Larger firms, supermarkets, as well as organic retailers are all competing to woo customers with similar products while each attempting to differentiate their shopping experience to increase market share.

Target Market

SmartCart can improve the shopping experience for anyone with limited time to spend in the grocery store and is comfortable using a touch-screen tablet. Through focus group testing, we have identified that are target market demographics are men and women, aged 25-45.

| Shopper Target Market Segments(Age in years) | 18 -25 | 25-35 | 35 and up |

| Men | 45% | 42% | 51% |

| Women | 55% | 58% | 49% |

| Publix Grocery South East Store Locations | Size of Market# of Store Locations | Estimated Unit Sales |

| Florida | 775 | 38,750 |

| Georgia | 185 | 9,250 |

| Alabama | 65 | 3,250 |

| Virginia | 4 | 200 |

| Tennessee | 41 | 2,050 |

| North Carolina | 26 | 1,300 |

| South Carolina | 58 | 2,900 |

Competition

There currently isn’t any direct competition for the SmartCart. The traditional shopping cart doesn’t feature the technology and personalization capability SmartCart offers. To address staffing headcount concerns, some grocers have incorporated Self Check- Out Kiosksthat could serve as competition for the product. However, Self-Check-Out Kiosks are costly, take up substantial floor space, and an attendant is still needed to supervise the area. SmartCart is a better solution to the traditional shopping cart and kiosk, as the program is able to be installed on a store’s traditional shopping carts and eliminates the check-out process with the card reader available on the product. Any brick and mortar grocery store looking to gain a competitive advantage over strengthening e-commerce retailers, farmer’s markets, and others can incorporate the SmartCart to increase customer foot-traffic, item sales, customer satisfaction and loyalty.

Launch Plan

We plan to start with a limited launch of the Smart Cart with the largest grocery chain in the southeast United States, Publix Supermarkets, Inc. Publix owns and operates over 1,100 stores in the southeast and mid-Atlantic states. Publix has an excellent reputation for quality and customer service and sufficient size and geographical presence to help the Smart Cart to become well-recognized in the market. We plan to approach Publix with a plan for a trial run in 10% of their stores (115 locations) for the 2018 calendar year. Assuming a successful trial and launch, we think we could roll-out the Smart Cart to 25% of Publix stores in 2019 and 50% of Publix stores in 2020.

Marketing Objectives

Below are our sales and profitability objectives associated with our marketing plan for the next three years.

Sales

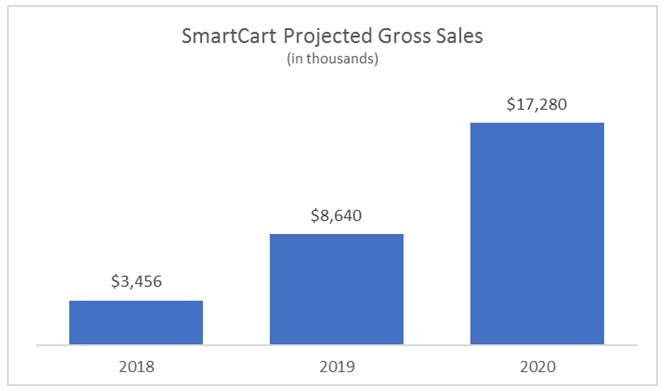

Our goal is to conduct a successful limited launch of the Smart Cart with the largest grocery chain in the southeastern United States, Publix Supermarkets, Inc. Publix currently operates 1,152 stores, with over 700 stores in Florida alone. Our early survey work indicates that nearly 100% of shoppers think there is currently a need for the SmartCart technology in stores, therefore, we feel confident that we can achieve a trial with Publix to launch our product in 10% of their current operations, or approximately 115 stores. We estimate that each Publix location utilizes approximately 100 carts. This translates to roughly 11,500 units of SmartCart sales for 2018, or $3,456,000 at an average selling price of $300 per cart. Assuming a successful launch and trial period of one year with Publix, we project that we can obtain further penetration of 25% of Publix stores in 2019 and 50% penetration in 2020. If we hit these penetration goals by 2020, sales will increase to $8,640,000 in 2019 and $17,280,000 in 2020, which represents 150% and 100% growth, respectively. Even if the number of Publix stores does not increase over the coming three years, this is still a significant growth opportunity.

Profitability

Our estimated cost of goods sold is $220 per unit, which will provide us with a 26.7% gross margin. We assume no cost efficiencies gained in 2019 or 2020, though there could be opportunities to save on input costs as we gain economies of scale from growth. Gross profits are projected to grow from $921,600 in 2018 to $4,608,000 in 2020, assuming we hit our sales goals outlined above and gross margins remain constant.

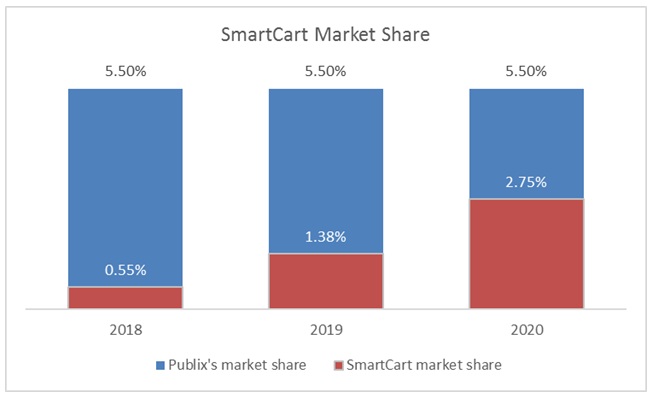

Market Share

Given that we will be conducting a limited launch with one grocery chain, our market share will be defined and limited by Publix’s market share. Currently, Publix enjoys 5.5% of total supermarket and grocery industry sales in the United States, according to analysts at IBISWorld (Hurley, 2017). If we obtain 10% penetration within the current Publix store base, then we can conservatively assume that we will control 0.5% of the grocery shopping cart market. This will grow to 2.75% by 2020, assuming no changes to Publix’s future market share or our customer base.

Marketing Strategies

We anticipate the Smart Cart to be a major win for customers within the shopping market compared to the traditional method of clipping coupons, spending hours drifting through the store, and not knowing your total balance until check out. Our strategies will cater to the ease of the shopping experience and strengthening customer loyalty by factoring in our survey and focus group responses.

Product

The Smart Cart technology will be available through a tablet on each shopping cart, which can be accessed by entering your login credentials or fingerprint. Once logged in, personalized coupons will be available for the items on your shopping list as well as directions through the store to assist in navigation to each of those items. The Smart Cart will suggest particular brands and quantities for optimal savings during the shopping trip. As items are placed into the cart, a running total will show to help the shopper stay on budget and will update for items removed. This will result in less waste from products spoiling while outside of their optimal temperature.

The tablet’s design will look like a traditional rectangular, sleek, white tablet. The smudge-proof screen will provide customer preferences on font color and size to assist with visibility. There will also be reminders for items that are purchased regularly to make sure nothing is forgotten. The Smart Cart will provide alerts for products in the cart that contain allergens from a provided list and for items that are prohibited from a diet plan.

The Smart Cart allows for expedited checkout by using a card on file or by swiping a new one. A help button will also be available in case the customer needs assistance from a store clerk. When placing food items in the cart a feature will provide recipe ideas and locations for the other ingredients then sends the recipe to be accessed at home when cooking.

There will be an option for shoppers to submit feedback through the Smart Cart and the store can submit feedback directly through the technical support line. The feedback and data collected from the Smart Carts will provide the direction for the second and future generations of our product.

Price

The Smart Cart will sell directly to stores for $300 per unit, with an average cost per unit of $220.

Promotion

- The Smart Cart will be advertised in Publix weekly savings flyers through email and mail to inform shoppers of the various features.

- We will provide Publix with detailed informational cards to provide their shoppers so they will be knowledgeable and aware of our new product a month prior to release.

- During the initial launch week a $5 off coupon will be provided to each shopper in the store to incentivize current and prospective shoppers to use our product.

- An Instagram and Twitter account will be established for a small amount of social media marketing. A YouTube channel will be created for training videos for shoppers and store employees.

Placement

The Smart Cart will be sold to Publix Supermarkets, Inc., the largest grocery chain in the southeastern United States.

Physical Layout

In Publix, the Smart Carts will be located by the front door of each store. There will be a designated area where the traditional carts were stored that will be updated to charge each Smart Cart efficiently.

Positioning

The Smart Cart will be positioned as a means to increase shopper efficiency and customer satisfaction, and customer loyalty. It will be targeted to all shoppers at Publix Supermarkets.

Process

There will be multiple ways for end users to be educated on how to properly use the Smart Cart. First, detailed instructions will be provided via social media and to users of Publix’s website. In addition, there will be training videos available for free on our YouTube channel. Finally, we will provide training to employees of Publix so they can assist with any questions shoppers may have while shopping.

We will train the employees of Publix Supermarkets to become experts on the features and benefits of the Smart Cart. There will also be a product support help line for any technical issues that may arise over the product’s life.

Critical Factor

- Maintain positive relationship with Publix Supermarkets, Inc. through technical support and trainings

- Maintain positive relationship with shoppers by acting on feedback received

- Provide a thorough and current database of coupons and product offerings

- Provide a thorough and current database of recipe ideas

- Maintain updated map of product locations for each store

Assumptions:

- Estimates are based on product being available at estimated date (February 30, 2018)

- Prototypes are created and tested thoroughly to ensure high performance and error reduction of 90% or greater

- Training program will occur frequently to ensure proper marketing (once a quarter)

- Economic outlook and/or markets will not have a significant change from forecasts

SMART CART- PRODUCT EXAMPLE

Appendix A- Consumer Based Features, Advantages, and Benefits (Consumer)

| Features | Advantages | Benefits |

| Touch Screen Display Monitor/User Interface: | -Consumer views personalized promotional material while shopping-Shopper inputs shopping list-Shopper is able to view item recommendations

-View store/ aisle directions |

-Convenience-Increase Sales |

| Sensor/Scale | – Shopper awareness of cart contents-Items placed in cart are added to bill/Items removed from cart are deleted from bill | -Store Security-Convenience |

| Credit Card Reader | -Smart Cart tallies items throughout shopping experience and the shopper is able to check out using the product. | -Convenience-Efficiency |

| GPS and Routing | – Shopper can easily identify specific aisle location for items | -Convenience |

Appendix B- Consumer Based Features, Advantages, and Benefits (Retailer)

| Features | Advantages | Benefits |

| Touch Screen Display:Monitor/User Interface: | Scroll promotional items to consumer as they shop. The Smart Cart profile identifies brand preference, purchase frequency, and history to tailor the promotions. | Increase in Product SalesReplaces Paper Ads- Saves Printing Costs |

| Sensor/Scale | Retailer’s inventory can be tracked by weight of item in cart. Customer is charged for all items that are in cart at check-out | Faster Self-Checkout – No employee neededProduct Security- Decrease in TheftIncrease in Product Sales |

| Credit Card Reader | Credit Card registry is connected to the retailer’s account. All transactions processed are available to the store immediately. | Faster Self-Checkout- No employee needed |

| GPS and Routing | As the store layout changes, the retailer has access to easily “Drag & Drop” new location of their items and the GPS location is updated in real time on each device. | Convenient Product LocationIncrease in Product Sales |

Appendix C – Smart Cart Projected Gross Sales

Appendix D – Smart Cart Market Share

Appendix E – Pro Forma Income Statements and Financial Plan

| Smart Shopping Cart | ||||||

| Pro Forma Income Statements | ||||||

| 2018 | 2019 | 2020 | ||||

| Sales: | ||||||

| # of Publix Stores | 1,152 | 1,152 | 1,152 | |||

| x Percent Store Penetration | 10% | 25% | 50% | |||

| = Store Penetration | 115 | 288 | 576 | |||

| Units Sold @ 100 Carts/Store | 11,520 | 28,800 | 57,600 | |||

| x Avg. Selling Price | $300 | $300 | $300 | |||

| Gross Sales | $3,456,000 | $8,640,000 | $17,280,000 | |||

| % growth | 150.0% | 100.0% | ||||

| Cost of Sales: | ||||||

| Cost per Unit | $220 | $220 | $220 | |||

| Total Cost of Sales | $2,534,400 | $6,336,000 | $12,672,000 | |||

| Gross Profit | $921,600 | $2,304,000 | $4,608,000 | |||

| Gross Profit Margin | 26.7% | 26.7% | 26.7% | |||

Year 1 (2018)

Our goal is to obtain 10% penetration of Publix’s current store base, or 115 stores containing 100 carts in each store. This will equate to 11,520 units sold.

Year 2 (2019)

Increase penetration to 25% of Publix’s store base, growing unit sales to 28,800. This is 150% growth in sales with no changes to gross profit margins.

Year 3 (2020)

Increase penetration to 50% of Publix’s store base, growing unit sales to 57,600. This is 100% growth in sales with no changes to gross profit margins.

Appendix F- Grocery and Supermarket Industry Revenue Growth

As the grocery & supermarket industry continues to grow, demand for SmartCarts should increase commensurately.

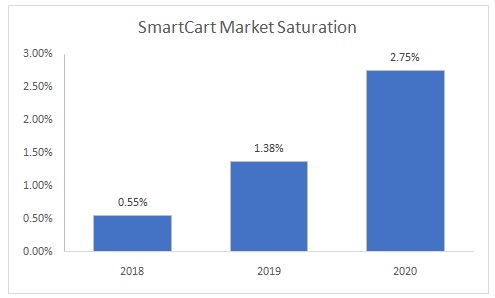

Appendix G- MARKET SATURATION

| Smart Shopping Cart | ||||||

| Estimated Market Saturation | ||||||

| 2018 | 2019 | 2020 | ||||

| # of Publix Stores | 1,152 | 1,152 | 1,152 | |||

| x Percent Store Penetration | 10% | 25% | 50% | |||

| = Store Penetration | 115 | 288 | 576 | |||

| Units Sold @ 100 Carts/Store | 11,520 | 28,800 | 57,600 | |||

| # of Publix Stores | 1,152 | 1,152 | 1,152 | |||

| Divided by: Publix’s Market Share | 5.50% | 5.50% | 5.50% | |||

| = Estimated # of Grocery Stores in U.S. | 20,945 | 20,945 | 20,945 | |||

| # of Carts @ 100 Carts/Store | 2,094,545 | 2,094,545 | 2,094,545 | |||

| Market Saturation | 0.55% | 1.38% | 2.75% | |||

| (Unit sales / est. # of grocery carts in U.S.) | ||||||