- Case StudyHelp.com

- Sample Questions

FM303B- IMM Graduate School of Marketing

Words : 3000

Do you have assignment answers on FN303B financial management assignment 1 question but have no idea how to finish it before the deadline? Casestudyhelp.com provides the best FM303B Financial Management Assignment Question and Answer to students who are looking for help.

SECTION 1 – Study Unit 1 – Marketing = shareholder value creation [20]

- In the past year, a shareholder in a listed services organisation achieved a share price gain of R370 and received dividends of R7 per share. The current share price is R1

Discuss what this means to the shareholder with respect to shareholder wealth. (6)

- Explain how marketing may have contributed to this increase in shareholder wealth? (5)

- With reference to an online shopping organisation of your choice, discuss two ways that the company can measure its achievement of the customer perspective of the balanced scorecard and why these are important for increasing brand equity. Indicate the customer-related metrics that can be used in each case.

Provide a brief, one-sentence, and correctly referenced introduction to the company you have chosen. Your example must have correctly referenced sources (in-text and reference list). No marks will be awarded for an incorrectly referenced example. Copying from another student is plagiarism and will result in disciplinary action. (9)

SECTION 2 – Study Unit 2 – Forecasting in the marketing environment [30]

Bold Brands Limited (BBL) is a marketing agency that provides brand communication services to organisations in the retail sector. Market research has indicated a demand for digital communication services of R600 million, increasing by at least 20% per year.

BBL is considering launching digital marketing communication services on 1 January 2021. The company’s strategic forecasting horizon is three years.

You have been asked to assist with cash-flow forecasting for BBL to introduce the new service.

The following information is available:

The company’s existing services have created high brand equity through client loyalty, and sales have grown steadily over the past years. With the introduction of digital services, BBL becomes a full-service agency.

The synergistic value created by the new division is expected to result in a once-off increase in traditional sales of 40 units – over and above the normal 12% growth rate of advertising sales. Thereafter all BBL sales volumes are expected to grow at a rate of 10% per year. (Note: This increase for 2021 must be based on 2020 sales, excluding the additional 40 units).

BBL expects to complete 60 digital projects in 2021, increasing by 18% every year thereafter. The average fee for a digital project is estimated to be R250 000. Traditional projects are achieving average revenue of R1,6 million per project.

BBL’s historical revenue is as follows:

| Traditional projects | 2020 | 2019 | 2018 |

| Sales | 225 projects | 200 projects | 170 projects |

The contribution margin ratio for traditional projects in 2020 was 20%. Digital projects are expected to achieve a contribution margin ratio of 40% in 2021.

The marketing budget for both services (in total) is R22 million in 2021. Of this, 15% is to be allocated to marketing the new digital products.

BBL’s direct variable costs consist primarily of staff costs. Staff salaries are expected to increase by 8% per year. Digital marketing staff are to be hired in 2021 at the start of the new venture. Because their initial salaries are much higher than those offered by the market, their salaries are expected to increase by only 7% per year.

Project fees and all expenses other than staff costs are budgeted to increase annually by the inflation rate of 4%. During 2020 R6 million was spent on the establishment of the new service. These expenses will be capitalized over three years and are tax deductible.

The company’s WACC is 14%. The corporate tax rate is 28%.

- Forecast the demand (number of projects) for each of the years (2021, 2022 and 2023) for BBL’s traditional services. (1)

- Using your answer from Question 2.2, forecast the total contribution for the company (after marketing expenses have been taken into account) for the next three years (2021, 2022 and 2023).

A suggested format is provided below. (7)

| 2021 | 2022 | 2023 | |

| Traditional projects | |||

| Average fee (per project) | |||

| Variable cost (per project) | |||

| Contribution (per project) | |||

| Number of projects sold | |||

| Total contribution(before marketing expenses) | |||

| Digital projects | |||

| Average fee (per project) | |||

| Variable cost (per project) | |||

| Contribution (per project) | |||

| Number of projects sold | |||

| Total contribution(before marketing expenses) | |||

| Total contribution for the company | |||

| Marketing expenses | |||

| Total contribution |

- Calculate and explain whether the NPV of the forecasted additional contribution made by digital services only, calculated in Question 3, is acceptable. Remember to include marketing expenses and establishment costs.

Comment on your findings and recommend to BBL whether to continue with the establishment of the new service.

Show an NPV schedule and all workings.

A suggested format is provided below. (5)

| NPV for digital services | Up front (time 0) | 2021 | 2022 | 2023 |

| Contribution(before marketing expenses) | ||||

| Marketing expenses | ||||

| Initial R&D cost | ||||

| Profit before tax | ||||

| Tax shield(from R&D amortisation) | ||||

| Profit(for tax calculation only) | ||||

| Tax | ||||

| Net cash flow |

- BBL is concerned about the digital services division’s direct variable costs. Expert employees are difficult to source, and the company is worried that the budgeted annual salary increases of 8% will be insufficient.

Calculate the sensitivity of these direct variable costs relative to the NPV and explain your answer. (5)

- List and explain two (2) examples of external environmental variables that may negatively influence BBL’s (2)

- BBL’s forecasted net cash flows for the digital services may vary by 25% either way.

- Perform a scenario analysis for BBL calculating and commenting on the NPV for the base, best and worst-case scenarios. (4)

- Based on the scenario analysis, do you recommend that BBL still pursue the digital service opportunity? Why, or why not? (1)

- Calculate the revenue market share for digital services for each of the next three years (2021, 2022 and 2023) based on the forecast you have developed. Comment on the results. (4)

- Why is it important for BBL to use scenario analysis? (1)

SECTION 3 – Study Unit 3 – The pricing decision [15]

- Explain the link between pricing strategy and shareholder (3)

- A leather goods brand markets two products: leather purses and leather The purses are priced at R550 each and the wallets at R480 each.

Monthly demand for the products in a high-income area is 400 purses and 300 wallets.

The PED for the products is 1, 4 and 0,6 respectively.

Believing that leather goods are luxury items, as their demand is not too sensitive to a price increase; the marketing department proposes that a 20% price increase on all its products will increase revenue.

Required:

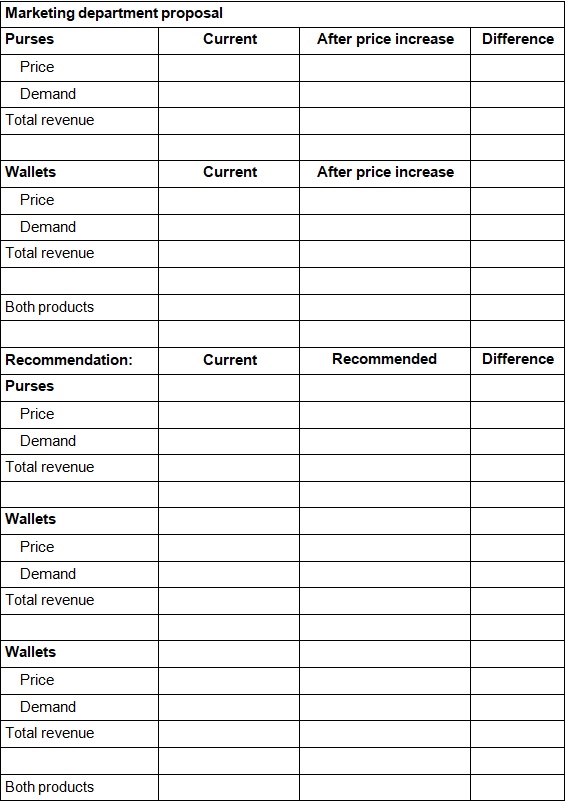

Advise the marketing department on whether their price increase strategy is a good idea and provide recommendations to the company on how to proceed to increase revenue.

Show all calculations, including the PED calculations for every product, indicating the total revenue increase the brand can expect if your recommendations are applied.

You may use the template below as a guideline for your calculations:

Remember to interpret your calculations. Providing only calculations is insufficient. (12)

ASSIGNMENT TOTAL: 65