- Case StudyHelp.com

- Sample Questions

Case Study Assignment Questions and Answers

Assessment Detail

- Word=2000

Do you need Case Study Assignment Questions and Answers? We provide Case Study Assignment Help by professional writers with 100% plagiarism-free and high quality content work at a cost-effective price. If you need, you can avail at casestudyhelp.com.

Case Study Assignment

Question 1

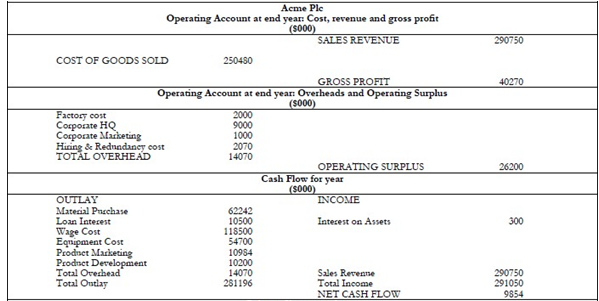

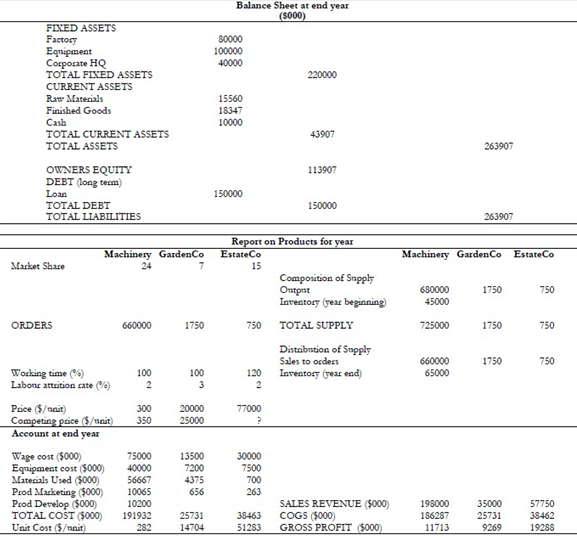

The new Chairman of the Board and the CEO were having a heated discussion. The CEO felt that the new Chairman did not yet really understand Acme’s business, while the Chairman felt that the CEO was making a serious strategic mistake.

The CEO explained “My strategy has been to capitalize on the growth in demand for gardening services. So, over the past five years our trajectory has been to expand from our dominant market position producing gardening machinery to domestic garden maintenance and then on to maintenance contracts for companies. So, we acquired Garden Co four years ago and Estate Co two years ago. Both acquisitions were based on a careful analysis of the match between our resources and the skills required to maintain domestic and industrial landscapes.”

The Chairman replied “But they are in totally different markets. Technological change has resulted in many new types of lawnmowers and in fact many engineering companies are diversifying into garden machinery. Domestic demand for lawnmowers has leveled out in the last three years and the demand for domestic contracts has also more or less stopped growing. There are huge numbers of small companies competing in the domestic market and we can’t easily shift people among the three operations because the skills are different. I appreciate that the company market is growing at 20% per year but it seems to me that Estate Co was a very expensive purchase at $120 million. I am unhappy about the financial position, and I think you are steering Acme into disaster.”

The CEO said “Nonsense. I am a great believer in synergy, and I am sure that our integrated expansion will pay off. The figures tell us that our finances are sound and Estate Co is already highly profitable.” The CEO then walked out of the meeting shaking his head in frustration.

- The Chairman and the CEO cannot agree. Do you think the CEO is right and that the Chairman’s lack of knowledge about the industry means he cannot contribute to a strategic analysis, or do you think the Chairman’s concern is justified? Use strategic models to argue your case.

- Assess what Acme should do both in the short and long term.

Question 2: The veteran returns

In 2004, Coca-Cola, the world’s biggest soft-drinks firm, was experiencing one of the greatest crises of its 121-year history, so its directors looked for an outsider to turn the company around. But Neville Isdell was not the first or even the second choice of Coca-Cola’s directors. Only after rejections from James Kilts, then boss of Gillette, a consumer-goods giant, and Carlos Gutierrez, then boss of Kellogg, a food firm, did they turn to Mr. Isdell, then aged 62, who was in retirement after having spent 40 years with the company. He did not hesitate to accept the invitation, having been passed over for Coca-Cola’s top job in 1997 and again in 2000, which had prompted his early retirement. Mr. Isdell had worked in South Africa, Australia, the Philippines and Germany and had been responsible for taking Coca-Cola into new markets in India, the Middle East and the former Soviet Union; he ended up in charge of European operations.

Mr. Isdell had a reputation as a hands-on manager and his first action on returning to the company was to investigate its troubles for himself. He criss-crossed the world in 100 days to listen to employees of all ranks in many of the 200 countries where Coca-Cola sells. What he found was sliding sales, demoralised staff, ineffective marketing and a lack of leadership. He concluded that the most valuable brand in the world was experiencing a crisis of confidence. “We had lost our belief in our ability to win,” says Mr.Isdell.

Back at Coca-Cola’s base in Atlanta, Georgia, Mr. Isdell shared his findings with the company’s top executives. The result of what he calls a ‘cathartic process’ was the Manifesto for Growth, a ten-year plan to revive the company. The main points of the Manifesto were:

- Improve the production and marketing of Coca-Cola, Sprite and Fanta, the fizzy drinks that account for about four-fifths of the firm’s sales.

- Spend an additional $400 million on marketing to counteract the finding that the power of the Coca-Cola brand was slipping. The current marketing spend is about $1 billion, so this is a significant increase, although the time period is not

- Strengthen Coca-Cola’s portfolio of non-carbonated and ‘functional’ drinks. Bottled water, sports and energy drinks and fruit juice are now the main sources of new business in the soft drinks industry, with growth rates seven times higher than those for carbonated sugary drinks, sales of which have lost their vigour as a result of concerns over

- Buy Glackau, an American maker of vitamin-enhanced water, for $4.1 billion which was Coca-Cola’s largest acquisition to Subsequently, however, Coca-Cola lost out to its rival, PepsiCo, in a battle to acquire Sandora, a Ukrainian juice company.

Mr. Isdell once ran Coca-Cola Beverages, a European bottler, so he paid close attention to the company’s poor relations with many of its bottling companies. Under agreements that sometimes date back more than a century, Coca-Cola supplies concentrate to local bottlers, which then make and distribute soft drinks. The actual production and distribution of Coca- Cola follows a franchising model. The Coca-Cola Company only produces a syrup concentrate, which it sells to various bottlers throughout the world who hold Coca-Cola franchises for one or more geographical areas. The bottlers produce the final drink by mixing the syrup with filtered water and sugar (or artificial sweeteners) and then carbonate it before filling it into cans and bottles, which the bottlers then sell and distribute to retail stores, vending machines, restaurants and food service distributors. Mr Isdell gave the bottlers permission to team up with other firms in order to cater better to the boom in healthy drinks. Since Coca-Cola owns stakes in many bottlers, and owns some outright, this was another way to diversify. Coca-Cola Enterprises, a big American bottler in which Coca-Cola owns a large stake, now distributes Arizona, a ready-to-drink tea made by Ferolito, Vultaggio & Sons, an American iced-tea company. Mr Isdell also increased Coca-Cola’s stake in some bottlers or bought them outright.

Mr. Isdell’s efforts started to yield results fairly quickly. Coca-Cola’s share price rose by 20% during 2006, and in the first quarter of 2007 sales jumped by 17%, to $6.1 billion, and profits increased by 14% compared with a year earlier. Analysts at Stifel Nicolaus, a financial-services firm, considered these results the best evidence that Mr Isdell’s plan was working and that his long-term aims were sound. Bonnie Herzog, a beverage analyst at Citigroup, upgraded Coca- Cola to a ‘buy’ rating for the first time in four years, mainly because of the Glackau takeover. It shows that the firm is ‘getting its act together’, she says.

But others remained sceptical. Robert van Brugge of Sanford Bernstein, an investment-research company, thought the acquisitions of Glackau and Fuze, an American juice and tea firm, were good deals, but both are relatively small companies. Static sales in the developed world need a lift, he says. Europe, America and Japan accounted for roughly 70% of profits, but recorded low growth in 2006. And many new drinks, such as Coke Blak, a coffee-infused soft drink, and Gold Peak, an iced tea, were flops.

According to Euromonitor, a market-research company, Coca-Cola has been losing global market share since 2000. Pepsi appears to have done a better job of moving into health drinks in America and, because it makes snacks as well as soft drinks, has another business as a hedge which Coca-Cola does not. Mr. Isdell had no plans to diversify soon into snacks because he wanted to fix things inside Coca-Cola first.

He pointed out at the end of 2006 that his firm has beaten analysts’ expectations in each of the past ten quarters, though he admitted that ‘we are not declaring victory yet.’ Some analysts would have preferred more radical measures, such as bolder acquisitions and job cuts. But they thought an insider was unlikely to make drastic changes and have actually been surprised by how much Mr. Isdell achieved. Clearly, it is fatal to underestimate the difficulty of stopping the rot at a huge firm like Coca-Cola. But for Mr. Isdell to be seen as the company’s saviour it was felt that he needed faster growth.

Required:

- This account lays stress on the fact that Mr. Idsell was a Coca-Cola Did the fact that he was a Coca-Cola veteran have a positive impact on how well he tackled the strategic problems facing Coca-Cola? Assess what happened using the process model.

- What changes might CEOs such as Mr. Kilts or Mr. Guitierrez have m

Question 3

Kenwood Technologies has been facing increasing competition for several years in all its markets with the result that overall profitability has decreased significantly. Last year the CEO exhorted his 25 SBU managers in 14 countries to improve performance but profits had continued to decline. The CEO came to the conclusion that ‘they are not really trying’ and needed inspiration to make greater efforts so he made the following announcement to a meeting of SBU managers.

“I know you can all do great things, and it is my job to push you until you do. Here is what I expect you to achieve:

- Position Kenwood Technologies as the leading high-quality low-cost brand in all our markets

- Increase return on sales for every SBU by 5%.

Now that you know what I believe can be achieved I am certain that you will go out and do it.”

1. Are managers likely to react positively to these ‘inspiring’ objectives?

2. Given Kenwood Technologies’ situation, what two ‘inspiring’ objectives would you propose and why?