- Case StudyHelp.com

- Sample Questions

Maipu Case Study Analysis

Looking for History of Maipu Communications Technology Co., Ltd.? Get Case Study Answers on Maipu Communications Technology Case Analysis. We Provide Case Study Assignment Help, My Assignment Help & Assignment Writing Help from Masters and PhD Expert at affordable price? Acquire HD Quality research work with 100% Plagiarism free content.

Founded in 1993 in China’s western city of Chengdu, Maipu is a private high-tech corporation built on the philosophy of organic growth through developing intellectual properties and innovations. The company’s mission is to make network services more intelligent by providing customized, easy-to-use and secure network infrastructure equipment and industry-specific applications and services; the company aspires to become the leading provider of intelligent network solutions for corporations in China. With over 20 years’ experience of serving corporate customers, Maipu offers a comprehensive range of integrated and intelligent network equipment and services to clients at both local and national levels. Its products and solutions have been widely adopted by financial services companies, governments, Internet service providers, military, and utility companies. Maipu’s products have a dominating market share in the financial industry in China and are sold in over 40 countries worldwide.

Throughout the company’s past growth, R&D and innovation played a pivotal role. Over 300 of Maipu’s 1200 employees work in R&D, and the company’s R&D investments account for over 10% of its annual sales. As the result of the company’s focus on technological innovation, Maipu currently owns the intellectual property for all the key technologies deployed in its products. In addition, it holds over 400 patents, and dozens of its innovation projects have been recognized by the Ministry of Information and Telecommunications and by agencies at the provincial level.

Between 1993 and 2013, Maipu went through the start-up, growth, and maturity periods in terms of its products, corporate strategies, and innovation models. The company started with 3 people, RMB5,000 (approximately US$850) and one innovative product, the multi-port repeater. The product was developed by one of the founders and designed to significantly reduce network access costs for banks to connect their terminals to computer networks. Through its “try before you buy” sales approach, Maipu quickly developed a loyal customer base in the banking industry. Doubling as the after-sales support technician, the inventor of the product was able to gain first-hand customer feedback and improved the product in a timely manner. With the success of its first product, Maipu quickly grew to a company with an annual sales of over RMB50 million in 1995.

Nevertheless, Maipu’s success was challenged by a growing number of new entrants and copycats in the marketplace. To maintain its growth trajectory, Maipu had no choice but continue to be entrepreneurial and innovative. In 1998, the company decided to enter the Digital Data Network (DDN) equipment market. The target customers of the DDN equipment products were major telecommunications service providers. Once again, Maipu’s innovative technology provided the company with an important competitive advantage; the bandwidth and coverage of its products exceeded those of any competing products on the market at the time. As the result, Maipu experienced a period of rapid market share and revenue growth between 1998 and 2002.

During this period, Maipu implemented the “continuous improvement” tacit in its product development in order to launch its products quickly and beat competitors to the market. New products were tested and improved at the clients’ sites instead of the lab. The R&D team was intimately involved in the sale and after-sale support of products in order to identify product issues and address customer requirements quickly. This approach shortened temporal product development and time-to-market requirements significantly.

Realizing the critical role innovation played in the telecommunications equipment industry, Maipu established its R&D and Innovation group during this period. The group demonstrated great entrepreneurial spirit and market orientation. It worked closely with the sales division and customers to determine product requirements from the market. While its size was relatively small at the time, the R&D and Innovation group consisted of small specialized teams whose members were highly motivated and competent in various aspects of the product innovation lifecycle. During the growth period, a series of Maipu’s sustaining innovation initiatives led to competitive prices and enhanced usability of its products, and its disruptive innovation in equipment design reduced the cost of DDN node computer equipment by 70%, reinvigorating the adoption and extending the longevity of this technology in the marketplace. As the result of its successful innovation efforts, Maipu dominated the DDN node computer market with an over 80% market share in China. At the same time, Maipu’s R&D and Innovation group led the company’s transition from the aging DDN market to IP network products.

Between 2003 and 2012, Maipu’s IP network technologies and product lines matured and stabilized. The company emphasized on meeting the needs of clients in the financial services, network services, and government sectors. To support its target markets, the company developed a family of router products that were designed to reduce the complexity of network implementation and total cost of ownership for clients, while at the same time, enhance network security and compatibility. To become a comprehensive network solution provider, Maipu added network switches, network security products, VoIP, and network management software to its product offerings between 2002 and 2003. In 2007, Maipu launched a line of high-end network switches that were deemed as the most efficient switches in the domestic market. During the subsequent years, the company’s network switch business exceeded its router business in terms of sales volume and revenue. As a result, the company experienced steady growth in both sales and profits during this growth period.

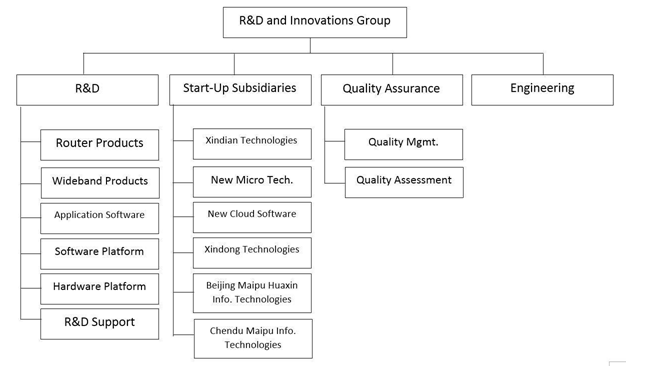

Expanded product lines and complex technologies required Maipu to significantly grow its R&D and Innovation group. The old model of small independent R&D teams could no longer effectively support the highly complex innovation projects that required a great deal of human capital and diverse expertise. Maipu reformed its innovation model by adopting the Integrated Product Development (IPD) management approach popularized by IBM. The IPD approach is more appropriate for managing large innovation teams and is characterized by cross-functional teams, structured processes and subprocesses, IPD tools, and continuous assessment. To support the IPD model, Maipu went through a major internal reorganization and redesigned its product development workflow. It established the Investment Prioritization Committee (IPC), formed a cross-functional Product Development Team (PDT), and created the specialized process management team to continuously improve and optimize innovation processes. The group’s productivity and professionalism during product development was further enhanced through functional specialization as illustrated in the organizational chart of Maipu’s R&D and Innovation Group (See Figure 2). The IPD innovation model proved to be effective as evidenced by impressive innovation outcomes during this period. Maipu was able to produce at least one killer innovation per year, and the majority of the company’s patents and innovation awards were achieved during this period.

Figure 1. Organizational Structure of Maipu’s R&D and Innovation Group in 2012

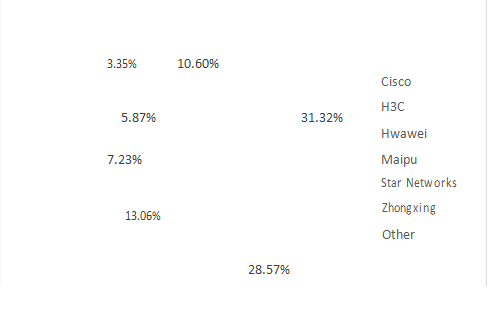

The Age of Transformation

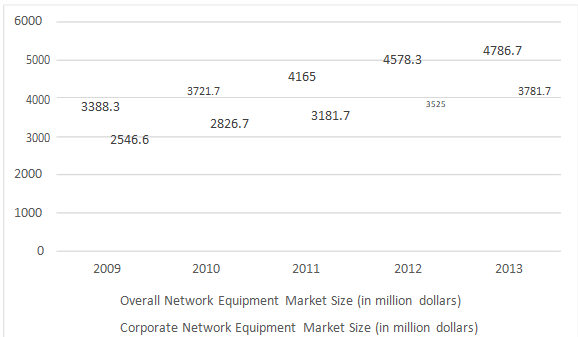

The period after 2013 could be termed as the age of transformation for Maipu due to changes in the external environment. While the network equipment market continued to grow in China (see Figure 2), maintaining a competitive position in this market became more and more challenging for Maipu. As Internet technologies matured over the past 20 plus years, achieving innovation of network equipment products had become more and more difficult. Differences among products from various vendors had become so negligible and the inevitable result was a series of severe price wars. Industry giant Huawei’s entry into the corporate network domain in China further intensified the competition in this industry. Maipu’s competitors in the domestic market included Cisco, H3C, Huawei, Zhongxing Communications, Star Networks, Fenghuo Telecommunications and Juniper Networks, all of which commanded a significant share of the market in various sectors as illustrated in Figure 3. Maipu’s market position as the leader of 2nd-tier vendors also put the company at a disadvantageous position in a mature market, and this situation caused the firm to lose market share in multiple fronts. Furthermore, the growth of the network infrastructure markets had become very slow compared to the growth of the market for cloud computing, big data, mobile Internet and Internet of Things (IoT). As organizations shifted their resources toward these new technologies, Maipu would be competing against other industry giants for a slice of this ever shrinking pie unless the firm could innovate effectively.

Figure 2. Network Equipment Market Size in China (2009-2013)

Figure 3. 2013 Market Share of Various Firms in the Network Equipment Market in China

Under intense competitive pressure from the market, Maipu had been consistently lowering the prices of its products leading to reduced overall profit margins. Maipu had also been aggressively controlling its costs and improving operational efficiency. Nevertheless, these efforts have not been enough to return Maipu’s revenue and profit growth to the good old days. At this critical juncture, Maipu decided that it must transform itself by drastically overhauling its product mix through R&D and innovation. Inspired by new opportunities brought by cloud computing, big data, wireless Internet, and IoT technologies – all of which having received growing industry attention in the recent years – the executive management team defined the new vision to be “expanding both the corporate network and industry application solution lines of business and becoming the leading brand in intelligent network services in China.” Maipu planned to achieve this vision by providing intelligent, high-capacity, secure and energy-efficient network solutions to clients, increasing its investments in mobile Internet applications and developing mobile Internet services. Its corporate network product offerings now included routers, switches, network security equipment and WLAN equipment, and its industry-specific application and service product offerings consisted of unified communication, mobile network management systems, mobile Internet services and multimedia information dissemination systems. The management team made the following decisions:

- Maintain and enhance market share and technology advantage in the area of corporate network equipment as well as complete and enrich its four basic network product lines (i.e. routers, switches, network security products and WLAN equipment) to provide comprehensive and superior network solutions.

- Continue to strengthen the company’s strong hold in the financial industry market by intensifying our business development efforts targeting at banks, credit unions and brokerage firms.

- Enhance our collaboration efforts with network service providers and diffuse our products to new markets through the channels of network service providers.

- Develop competitive network solutions for growing industry sectors, such as the healthcare and education sectors at the municipal level to develop broader market coverage.

- Explore market opportunities in the military and utility sectors by taking advantage of the Chinese government’s growing concerns and emphasis on network security.

- Increase investments in developing industry-specific applications and services to meet the needs of clients. Increase the contribution of industry-specific applications and services to the company’s overall revenue.

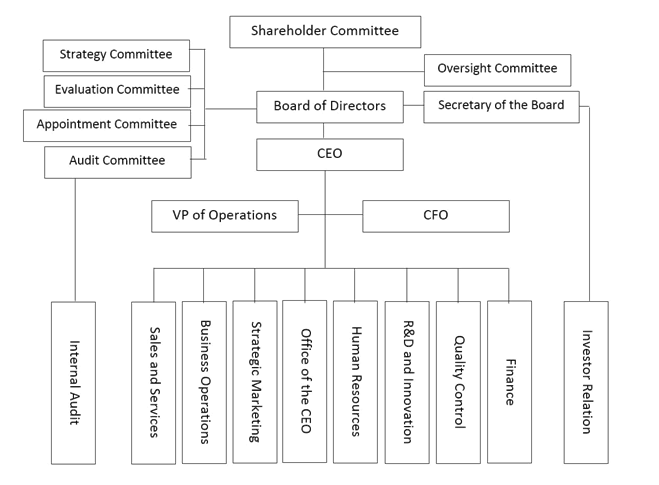

To better support the new business objectives and strategies, Maipu augmented its organizational structure accordingly. Figure 4 displays the current organizational structure at Maipu.

Figure 4. Current Organizational Structure of Maipu

Innovation Model at Maipu during the Age of Transformation

During the age of transformation, Maipu’s innovation model could be defined as “market-driven platform + distributed innovation.” Market-driven platform refers to Maipu’s existing infrastructure of a large customer base, strong technical know-how, established brand name, superior management team, and the firm’s ability to provide high quality pre- and after- sales services to customers. Distributed innovation refers to attracting external talent to create start-up innovation subsidiaries funded through professional angel investors. These innovation subsidiaries have the advantage of operating with greater freedom, flexibility, agility, and efficiency than their parent organization in the hope of developing more disruptive innovations. Operated as start-ups, the subsidiaries are expected to focus on technology and product innovation and provide Maipu with new products and solutions that would prove to be competitive in the marketplace, and at the same time, the subsidiaries leveraged the parent company’s resources, brand name, services, access to customers, and economy of scale. The current innovation model can be best described by the organizational structure of Maipu’s R&D and Innovation Group displayed in Figure 5. A total of six innovation subsidiaries were established covering several technologies including wireless Internet, cloud computing, information security, and multimedia communication. To support innovation, Maipu’s cross-functional product management and development team provided the subsidiaries with support to reduce time-to-market of new products.

Figure 5. Current Organization Structure of R&D and Innovation Group

The company has achieved some early success through its current innovation model. Two of the six subsidiaries have achieved profitability in less than two years. Nevertheless, in terms of using innovation to support its strategic objectives, Maipu still faced the following challenges in its innovation endeavor:

- Although six innovation subsidiaries were created within two years, so far, the innovation model has only led to a very limited number of innovative products. After 2 years, only one new product, a software system designed to address security and disaster recovery issues of 3G network equipment, had achieved widespread adoption by the market and financial success. All the other innovation initiatives were plagued by various technical and market-related problems which led to disappointing results.

- For the past two decades, Maipu has developed an effective system to balance and control quality, schedule, and budget associated with innovation initiatives. Nevertheless, the distributed innovation approach has undone Maipu’s effort overnight and led to poor quality products as well as severe budget and schedule overruns. In their pursuit of development efficiency, the subsidiaries failed to enforce rigorous testing processes and quality standards. As a result, the quality of the products developed by the subsidiaries was consistently subpar compared Maipu’s own products. These failures affected the overall brand image of Maipu in the marketplace. Furthermore, the subsidiaries often did not practice effective schedule management leading to repeated delays of product release. As a side effect of poor development schedule management, several subsidiaries were struggling financially.

Mr. Cui, Director of Marketing at Maipu, commented, “Maipu must enforce stricter rules for the innovation subsidiaries. We all understand that innovation initiatives come with the risk of failure, but the current innovation outcomes are not commensurate with the amount of investments we are making. The subsidiaries rely on Maipu’s brand image to market their products and Maipu’s infrastructure to provide after-sale services. We are now getting too many client complaints regarding the quality and delivery delays of their products. This is wasting a lot of the parent company’s time and resources.”

- Misalignment between innovations and market needs existed. Cancelled and failed R&D projects due to market misalignment caused significant financial losses to both Maipu and its innovation subsidiaries. The majority of the cancelled and failed projects fell into the following two categories: 1) The new product could not be successfully sold through Maipu’s existing sales channels, and 2) the size of the target market for the new product was too limited for the innovation to make meaningful contribution to Maipu’s revenue and profit objectives.

Additional issues with the current innovation model emerged in Mr. Zhao’s discussions with the leaders of the subsidiaries:

- Li, General Manager of one of Maipu’s subsidiaries, Xindian Technologies, complained, “Maipu is micromanaging everything that we do. Its need to control budget has created many bureaucratic hoops that we have to jump through to get anything approved. This process has affected our speed to act and has wasted a great deal of our energy and resources.”

- Zhang, General Manager of New Micro Technologies, another of Maipu’s subsidiaries, complained, “The performance evaluation approach used by Maipu is not suitable to firms like ours. In the high-tech industry, it is almost impossible to estimate the market outlook, development cycle and costs of new product development. Quantitative metrics are meaningless to firms like ours.”

- Liao, General Manager of New Cloud Software, commented, “The idea of resource sharing is a great one, but it falls apart during execution. Some technical experts are being pulled into multiple projects simultaneously, and they ended up not being able to focus on or complete any project successfully.”

- Ren, General Manager of Xindong Technologies, commented, “Maipu’s intolerance of innovation project failure is causing low morale among our employees. Everyone is getting more and more conservative and is only willing to participate in low risk projects now.”

Conclusion

At this important juncture in Maipu’s history, Mr. Zhao felt baffled by the dilemma with which he and his organization were faced. History had shown that as a company grew larger, its innovation agility and efficiency diminished. Whether Maipu could escape from this curse would be essential to the future of the company.

According to the Maipu’s Case, please answer the following questions:

- Analyze the corresponding strategies of Maipu in start-up, growth, and maturity stages.

- What are the competitive advantages for Maipu in three stages including start-up, growth, maturity? How did Maipu build its competitive advantages in each stage?

- Analyze the advantages and disadvantages of Figure 1 and Figure 5 in Maipu. What is the relationship between Figure 4 and Figure 5?

- What kind of employees do you think are suitable to work in Maipu? Why?

- What are the challenges in innovation management that Maipu faces during the age of transformation? What are the causes for these challenges?

From the complaints from the leaders of the subsidiaries, what problems can you find? What are your suggestions to overcome these problems?

Reference ID: #getanswers2001239