- Case StudyHelp.com

- Sample Questions

FNSINC502 Assess Financial Products and Services Vulnerability to Money Laundering and Terrorism Financing

Are you looking for FNSINC502 Assess Financial Products and Services Vulnerability to Money Laundering and Terrorism Financing Assessment Answers? Avail best quality of FNSRSK502 Assignment Answers and Homework writing services from best online tutors. Casestudyhelp.com offer Dissertation Writing Help, Essay Writing Guide and Research Paper Writing Guide for College & University Students in the USA, UK and Australia at affordable price.

FNSINC502 Assess Assessment Details:

- No. of Words: 3000

- Citation/Referencing Style :: TAFE AUSTRALIA

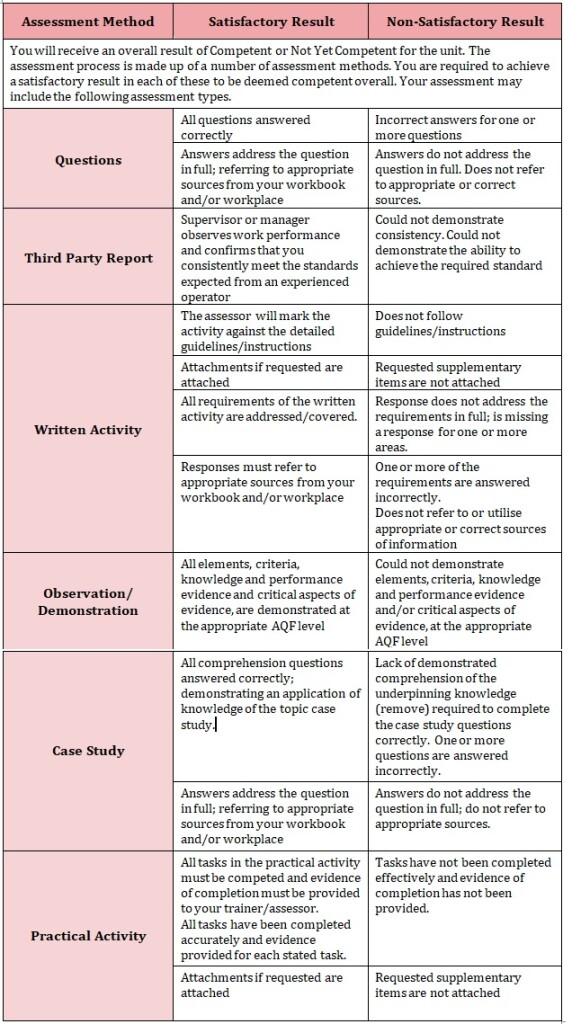

FNSINC502 Assessment Guide

The following table shows you how to achieve a satisfactory result against the criteria for each type of assessment task. The following is a list of general assessment methods that can be used in assessing a unit of competency. Check your assessment tasks to identify the ones used in this unit of competency.

Research Report

This activity is comprised of a number of written questions where you will be required to demonstrate essential knowledge required to assess financial products and services vulnerability to money laundering and terrorism.

Instructions

You will need to research information to assist with your responses for this task.

What you will need to complete this task

- Research materials such as books, internet, magazines, workplace documentation etc.

- Access to legislative and regulatory documentation relevant to own state or territory.

You should use a variety of sources to gather information including training resources, workplace policies and procedures (if you are able to access these) and government and industry bodies.

You are required to provide information about the following points. You must prepare a written response to each point, which can be supported by example documentation as required. Ensure material is referenced appropriately.

Suggested Word limit

To complete this activity, you are required to submit written responses for each question of

| Long Answer | 8 typed lines = 100 words, or

10 lines of handwritten text = of a A4 page |

Your task is to research the following topics then outline your findings in a report. Use the questions below as a guide to your research:

- Identify the systems that can be accessed to obtain up-to-date information on products and services, and explain them

- Discuss the common compliance requirements for products and services used in the sector

- Identify and outline the characteristics of products and services that make them vulnerable to money laundering and terrorism financing

- Explain how to assess AML/CTF controls

- Outline the general characteristics and needs of the sector clients.

THIRD-PARTY REPORT ACTIVITY

The following task must be conducted in a safe environment where evidence gathered demonstrates consistent performance of typical activities experienced in the industry capability field and include access to:

- Common office equipment, technology, software and consumables

- Financial services product information.

For this task you are to complete the following steps to demonstrate your ability to maintain your currency of knowledge of financial products and their compliance requirements, analyse the potential use of these products in money laundering and terrorism financing, and assess anti-money laundering and counter terrorism financing (AML/CTF) controls.

For this activity you will need to perform the criteria listed below in a workplace or simulated environment.

Your supervisor or manager must complete the Third-Party Activity Checklist.

You must submit the completed and signed checklist with your other assessment tasks.

Perform the following steps to analyse the products and services the organisation uses:

- Identify and describe the major products and services used by the sector, including their function, purpose and the client needs it satisfies. Document this information.

- Analyse the characteristics of products and services and document their strengths, weaknesses, terms, conditions and compliance requirements.

Complete the following steps to undertake a money laundering and terrorism financing (ML/TF) risk assessment of these products and services:

- Analyse the characteristics of the products and services to determine their potential use for money laundering and/or terrorism financing. Document this analysis.

- Conduct a ML/TF risk assessment of the identified products and services. Provide the ML/TF risk assessment.

Undertake the following steps to assess and recommend anti-money laundering and counter terrorism financing (AML/CTF) controls:

- Collect and assess the information about the existing AML/CTF controls. Document this assessment.

- Determine the appropriate enhancements to the system controls for managing the ML/TF risks for specific products and services, and document this into recommendations for enhancing AML/CTF systems.

SHORT ANSWER QUESTIONS

Instructions

Answer the questions below by writing in the space provided. If you require more space, use a blank sheet of paper. Alternatively, you may like to use Microsoft Word and print out your answers to each question.

What you will need

- Research materials such as books, internet, magazines, workplace documentation etc.

- Access to legislative and regulatory documentation

- Your Learner Guide for this unit of competence

Suggested Word limit

| Short Answer Responses | 4 typed lines = 50 words, or

5 lines of handwritten text per question |

1. What can you use to help you identify products and services used by your organisation?

2. What are five examples of different product and service types and their purposes?

3. What characteristics of products and services might you be required to analyse?

4. Why should you analyse the characteristics and information to determine the product or services strengths, weaknesses, and terms and conditions?

5. What things should you considers to provide the best customer service and correctly match customers with the most suited product?

6. Why should you analyse the characteristics of products and services for potential vulnerabilities?

7. What steps are involved in conducting an ML/TF risk assessment?

8. Where might you collect inform information about existing AML/CTF controls from?

9. How might you determine the appropriate enhancements to system controls?

10. How could you submit recommendations for enhancing AML/CTF systems?

11. How should you plan and conduct reviews?

12. What procedures should you follow to apply any changes to terms and conditions?

13. What methods can you use to review emerging trends affecting financial services industry? List six.

14. How can you apply information regarding trends?