Investment management is one of the most commonly studied subjects in the field of management or MBA (Master of Business Management). The students are very much burdened with a lot of case study papers on investment management topics. Grades they get in these assignments carry a lot of importance in their academic and professional lives in the future.

Students often find it quite challenging to write them since it is a bit complicated topic. It is usually given to access how you will perform in real-life business management situations. The majority of the industrialists and capitalists around the world are in very much need of investment managers as their permanent employees to take care of risky business investments.

Thus, you always need the best online Investment Management Assignment Help service from a well-known service provider. CaseStudyHelp is always the top choice for you in this regard.

What Is Investment Management Case Study?

Investment management is mostly concerned with the buying and selling of investments or capital within certain defined structures. This is a total management system of managing various assets and securities like government institutions, private investors, corporations, charities, educational institutions, insurance firms and pension funds.

The main objective of investment management is to select the type of investment that yields the maximum profits with the minimum risks. It includes asset selection, stock selection, banking issues, financial statement analysis, etc.

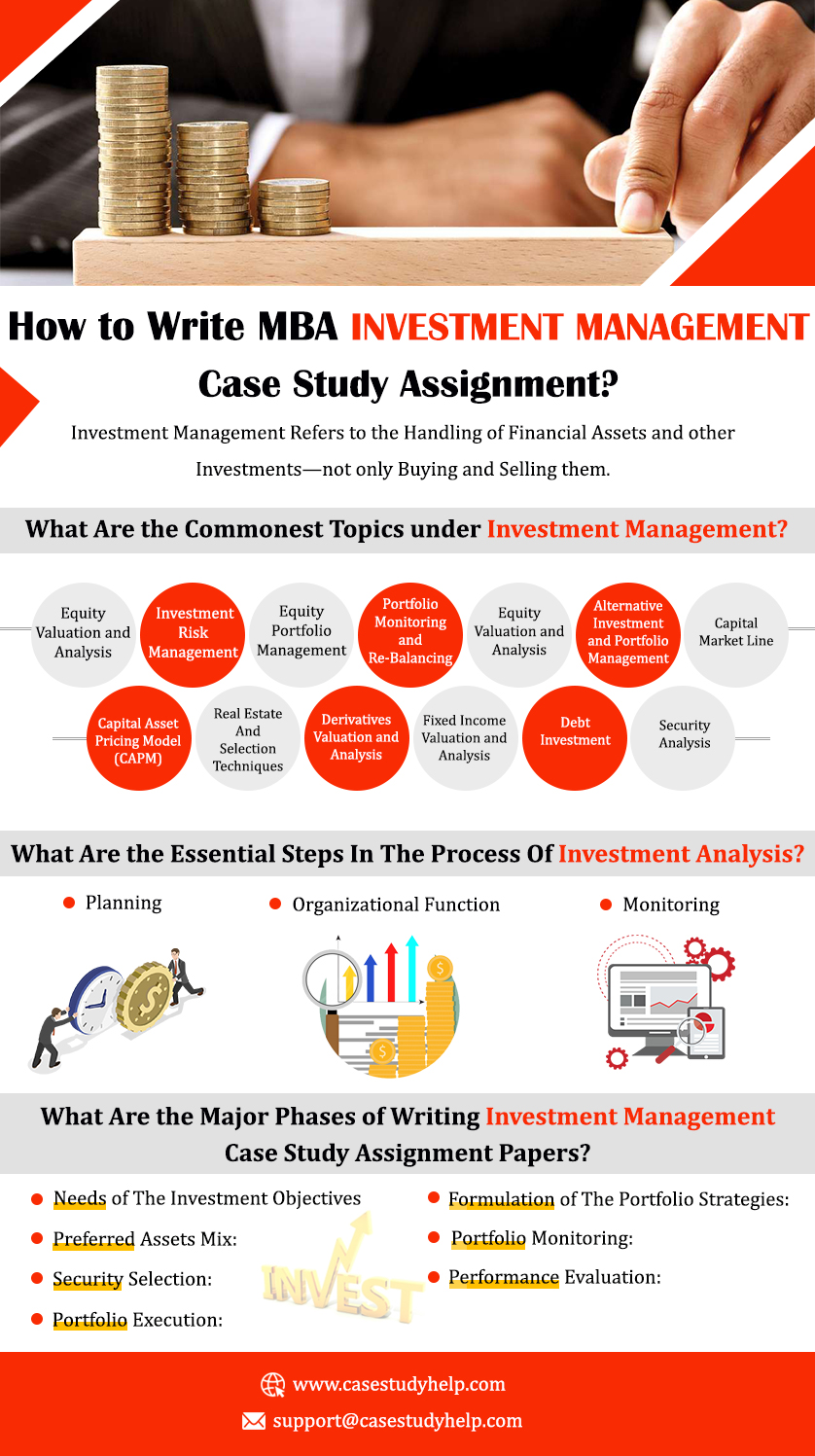

What Are the Commonest Topics under Investment Management?

- Equity valuation and analysis

- Investment risk management

- Equity portfolio management

- Portfolio monitoring and re-balancing

- Equity valuation and analysis

- Alternative investment and portfolio management

- Capital Market Line

- Capital Asset Pricing Model (CAPM)

- Real estate

- Derivatives valuation and analysis

- Fixed income valuation and analysis

- Debt investment

- Security analysis

- Selection techniques

If you avail of the best online Write Investment Management Case Study Assignment Service from us, we will help you best with all the key investment management topics mentioned above.

Hire MBA Assignment Helper For Any Subjects, Topic and Academic Level

What Are the Essential Steps In The Process Of Investment Analysis?

The entire process of investment management consists of the selection, interpretation, and evaluation of all the investment projects by considering all the returns, risks, and chances of profits and losses. Its aim is to maximize profits and returns. The entire procedure is explained below:

- Planning: It is the very initial stage of the investment management procedure. Here the investment strategies and policies are planned. All the investment strategies are made of industrial economic activities and entities’ policies. Investment management mainly focuses on making the market stable and ensures reliability in present and future.

- Organizational Function: The developed investment strategies and policies are needed to fund the business needs. It includes fundraising, finding resources, etc. You need to seek strategic investors to get the most beneficial projects and investment portfolios here.

- Monitoring: In this stage, you need to coordinate as well monitor all the needed actions to fulfil all the investment objectives. This can be attained by imposing all the necessary corrective actions concerning all the changing conditions in the investment market.

You can get all the help regarding the steps mentioned above by availing of our online Investment management case study with solution services.

Get Help with a Similar Task to – Investment Management Case Study Assignment

What Are the Major Phases of Writing Investment Management Case Study Assignment Papers?

While writing your investment management case study assignment paper, you always need to keep in mind all the phases of investment management. You always are in need to have a very sound knowledge of the subject to write your assignments well. Following are the major phases of writing your investment management case study assignment paper:

- Needs of The Investment Objectives: This explains the investment policies ad makes a gist of its core purposes, including risk, return needs, etc.

- Formulation of The Portfolio Strategies: Here, you need to select between the 2 broader categories – the active portfolio strategy and the passive portfolio strategy for planning an effective investment management strategy.

- Preferred Assets Mix: You need to decide the amount of the share of the portfolio for investing in different asset categories like a bond, cash, real estate, stock, etc.

- Security Selection: Here, you need to analyze as well interpret the tax shield liquidity, default risks and various other crucial factors for sel4ctin the best income paths.

- Portfolio Execution: In this stage, you need to implement your structural portfolio plan carefully.

- Portfolio Monitoring: Here, you need to monitor and revise each and every portfolio at very regular intervals.

- Performance Evaluation: Here, you need to assess the return rates as well the involved risks.

On availing the online Investment analysis and portfolio management case studies help service; you can get a clear idea of the phases of investment management started above.

Connect with Our Dedicated Investment Management Assignment Writers at Case Study Help to elevate your grades.

What Are The Tasks Of The Portfolio Manager?

- He determines the client’s risk levels and expectations on the present market conditions.

- He is always very busy doing all his work related to the investment as well related tax things. He also needs to plan the best asset allocation strategy.

- The traditional views of diversification tend to focus on the asset classes. Dynamic allocation is one of the most tactical allocation strategies. It is cost-effective as well tax efficient.

- A portfolio plan is a type of investment strategy where you make your most investment successful. Here you need to apply all the investment diversities by adopting the chances of risks too.

Thus, you always need to keep yourself updated with the latest changes in the global investment market, stocks and shares and take the new investment decision as per the current market conditions. We are always here to help you in all these respects.

Also Read

Why Casestudyhelp.com?

- We are the leading provider of the investment management case study papers

- Our experts deliver you quality content

- We provide only original assignment content

- All our assignment papers are free of any errors

- Our experts are always dedicated to your services

Thus, register with us on our official CaseStudyHelp.Com website soon to start a promising career in investment management.

Author Bio:

Hi, I am Lyana Jones, writer of this blog. I am Financial Experts in the CaseStudyHelp.com Investment Management Case Study writing team. I can assure you of the best service quality.

Hi, I am Lyana Jones, writer of this blog. I am Financial Experts in the CaseStudyHelp.com Investment Management Case Study writing team. I can assure you of the best service quality.

Pls. Contact us anytime, tell us about your topic, and get a 100% unique, 100% plagiarism-free research paper with impeccable grammar and formatting.