- Case Study Help

- Assignment Help

- Finance & Accounting Coursework Poject Help on Flagler Inc

Finance & Accounting Coursework Poject Help on Flagler Inc

BUS301 – Finance Case Study -Ratios, NPV, Profitability Index – Calculations & Analysis on Flagler Inc

A Comprehensive Academic Case Study Program Program Outline

Corporate Historical Perspective and Overview

Industry Classification: Specialty and All Occasion Gift Baskets

Company Overview: Flagler Quality Gift Baskets (FQGB), Inc. is a multimillion dollar Florida manufacturing concern with corporate offices in St. Augustine, FL and principal manufacturing/distribution operations in Tallahassee, FL. FQGB has a sales presence in all 50 states, Puerto Rico, and several international countries (Canada, Mexico, and Caribbean).

Company History and Founder: Flagler Quality Gift Baskets (FQGB) was founded in 1952 by Ms. Henrietta Flagler in St. Augustine, FL. Ms. Flagler’s primary goal in establishing the organization was to furnish employment opportunities for “stay-at-home” mothers whom had a desire to supplement their family’s income and stay active in the labor force. Simply stated, she identified a significant workforce that was being underutilized. During the early post-war 1950’s, Ms. Flagler determined that many women had school-age children (today’s baby boomers) and could not work traditional 9-to-5 jobs. These women had several work hours available (most days) but required flex-time scheduling that was not available to them in traditional male-dominated manufacturing.

FQGB started small with a total workforce of 5 stay-at-home assemblers in the St. Augustine community. Ms. Flagler (as the sole owner/operator) was the only manager/executive. By providing flex-time work opportunities and high quality products, FQGB grew steadily during their first decade of its existence. With Ms. Flagler at the helm, the company reached several milestones. By 1958, the company employed 50 stay-at-home assemblers throughout the northeast Florida region. In 1959, for the first time gross sales passed the $1-million-dollar mark. By the end of 1970, gross sales had grown to $12 million annually and the company had employed to over 200 stay-at-home assemblers, all working part-time from their homes. After running the company from her basement and converted garage (all distribution and administrative functions), in 1970 the first official corporate office and warehouse distribution center was established in St. Augustine.

In 1978, FQGB strategically changed its operational philosophy and model from decentralized assemblers throughout a regional area to a centralized operation. It opened a new manufacturing facility in Tallahassee, FL in 1979. The facility was equipped with state-of-the-art equipment (for the time) and the operation employed 50 production workers along with 12 management/supervisory staff. In 1980, the first full year of production, sales at the new manufacturing facility reached $35 million. The small, but rather antiquated decentralized model remained in St. Augustine. However, over the 2-year period (from 1978-1980), the assemble-at-home model was phased out with only the St. Augustine corporate head-quarters remaining.

Ms. Flagler remained the CEO of FQGB until 1985 when she retired and passed unconditional control to her son, Henry (who was the President and COO at the time). Under his leadership, the company flourished. With only slight variations, sales grew consistently every year. New products were introduced and production in Tallahassee’s manufacturing center increased. By 2000, gross sales had risen to $100 million a year.

While net profits were at an all-time high, Henry felt uneasy. Something did not feel quite right in the market and internal operation. Over the next 6 years, growth remained steady but not explosive. Wages rose, cost of goods were harder to control, and profits were stagnant.

In 2008, due to the impactful national and global recession, gross sales dropped dramatically. The 2008 gross sales figure of $78 million, while respectable, lead to net profits drying up completely. For the first time in over 50 years of operation, FQGB posted an annual net loss in 2008 of 2.3 million dollars. Even though FQGB was an employee-centered operation and Henry had been trying to keep as many people employed at the company as possible, he knew what had to be done; layoffs were inevitable. He cut other costs wherever and whenever he could. Trying to be merciful to the employees but always understanding that the company needed to survive, the first set of downsizing layoff happened in 2009. Over the next three years, approximately 20% of the labor force and 10 managerial/supervisory staff were downsized. While the strategy was successful (by 2012 the company had weathered the storm of the recession), the family atmosphere that had once been infused through the entire operation was gone. In 2013, sales had crept up to $84 million, and, with the labor and value chain expense cuts, FQGB made a small profit. This trend of small increases in profit continued through 2017.

After 32 years of leading FQGB, Henry began planning his retirement. A critical question loomed: who was to succeed him and carry on the FQGB tradition? It needed someone who was strong, understood the culture and the industry, but was also willing to be innovative and move the company forward in the fast-changing world of manufacturing and distribution. The company was facing several problems but also had numerous opportunities that needed to be addressed and/or acted upon. The company was in good shape (given what it had gone through the past several years). His mother (and sounding board) had passed away in 2015 and Henry had no children. Though there seemed to be more questions than answers, Henry knew it was time to act.

Location(s):

Corporate Headquarters – St. Augustine Florida

Distribution and Manufacturing Center– Tallahassee Florida

Venture Size (based on # of employees):

2017 – 150 Line Employees (three operational shifts)

22 Administrators/Managers/Supervisors (three operational shifts)

Current Product Line and Services:

Standardized Gift Baskets

Pre-packaged/assembled gift baskets - sizes vary from small personal 4/5 item gift baskets to large baskets with 25+ items

Baskets can be whicker, metal, plastic, or wood

Sent directly to customer or designated recipient

Generic Gift Basket Themes – Birthday, Weddings, Valentine’s Day, St. Patrick’s Day, Mother’s Day, Memorial Day, Fourth of July, Halloween, Thanksgiving, Christmas and New Year’s (products included based on the holiday)

Gift cards available and personalized messages included

Primarily sold through catalog sales and distributed through all possible package delivery organizations (DHL, FedEx, USPS, etc.)

Customized Gift Baskets

Customers can select to have a personalized gift basket constructed – items selected will determine costs and size of product

Product Choices

- Cheeses (50 different varieties including all types of dairy and goat products)

- Wrapped Meats (salami, peperoni, distinct international meats, etc.)

- Nuts (salted, unsalted, raw, smoked, exotic, etc.)

- Cookies (local as well as national brands)

- Cakes (local as well as national brands)

- Jams and Jellies (all varieties)

- Coffee and Teas (all through strategic alliances with major brands – e.g. Starbuck, Twilling, etc.)

- Candy (local vendors as well as national/international brands)

- Chocolate (fine chocolates from prestigious operations – e.g. Godiva, Ghirardelli, etc.)

- Wine (primarily Napa Valley wineries but also local and international wineries – sparkling wine as well)

- Holiday Specific Items

- Seasonal Fruits (oranges, apples, figs, etc.)

- Miscellaneous Items (cutting boards, cheese knives, metal tins, coffee/tea cups, wine crystal, etc.)

Customer Base and Utility Sought:

The customer base is delineated on the following factors:

- Demographics –

- Income – ranges from national household mean ($59,000.00 per year) and higher

- Age – young professionals through empty nesters/seniors

- Gender – 75% female and 25% male customer base

- Family Size – one to three children

- Education – college often with specialized career training

- Occupation – professionals, supervisory/managerial, specialized careers, etc.

- Socio-Economic – middle to upper socio-economic groups

- Ethnicity - all

- Geographic – While the product is purchased throughout the U.S. (and various North American/Caribbean locations), the primary customer base within communities lies in traditional suburban areas as well as urban professional locations

- Psychographics – Lifestyle for the product line is active and career oriented…lifestyles that have time constraints while valuing convenience and quality

- Purchasing Behavior – customers purchase product throughout the year…most purchases are based on special occasions and holidays

Company Culture and Ethical Standards: FQGB’s corporate culture has always stress an employee centered philosophy. Operational components such as exemplary employee safety, above market pay and benefits, generous time-off/personal day policies, and various external activities have contributed to a strong work culture. While the culture was impacted by downsizing/layoffs from 2009 -2012, Henry Flagler has worked passionately to rebuild employee trust and a positive work environment.

Significant Corporate Stakeholders:

- Privately Held S-Corporation – Flagler Family Members (non-participating siblings and children)

- Internal Stakeholders - Managers, Staff, and Labor

- External Stakeholders - Operational Community and Customers

Pending Legal Issues:

None at this time

Brand Image:

FQGB has impeccable positive brand recognition. The brand name and company reputation has been cultivated and protected throughout the life of the organization. FQGB brand:

- is widely recognized and become insisted upon by its customer base;

- has become synonymous with quality and value; and

- is respected throughout the national business and manufacturing community.

Philosophical Position on Risk Taking and Debt:

Since its inception, FQGB has had a foundational philosophy of sound operational strategies with minimal risk-taking. The company has functioned with a low overall debt ratio and has only assumed long-term debt when capital expenditures were projected (e.g. new equipment and facilities). In each instance, long-term loans were paid off well before maturity. In 2008 when FQGB had its first operational loss (2.3 million), the company had a large cash reserve to counteract those losses and pay all vendors and employees.

Social Responsibility Programs:

FQGB has committed a significant portion of its net profit and personnel time to community events, activities, and programs. Social responsibility events, activities, and programs have encompassed:

- Various United Way Charities

- Sponsoring Senior Community Center Events

- Professional Training Programs for Single Mothers

- Boy and Girls Clubs of America

- American Heart Association Events and Activities

- Special Needs Children Organizations

- Other Local and Community Events, Activities, and Programs in the St. Augustine and Tallahassee Communities

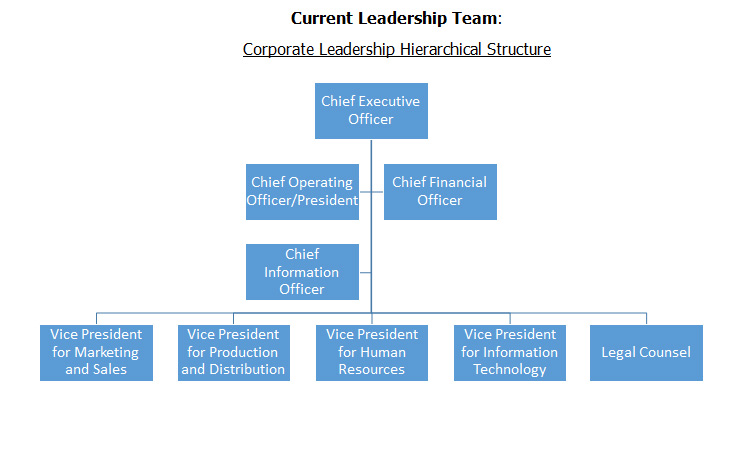

Current Leadership Team:

Corporate Leadership Hierarchical Structure

Divisional Hierarchical Structure – Marketing and Sales

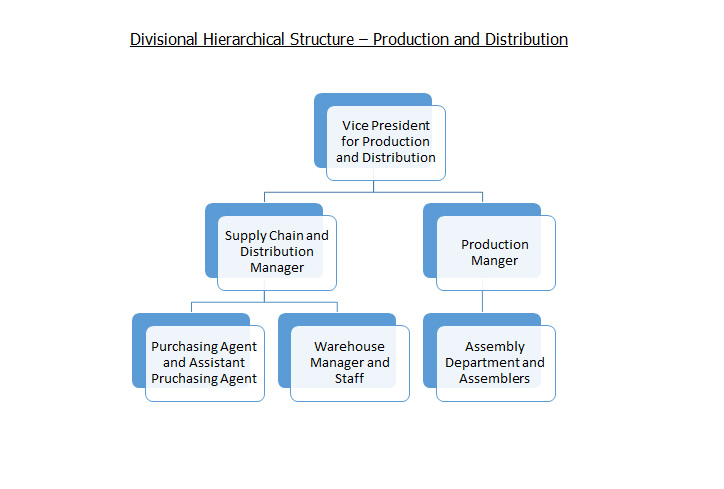

Divisional Hierarchical Structure – Production and Distribution

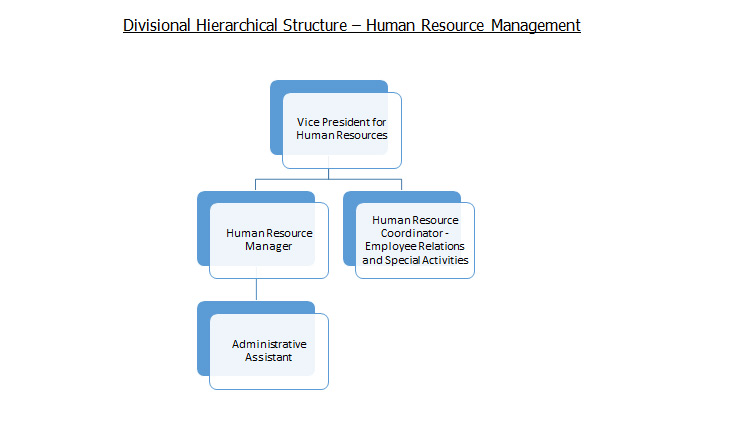

Divisional Hierarchical Structure – Human Resource Management

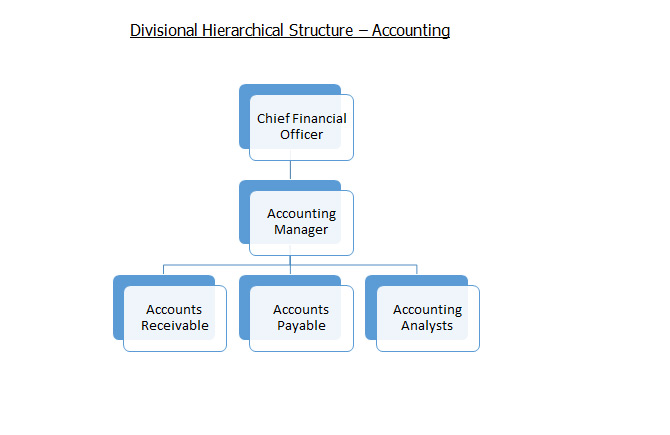

Divisional Hierarchical Structure – Accounting

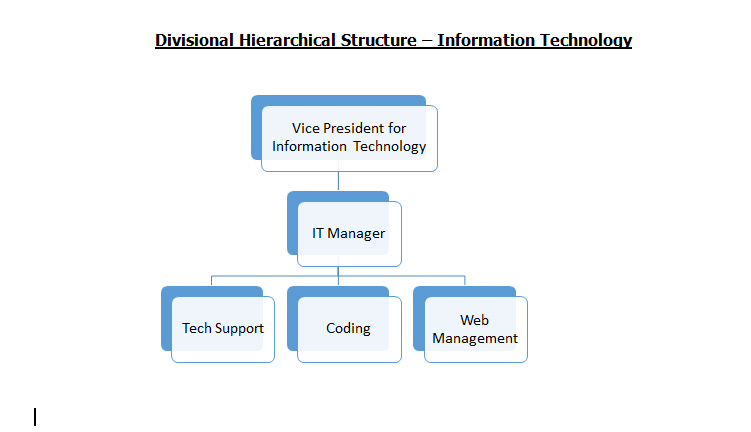

Divisional Hierarchical Structure – Information Technology

Divisional Hierarchical Structure – Legal Counsel

NOTE: the company has an independent attorney on retainer for corporate and other legal issues

Operational Synopsis (Current Picture in Time)

Current SWOT Analysis:

Internal Elements (1-10 scale – 1-5 Weakness…6-10 scale Strength)

- Core Competencies

- Distinct Competencies

- Financial Position

- Brand Perception

- Economy of Scale

- Learning Curve Impact

- Cost Advantages versus Industry

- Customer Loyalty

- Promotional Capabilities

- Intellectual Capital

- Internal Planning

- Definitive Vision (5-10 years out)

- Mission (Operational)

- Customer Responsiveness

- Capacity Utilization

- Facility and Equipment

External Factors (Opportunities and Threats)

- Industry Attractiveness

- Distinct Segmentation/Generic Segmentation

- Geographic Potential (e.g. international markets)

- Related Diversification Prospects

- Industry Innovations

- Industry Rivalry

- Power of Suppliers

- Power of Buyers

- Substitute Products

- New Entrant Potential

- Alliance and Joint Venture Possibilities

- Market Growth Rate

- Six Environmental Factors

- Social

- Legal

- Economic

- Political

- Technology

Functional Systems:

Accounting

Inventory

Production

Human Resources

Marketing

Competitive Environment (Specific Impact on Operation)

Six Environmental Factors:

Social

Legal

Economic

Political

Technological

Five Forces Model:

Industry Rivalry

Power of Suppliers

Power of Buyers

Substitute Products

New Entrant Potential

Operational Strategies

Financial Operation:

Income Statement

Balance Sheet

Cash Flows

AR and AP Policies

Budgeting Process

Break-Even Point Analysis

Daily Financial Operating System

Human Resources:

Hierarchical Structure and Levels

Positions/Job Descriptions

General HR Policies and Procedures

Marketing:

Product/Service Depth Chart

Pricing Philosophy

Distribution Strategy

Promotional Mix and Tools Utilized

Get Assignment help with your Business Administration | BUS301 Finance & Accounting | Case Study -Ratios, NPV, Profitability Index – Calculations & Analysis

Finance & Accounting Coursework Poject Help on Flagler Inc: AI & Plagiarism-Free

Ready to excel in your academics? Our expert writers provide high-quality, customized Finance & Accounting Coursework Poject Help on Flagler Inc to meet your unique needs. Take the first step toward success—contact us today for unmatched assignment assistance!

NEED ASSIGNMENT HELP?

Boost Your MBA Grade!

CDR for Engineers Career

Browse Similar Services

- 15 Essential Tips on How to Boost Your Assignment Writing Skills

- Assignment Help on Christmas Festival

Get Expert Assistance!

Best Deals on Assignments!